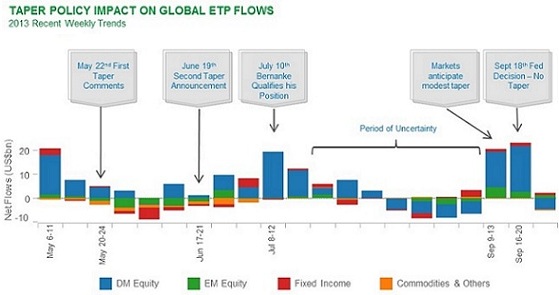

The year of the policy-driven market continued in September, with the Fed’s shifting signals impacting global ETF flows yet once again – particularly in emerging markets. Dodd Kittsley dissects the numbers and shares what the implications are for emerging markets investors.

by Dodd Kittsley, Blackrock

The year of the policy-driven market continued in September, with the Fed’s shifting signals impacting global ETF flows yet once again. While concerns over an imminent taper caused investor uncertainty and modest outflows at the beginning of the month, things quickly turned around following the Fed’s surprise announcement that it would maintain its current pace of monetary stimulus.

Global ETF flows in September surged to $35.0 billion. The month saw a jump in equity inflows ($28.7 billion) and a return to fixed income inflows ($6.6 billion) following redemptions in August. On the equity side, developed markets ($23.4 billion) led the charge, with two-thirds of flows going into funds with US exposure. Meanwhile, fixed income flows continued to trend toward shorter maturity exposures ($3.1 billion).

One notable development in September was the pickup in emerging market (EM) ETF inflows on both the equity ($5.3 billion) and EM fixed income sides ($0.9 billion). While it’s still too early to call it a trend, this may indicate that some investors are warming up to EMs again – with the Fed’s actions a likely tailwind. We saw the same turnaround in EM flows after the Fed’s no-taper announcement in June (see below).

So what are the implications for EMs investors? For one thing, it’s important to understand what’s driving EM investment behavior. Clearly, expectations regarding US monetary policy have been a major influence on EM ETF flows this year. When investors have been worried about tapering, we saw outflows in EM funds. When the Fed backed off, investors edged back into them. We may see this dance again, depending on what happens at the next FOMC meeting.

But these delays are simply postponing the inevitable: eventually, tapering will occur. And while there’s certainly evidence to suggest that the end of US stimulus might be negative in the short-term for some EM economies, not all EMs are alike – and some may be better suited to weather the end of easy money than others (Russ K’s pick: China). This is where knowing what you own in an ETF becomes key.

It’s also important to understand that the end of QE3 doesn’t necessarily signal disaster for EMs. As Russ points out in a recent post, the impact of tapering on emerging economies will depend largely on the pace and the expected path of rates – two factors that are, for now, unknown.

Source: BlackRock as of 9/30/13

Copyright © Blackrock