October 2013 - Market Update

by Brooke Thackray, AlphaMountain Investments

Should I stay or should I Go? – The Clash 1982

The Clash’s only hit single “Should I stay or Should Go” takes me back to yesteryear. I can remember it being played constantly in my undergraduate pubs. Many investors, once they have reduced their equity positions find it diffi cult to get back into the market, regardless if it has increased or decreased. As a result they suffer indecision–wondering, “Should I Stay or Should I go?”

For seasonal investors, the answer of whether to get in the market on not, is so much easier compared to investors following other disciplines. The answer is based on seasonal investing being a long-term disciplined strategy. Yes, you heard it correctly– seasonal investing is a longterm discipline. Although the trades are shorter than the standard “buy and hold” approach, the discipline’s success is based upon performing a number of trades over time, realizing that all trades will not work, The goal is to have the trades that do work, more than offset the trades that do not work.

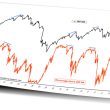

Most of the regular readers of this newsletter and my books, will be familiar with the favourable six month cycle (for stocks) that lasts from October 28th to May 5th. This six month period has historically been a much better time to be in the stock market than the other six months of the year. This makes the answer to the question, “Should I Stay or Should I Go?”, so much easier for seasonal investors. In short– the answer is go– increase stock market exposure at the start of the favourable six month period. Yes, there may be a better time to enter the market, but on average, entering at the end of the October 27th (to be in the market for October 28th), has proven to be a longterm successful strategy.

I am not the fi rst person to put forward the favourable six month strategy. In fact, it has been written about, in its different variations, by many others. Academics like everything in nice tidy boxes, so they almost universally have analyzed the six month period starting at the beginning of November and ending at the end of April. Sometimes this strategy is called the Halloween Effect. Professors Jacobsen and Zhang published, The Halloween Indicator: Everywhere and All the Time, in October 2012. This article illustrated the magnitude of how much better the November to April six month period is for stocks, compared to the other six months of the year. The article can be found at, http://papers.ssrn.com/sol3/papers. cfm?abstract_id=2154873.

In 1999 I coauthored Time In Time Out: Outsmart the Stock Market Using Calendar Investment Strategies. At the time, it was probably one of the most seminal works on the six month cycle in the stock market– it looked at averages, frequencies, decade analysis, included interest and dividends etc. In working up my analysis, it became quite clear that being in the market for the last few days of October provided a large benefi t. In my Thackray’s 2011 Investor’s Guide, I presented the Last 4 Market Days in October strategy. From 1950 to 2009 the last four days in October produced an astounding average rate of return of 1% and was positive 58% of the time. It is important to realize that like any strategy, it does not work all of the time, but when it works, it can work very well. Investors should seriously consider entering into the market for the last few days of October, in order to start of the six month favourable season for stocks.

I often get asked the question: should a seasonal strategy be altered for economic announcements? In other words, should strategy implementation be delayed until after announcements, such as an unemployment report? The simple answer is NO. The truth is that no one knows what the employment report beholds. Everyone has expectations and if the actual results beat the expectations, then the market will likely respond by moving higher, and if results fall short of expectations, the market will likely decline. It is too risky to guess. If a strong seasonal trend exists and a favourable announcement is released, the potential upside movement tends be larger than the potential downside movement if an unfavourable announcement is released.

I raise this point because of the current shenanigans taking place in Washington with the debt ceiling limit. The government is set to run out of money sometime later in October. Most people expect the government to resolve the issue before it becomes critical, although they do admit that there is a slim chance that the impasse will not be broken. As we move closer to the government running out of money and without any progress in talks between the two parties, the markets will likely respond negatively. If the situation has not been resolved by the start of the favourable six month seasonal period for stocks, what is the best strategy for a seasonal investor? Although there may be increasing risk of a default, the seasonal investment approach is to enter the market. If the debt ceiling is resolved shortly afterwards, the market could respond violently to the upside. Investors staying out of the market, waiting for a better time to enter could miss out on large gains.

You can read the Brooke Thackray's entire October 2013 Letter in the slidedeck below: