by Paul Moroz, Mawer Investment Management

Political differences in Washington have managed to create an anomaly in financial markets, effectively pricing in the technical default, or at least temporary deferral, of short term U.S. government debt.

Historically, T-Bills have been thought to be risk free. This is reflected in their use of the so-called TED spread (Treasury to Euro Deposits). The spread in 1 month U.S. T-Bills and 1 month USD LIBOR reflects financial credit risk over the “risk free rate.” It is a good indicator of strain in the financial system. (Yes, I know TED is ancient and LIBOR is rigged, but I think the point remains valid.) The higher the spread, the greater financial risk and vice versa. Usually, at least.

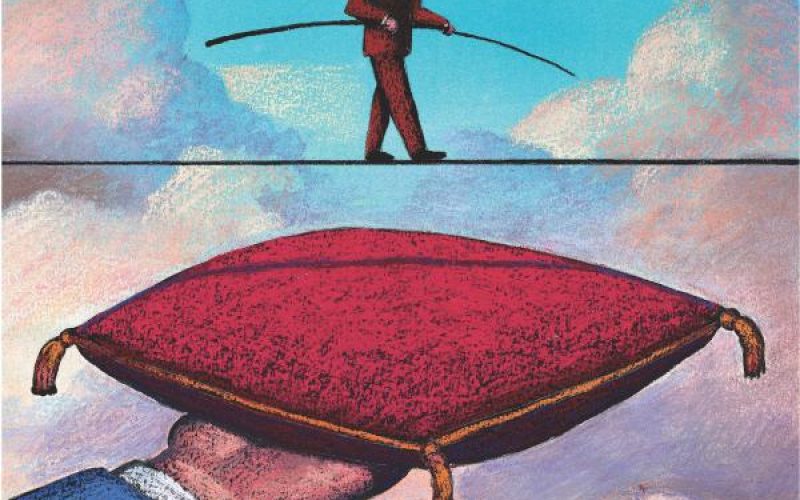

The TED spread just went negative, and it’s not a good thing. Why? Because it is a result of higher short term U.S. T-Bill rates due to the politics concerning the debt ceiling. What complicates matters is the use of T-Bills as collateral in the financial system. Imagine getting notified from your bank that they no longer consider your house collateral for your mortgage.

“Mr. Smith, please provide us with another good asset… it could be cash… and, oh… we don’t accept equities.”

What do you have to sell to appease the bank? Your house? Your equities? Your vehicle? If Washington can’t get their act together and the U.S. defaults, there is a possibility of a significant domino effect impacting all parts of the financial system.

While short term T-Bills rates are easing this morning on news of political progress, the lesson is clear: Treasury Bills are low risk, not no risk. We hope that Bill and TED’s excellent adventure normalizes shortly.

Paul Moroz

Copyright © Mawer Investment Management