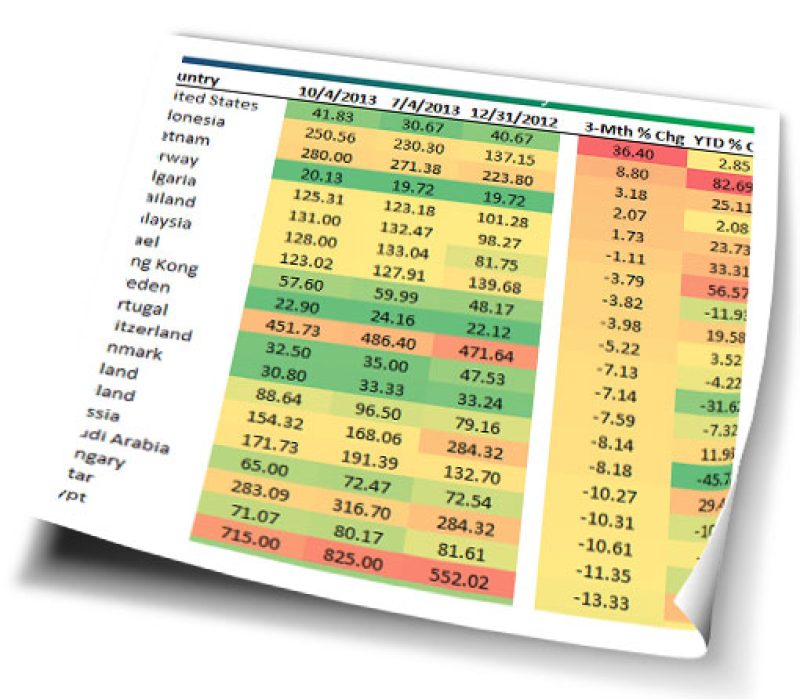

Due to our nationally-loved politicians down in DC (we hope you get the sarcasm), default risk on US debt has been rising rapidly in recent weeks. Over the last few decades, US debt has typically been the least risky in the world, but that is no longer the case due to our inability to pass, much less balance, our budget. Throw in a fight between the two parties in Congress and the White House over raising the debt limit, and you get to where we are now. As shown in the chart below highlighting 5-year credit default swap (CDS) prices on the sovereign debt of the "least risky" countries in the world, the US is moving on up towards the middle of the pack. Eight countries are now seen as less likely to default on their debt than the US. These include Norway, Finland, Sweden, Germany, Denmark, Austria, Switzerland and the United Kingdom.

Below is a look at the change in default risk for a number of countries over the last three months and since the start of the year. As you can see, while most countries have seen default risk fall significantly over the last three months, the US has seen its default risk spike by 36%. And we can only expect it to spike even more as the fight in Washington intensifies. Thanks DC!

Copyright © Bespoke Investment Group