by Eddy Elfenbein, Crossing Wall Street

We’re getting close to what is historically the best time of the year for stocks.

I took all of the historical data for the Dow Jones from 1896 through 2010 and found that the streak from December 22nd to January 6th is the best time of the year for stocks. (December 21st and January 7th have also been positive days for the market but only by a tiny bit.)

Over the 16-day run from December 22nd to January 6th, the Dow has gained an average of 3.23%. That’s 41% of the Dow’s average annual gain of 7.87% occurring over less than 5% of the year. (It’s really even less than 5% since the market is always closed on December 25th and January 1st. The Santa Claus Stretch has made up just 3.8% of all trading days.)

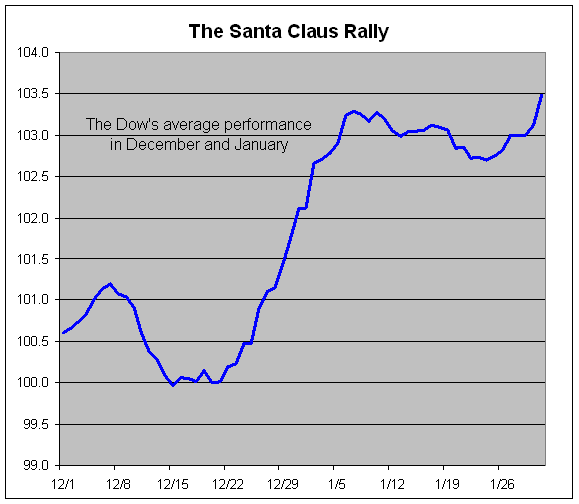

Here’s a look at the Dow’s average performance in December and January (December 21st is based at 100):

You should note how small the vertical axis is. Ultimately, we’re not talking about a very large move.

Copyright © Crossing Wall Street