by Matt Tucker, Head of Fixed Income Strategy, Blackrock

[dropcap color="#888" type="square"]W[/dropcap]ith the Fed deciding to delay tapering at their last meeting, it looks like the rise in interest rates that many investors have been fearing won’t happen quite yet. Eventually, as the Fed slows down and ultimately stops their bond-buying program and begins to increase the Federal Funds Rate, we will likely see higher interest rates. But for now, the timing of these events has been pushed out.Despite this recent news, we still see a lot of people focused on investments with low levels of duration, a common measure of interest rate sensitivity. This has been a driving trend in fixed income ETF and mutual fund flows this year, and is likely to continue until we see higher interest rates. The idea is to invest in funds that will be less impacted by a rise in interest rates, whenever that will occur.

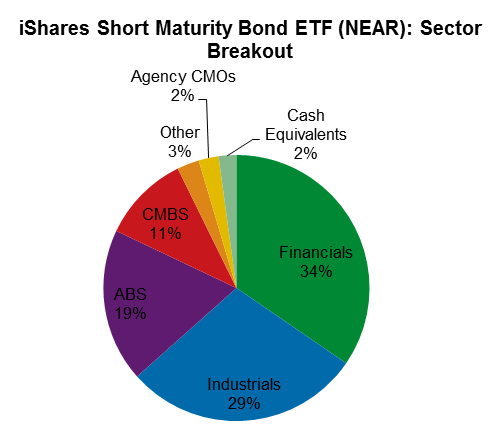

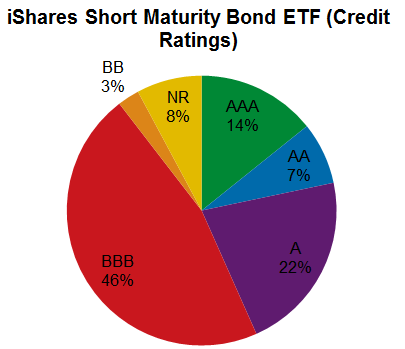

iShares recently listed a new fund that is aimed at just these investors. NEAR is the ticker of the iShares Short Maturity Bond ETF. The fund invests in a diversified portfolio of short maturity fixed income securities such as government bonds, corporate bonds, asset-backed securities, and mortgage-backed securities. It may also invest in commercial mortgage-backed securities. With a typical duration of around one year, the fund’s interest rate sensitivity should stay low. The fund will also try to produce income and will invest at least 80% of its net assets in investment grade securities. Here is a snapshot of the current holdings:

Source: BlackRock as of 10/2/2013

Credit ratings displayed are from S&P as of 10/2/2013.

People who follow our other fixed income iShares ETFs will notice that this fund is a little different. Our other bond funds seek to track indexes that each provide precise exposure to a specific segment of the market, such as 1-3 year Treasuries or emerging market bonds. NEAR is an actively managed, multi-sector fund where a portfolio manager is deciding what to put in the fund and how to reposition it on a regular basis. It is still providing exposure to a specific part of the market – in this case short maturity fixed income securities – but the composition of the fund will shift over time according to the opportunities that the portfolio manager sees.

So how can investors use a fund like NEAR? There are a couple of likely applications. The first is to seek to reduce interest rate sensitivity in an investor’s portfolio. NEAR’s diversified multi-sector exposure likely makes it a good candidate to serve as a core short duration investment. It should provide a balance between interest rate sensitivity (with a duration of around 1 year) and yield (with an average yield to maturity of just over 1%).

The other common application I expect to see is investors using NEAR as part of a cash laddering strategy. Many investors want to keep a portion of their portfolio in money market funds,* but are not pleased with the yields they are getting in today’s market. iMoneyNet shows that the average yield for a money market fund today is one basis point – that’s 1/100th of 1%. Of course, the advantage of a money market fund is that it seeks a stable value, so even though you are not earning much money you may be taking on less risk.

The idea of a cash laddering strategy is to split an investment between a money market fund and a potentially higher yielding fund. A hypothetical 75%/25% money market/NEAR allocation currently provides a yield to maturity of 0.25% while only taking on .25 years of duration. The NEAR investment does not have a stable value and its price will move around in response to changes in yields and market conditions, but may provide a pick-up in yield relative to a money market fund.* Investors can customize the allocation of each fund to find the appropriate balance of safety and yield that works for their investment goals.

So is this a NEAR-term opportunity? It might be, for those investors who are looking to reduce their portfolio’s exposure to interest rate risk, or for those who are looking to invest some of their cash back into the market. Investors now have a new building block that they can use to create the right portfolio for them.

*Know the Differences

Money Market Funds

- A type of mutual fund that invests in high quality short-term debt and pay dividends that generally reflect short-term interest rates.

- Seek to maintain a stable value called a “net asset value” or NAV of $1.00 per share.

- Often used by investors to park cash, or as an alternative to investing in the stock market.

- Considered to be fairly safe investments, however do have risks and fees. While a fund’s managers try to keep the NAV stable, the yield changes over time. These changes generally reflect short-term interest rates.

Actively Managed ETFs

- Funds that trade on exchanges intraday at the current market price, which may differ from net asset value.

- Fees consist of an expense ratio and applicable transaction or brokerage costs.

- Hold baskets of securities.

- Actively managed; manager seeks to outperform underlying benchmark

Matt Tucker, CFA, is the iShares Head of Fixed Income Strategy and a regular contributor to The Blog. You can find more of his posts here.

Copyright © Blackrock