by Dianne Lob, AllianceBernstein

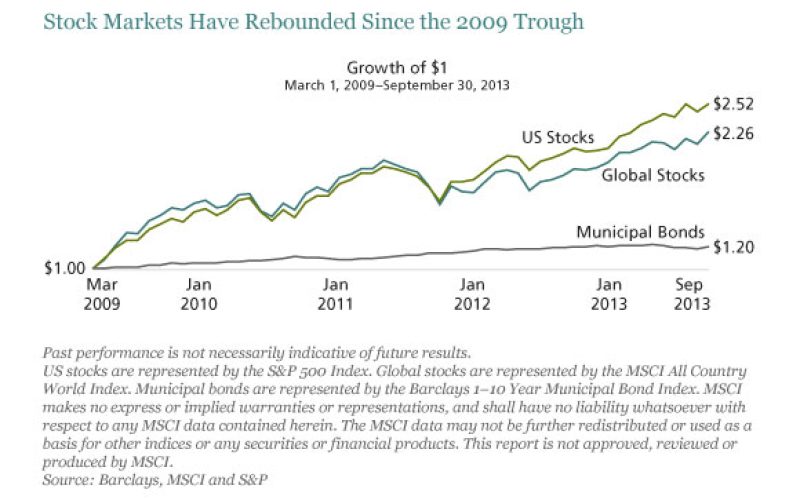

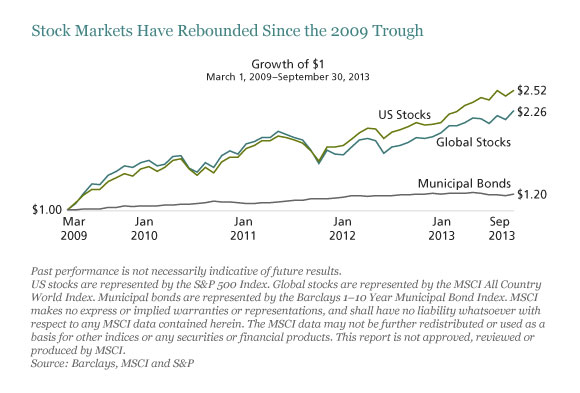

With global equity market returns of well over 100% since the bottom hit in March 2009 (Display) and the S&P 500 only modestly below the record it set a few weeks ago, some investors are asking if stocks are heading for a fall. We think any number of things could cause a short-term rollback—among them, the political stalemate in Washington—but the market isn’t overpriced.

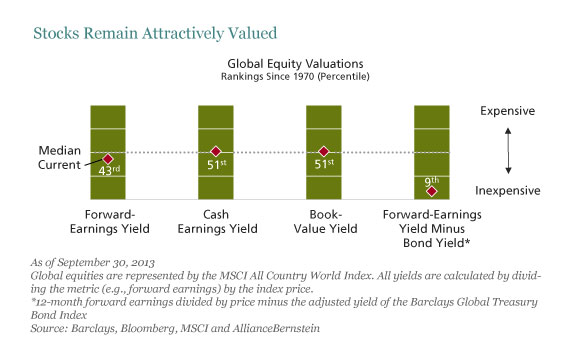

Global equity valuations are still around their historical averages, not resoundingly cheap by most traditional measures, but not rich either (Display). And with bond yields rising from historical lows, stocks are extremely attractive relative to bonds. Overall, we find stocks to be good value these days, particularly outside the US.

What About the US Budget Crisis?

The gridlock over the US budget and debt ceiling and the government shutdown has knocked several percent age points off the US stock-market indices in recent weeks. Budget battles have caused a dozen government shutdowns over the last 30 years or so, with only minor market impact, as Seth Masters and I wrote recently. While this shutdown is dragging on longer than most, it will likely be resolved in the near term—very possibly in conjunction with an accord on the debt ceiling.

Failure to raise the debt ceiling, by contrast, would be a very serious matter, potentially fueling global market volatility if it led to a US-government debt default. But in our view, it’s an unthinkable scenario for all parties in the political process. We expect them to find a resolution before the government actually defaults—whether that date is October 17 or somewhat later. Indeed, as of this writing, there was indication of some movement in that direction. Meanwhile, we’re making some modest portfolio changes to provide us with some insulation in the unlikely event of a Treasury default.

Where the Best Stock Opportunities Lies

Assuming that the logjam in Washington breaks, we see room for more growth in global stocks. The opportunities continue to be abundant across sectors, geographies, and investment styles, rather than concentrated by industry or geography.

Broadly speaking, we favor cyclical stocks like financials and housing-related shares, as the economic recovery continues to take root slowly. International markets currently offer somewhat richer opportunities than US stocks, because there are greater economic and policy uncertainties and these markets have recovered less lost ground.

In style terms, we find the value opportunity most compelling, despite the value rebound over the last year. Supposedly “safe” high-dividend-yielding stocks, by contrast, remain risky: overpriced relative to their own history and more vulnerable than most stocks to rising bond yields.

The views expressed herein do not constitute research, investment advice, or trade recommendations, and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Dianne F. Lob is Chairman, Private Client Investment Policy Group at Bernstein Global Wealth Management, a unit of AllianceBernstein.

Copyright © AllianceBernstein