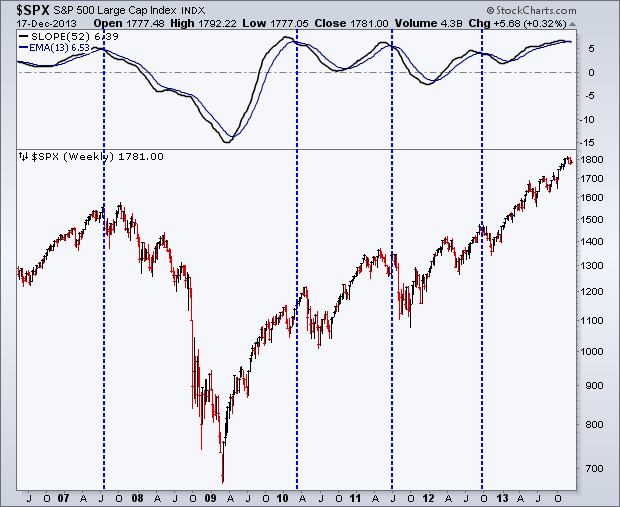

I stand here conflicted. The chart setup I’m going to discuss today has led to lower prices each time it’s occurred since 2007 but seasonality and Fed actions appear to favor the bulls. Before we get into it let me say that this is not some magical chart pattern and like everything in the market, nothing works 100% of the time. That’s a critical concept to understand when it comes to technical analysis… perfection does not exist. Now that we’ve gotten that out of the way, lets talk about the slope of the S&P 500.

On October 18th last year I wrote a post called “What The Slope of Equities is Telling Us.” I showed the chart below and discussed the implications it could have on the equity market. This was right before the short correction we had that bottomed in November and lead to the strong rally that’s lasted essentially all of 2013. The setup I’m talking about is the slope of the S&P 500 ($SPX) on a weekly basis. The slope can be used to measure the strength of a trend by looking at the price action over the last 52 weeks. As the chart shows, when slope falls under its 13-week exponential moving average over the last six years, its lead to drops in equity prices. Going forward I’ll be watching to see if slope strengthens and can get back above its EMA (although that hasn’t been the case for the past four occurrences) or if price starts to follow its slope and heads lower.

But let me say this, I am not using slope to call for a top in the stock market. As you can see, in ’07 and ’09 slope fell under its 13-week EMA a few weeks before a long-term (’07) and shorter-term (’09) top was put in. With slope failing to hold above its EMA as of last week, we know that the strength of the trend is degrading.

We must now take this into account with the other information that we have, such as seasonality, breadth, and momentum. Seasonality going into year-end is bullish. Ryan Detrick, the Sr. Technical Strategist at Schaeffer’s Investment Research has been tweeted about this all month (he’s a great follow by the way). I’ve discussed the divergence taking place in momentum in my Weekly Technical Outlook as well as the early warning signs for breadth.

We also can’t forget about the Fed! We get the FOMC announcement this afternoon. Equities are likely to continue taking their cues from the Fed, whether we get the taper announced today or not. No taper would probably be bullish and visa versa. I’m firmly in the camp that we don’t see the taper announced today, but we’ll see what happens this afternoon.

Copyright © Andrew Thrasher