When analysing investment thesis of any kind, it is important to read into the general conditions. In other words, it is wise to study fundamentals, historic cycles and anticipate the way conditions could change into the future (third being the most important). But is also important to value assets and look for cheap bargains, whether its through metrical valuations or long term nominal / relative performance.

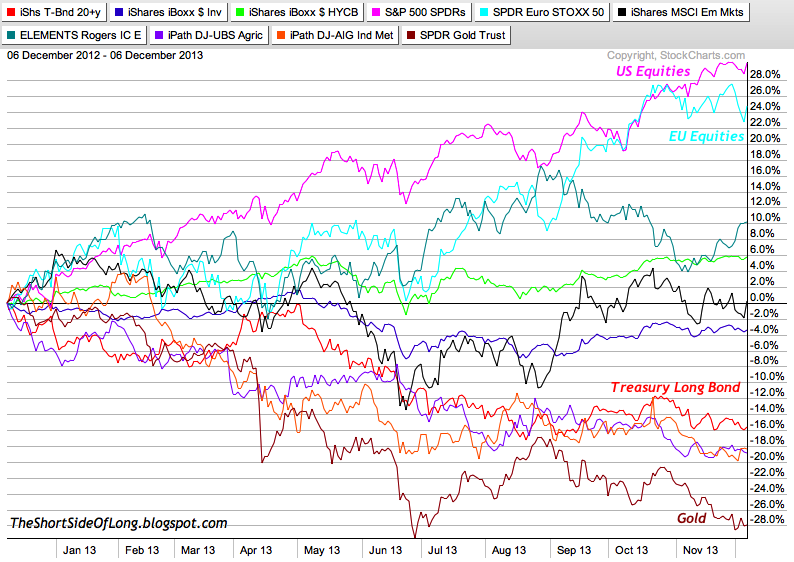

Chart 1: One year performance shows western equities leading the gains

Source: Stock Charts (edited by Short Side of Long)

Today I will cover major global macro assets, both based on nominal and relative performance over 1, 3 and 5 year time frames. So... let us start with the last 12 months.

2013 has been the year of western equity outperformance. Plain and simple - whether it was US, EU or in particular Japan (not on the chart above), this is just about the only asst class that worked and worked well. Energy held its own, mainly due to Brent Crude contract and recovery in Natural Gas, while Junk Bonds did decently as well.

On the other hand, both the inflationary and deflationary assets really took a beating in 2013. Neither an inflationary take off or a deflationary busy occurred, disappointing both camps. When we look at the performance of base metals, agriculture, gold as the inflation bet; or Treasuries as the deflation side bets, both did not work with corrections between 15 to 30 percent. Gold suffered its worst annual loss in three decades.

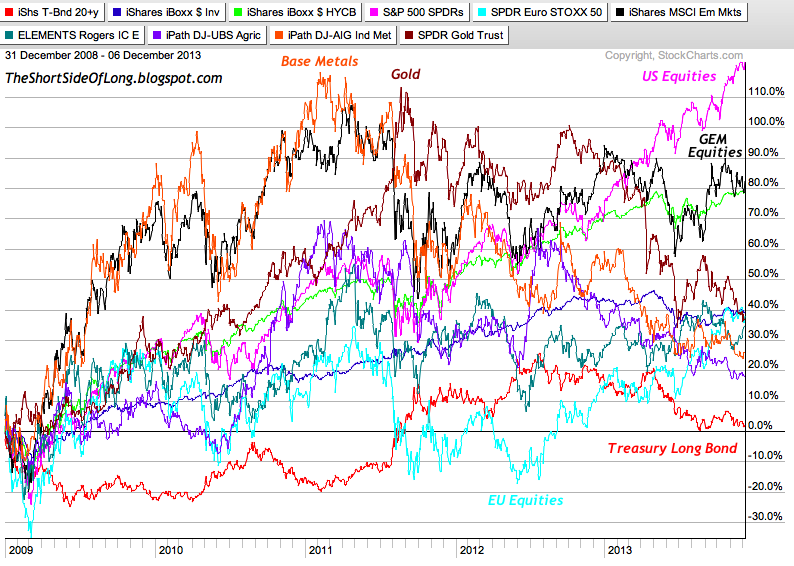

Chart 2: Inflation assets like commodities have struggled over three years

Source: Stock Charts (edited by Short Side of Long)

Zooming out to the three year time frame, not surprisingly it is the US equities once again outperforming the overall global asset environment. Since October 2011, they have all but gone in a vertical fashion. However, for majority of 2011 and 2012, it was the Treasuries that outperformed just about all other assets due to deflation and systematic risk worries (and a slowdown in many parts of the world including EU & China).

The under performers were inflation assets specifically linked to slowing demand out of China. Base metals are down almost 40% over the last three years, which is a super bear market in its own right. Agriculture and Gold also struggled. Interestingly, emerging market equities are about flat to slightly down, similar to the performance over the last 12 months (first chart above). Neither here nor there really.

Chart 3: Equities outperform bonds and commodities over five years

Source: Stock Charts (edited by Short Side of Long)

Finally, we come towards a typical five year buy and hold period. Over the last five years, especially due to the beginning of the bull market in March 09, US equities have once again outperformed all other global asset classes. For so many analysts that keep saying that this is the most hated bull market of all time, I wonder who is actually hating it with all the buying towards new record highs?

While it was base metals and Gold during the early stages of the "reflation" polices in the aftermath of Lehman chaos, eventually the global slowdown outside of the US impacted majority of these assets. In the bond sector, high yielding junk bonds recovered superbly out of the 2009 recession and super high default rate.

EU equities are now trying to play catch up, as they were extreme under performers during the Eurozone Crisis in 2011/12. On the downside scales we also find that agriculture and base metals linger near the bottom (ad they peaked in 2011). Finally, due to the very low beta and sharp under performance in the early parts of recovery, US Treasury Long Bond is currently the only asset class that has not returned any gains (currently flat with total return adjusted for interest). Even the major losers like base metals are still up about 25% over the last half decade.

So... which asset class would you buy over the next 3 to 5 years? Momentum or value driven?

- The ones that are currently hot in their uptrend like US equities, or the downtrending commodities? After all, every asset class has its 15 minutes to shine (outperform)...

- When it comes to equities alone, would you play catch up with the EU recovery, stick with the hot uptrend in the US or perhaps bet on the resurgence of the sideways trending GEMs?

- Junk bonds have outperformed Treasuries by about 80 percentage points on the total return basis since the beginning of 2009, so is it time to play a contrarian with a view on narrowing spreads?