Russ offers more evidence supporting his preference for equities over bonds: Historically equities have tended to outperform bonds on a monthly basis in a growth and inflation scenario like the one we’re in today.

by Russ Koesterich,, Chief Investment Strategist, Blackrock

I’ve long been advocating that investors should overweight equities relative to bonds, and while equity valuations are no longer at their cheapest and there are risks inherent in stocks, I still hold this view. In fact, all the factors I look at, including the economic backdrop, inflation trends, monetary policy and corporate fundamentals, suggest that investors should still consider overweighting equities.

Still looking for more insight into how the economic backdrop and inflation play into my preference for stocks? A new BlackRock Investment Institute paper I co-authored is a good source.

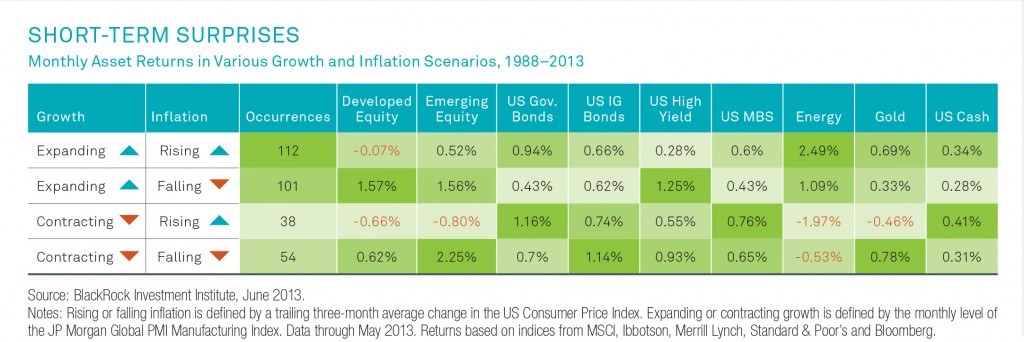

In the paper, “Risk and Resilience: Patterns in Equity Returns,” my fellow authors and I write that the direction of global economic growth (expansion versus contraction) and the direction of US inflation (rising or falling) together matter for the near-term returns of various asset classes.

In particular, we show in chart form how different asset classes performed monthly under four different economic growth and inflation scenarios between 1988 and 2013. As the chart below shows, equities tend to outperform bonds on a monthly basis in a scenario like the one we’re in today: expanding (albeit slowly expanding) growth and falling, or muted, inflation. One reason that expanding growth and muted inflation supports equities is that monetary policy is likely to remain accommodative when there’s a remote risk of inflation.

And today’s environment also should be good for both developed and emerging market stocks, although the performance of the latter will be somewhat dependent on the future path of monetary policy. As we write in the paper, my research team has found that the sweet spot for (monthly) developed equity performance has been a combination of global economic expansion and declining US inflation. Meanwhile, emerging market stocks generally tend to perform best in environments of falling inflation.

To be sure, factors beyond the direction of growth and inflation impact near-term returns. Both monetary and fiscal policies play a key role in setting the direction of asset classes. They not only have both a direct and indirect impact on a country’s future growth prospects, but they also influence investor sentiment. In particular, an unambiguous, pro-growth policy mix is generally viewed as supportive for risky assets, while increased policy uncertainty could hurt risky assets. As such, Washington-related fiscal policy uncertainty is currently fueling market volatility and muddying the return picture a bit, and Fed-induced liquidity is also wielding an impact.

Still, as my group’s research shows, the direction of economic growth and inflation levels can still affect short-term returns. And that we’re in an environment where inflation is not a threat and the global economy is continuing its slow recovery is more support for the case for equities over bonds.

Source: BlackRock Investment Institute, Investment Strategy Group research

Russ Koesterich, CFA, is the Chief Investment Strategist for BlackRock and iShares Chief Global Investment Strategist. He is a regular contributor to The Blog and you can find more of his posts here.

Copyright © Blackrock