Why Growth is Deep in the Heart of Texas

By Frank Holmes, CEO and Chief Investment Officer, U.S. Global Investors

|

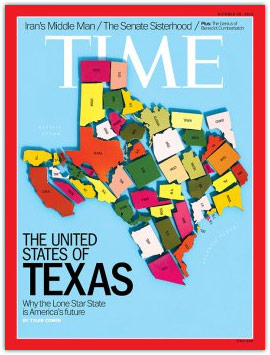

TIME Magazine’s cover this week features an engaging collage of the 50 states reassembled to fit within the boundaries of Texas. With a growing number of solid-paying jobs, affordable housing, and low taxes, “the Lone Star State is America’s Future,” declares economist and writer Tyler Cowen.

As a “Texa-Can,” I think the article gives compelling insight into what I’ve personally witnessed during my 20 years living in the states, which is very different from my experience living and working in Canada, where big government and overregulation abound.

I agree with the writer when he says there are “lessons Texas has to teach.” For example, states and cities could deregulate building development “so that rents and home prices could be much lower,” says Cowen. Or occupational licensing could be “scaled back” so that it is not so onerous to start applying one’s skill in the work force.

Notably, “a little more freedom in strategically targeted areas—that is, a little more Texas—could go a long way,” writes Cowen.

Whereas excessive regulations have often diluted the efforts of entrepreneurs and resulted in fewer innovations, lower profitability and less job creation, Texas is quickly becoming the nation’s poster child of how companies, communities, and individuals flourish when allowed to operate under a more business-friendly atmosphere.

Like the saying goes, “Everything is bigger in Texas,” and that is true for many companies in the state. Did you know that 52 of the Fortune 500 companies are headquartered in Texas? The state is tied with New York in having the second-most Fortune 500 companies.

It may also surprise you to know that these businesses are diverse. Although the state is well-known for its energy companies, such as ExxonMobil, HollyFrontier, Valero Energy, and Marathon Oil, there are many other major industries in the state including technology, airlines, telecommunications, consumer discretionary, and financials. Austin has Whole Foods and Dell. Dean Foods, Dr Pepper Snapple Group, GameStop, and Southwest Airlines are located in Dallas. Sysco and Waste Management are in Houston, to name only a few.

It is more than a twist of fate that Chief Executive magazine has ranked Texas as the best state in which to do business for the ninth year in a row. The magazine bases its annual rankings on taxation and regulation, quality of workforce and living environment. After having talked to hundreds of executives from around the world, I find these metrics are a powerful recipe for success and worthy of replication.

Perhaps after successive years of solid economic growth in Texas, the U.S. is now recognizing how the state offers a balance between prudent regulation and capitalistic risk-taking?

My resources experience tells me Texas could not have had this incredible success without being able to fully capitalize on the innovative technology that has unlocked the vast supplies located in the oil and gas fields. Take a look at the vertical growth in crude oil production this year. On a daily basis, the state is pumping out more than 2.2 million barrels of crude oil each day. At this rate, if Texas were a country, it’d be the world’s 13th largest oil producer.

Since the huge oil and gas boom, the state has taken leadership in the expanding employment in the industry. There are major oil and gas basins throughout the U.S., but research shows Texas has been providing the most jobs in recent years. According to the Bureau of Labor Statistics, since 2010, the oil and gas sector added about 150,000 new positions. An incredible two-thirds were in Texas.

In 2013, oil and gas companies in the Lone Star State persist in leading this job growth too. About 2,400 jobs were added in the second quarter of this year alone.

Our portfolio managers, including Brian Hicks and Evan Smith of the Global Resources Fund, have many firsthand accounts of the economic growth deep in the heart of Texas. They are often visiting energy companies that report decades of drilling ahead of them in the Permian Basin and Eagle Ford. These basins are mere hours from San Antonio, which has been U.S. Global Investors’ home base for more than 40 years.

Many fund families are located far from these enormous energy opportunities, so our entrenchment in this area sets the Global Resources Fund apart from our competition.

We believe this gives us a strategic advantage and is one reason investors have entrusted us with their money for the past 30 years.

This weekend, take time to check out TIME’s new feature on Texas, including the magazine’s top 10 reasons Texas is America’s future. And while you are at it, take a look at the fund’s most recent commentary, which discusses recent performance and more about the U.S. oil and natural gas boom.