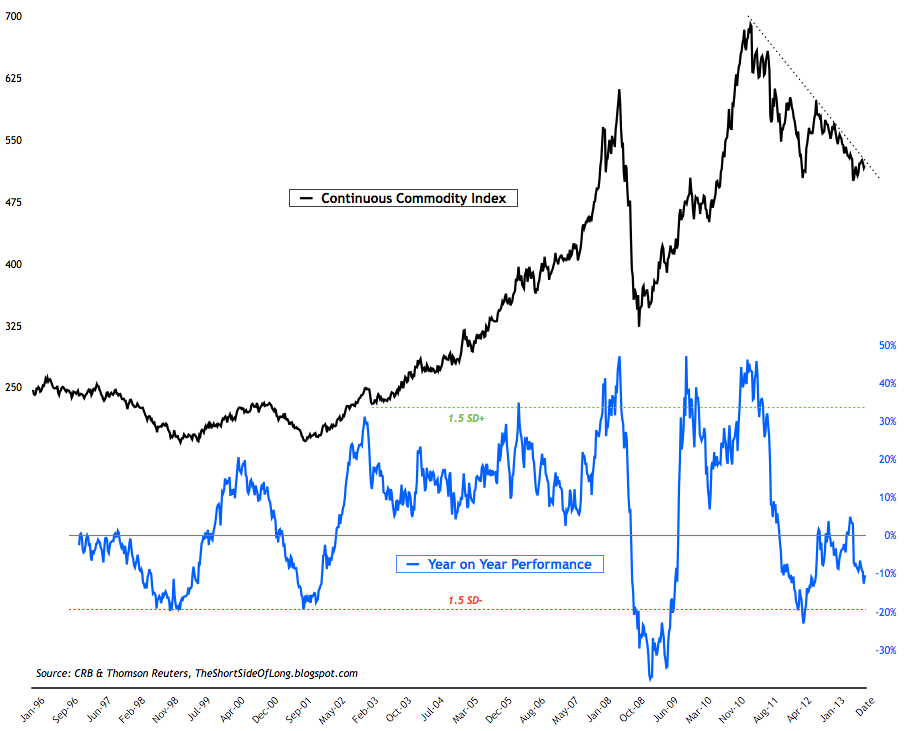

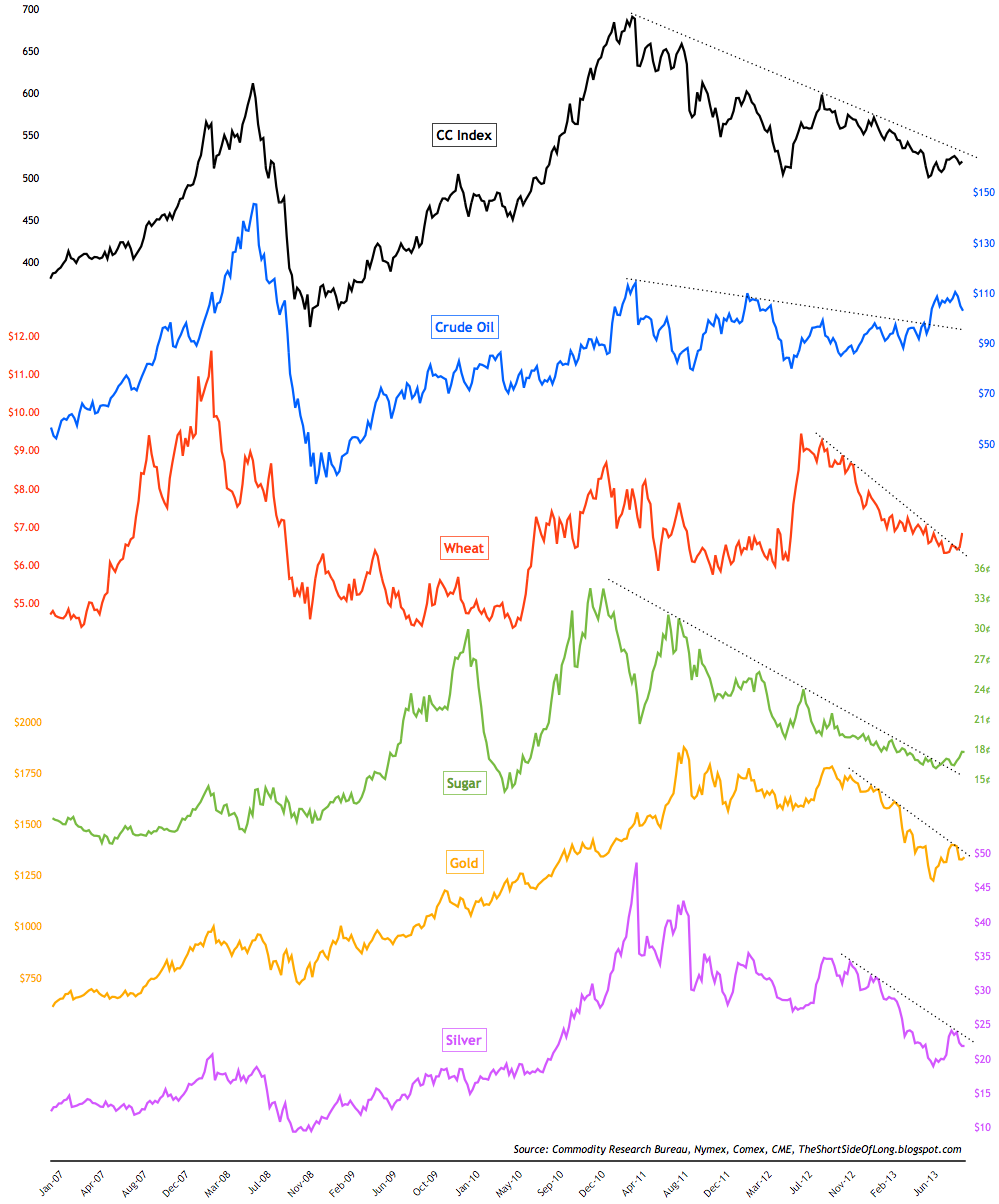

Interestingly enough, over the last few quarters just about every investment bank has declared the end to the commodities bull market. This is extremely premature in my opinion, as I continue to believe that demand and supply fundamentals still remain heavily in the favour of increasing prices (especially in agriculture and precious metals sectors).

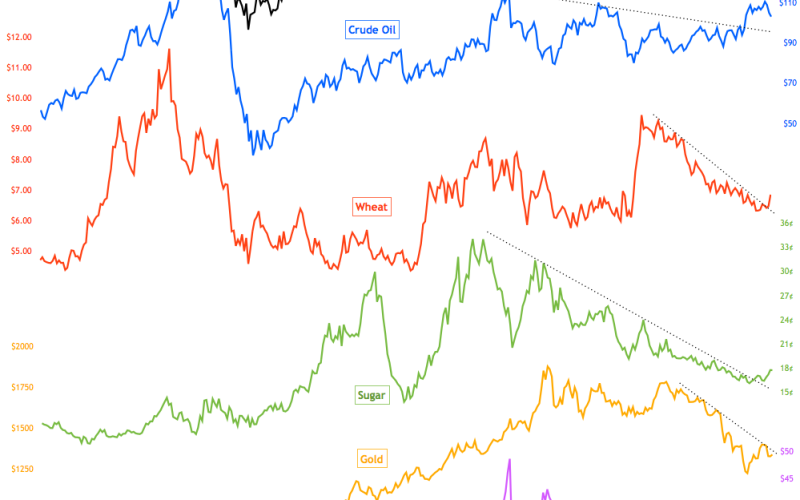

Nevertheless, commodities remain in a downtrend for now and have experienced an awful annualised performance over the last two years. I admit that there is still a potential for further downside prior to a proper bottom and a recovery towards new highs, therefore I am very selecting in which commodities are ripe to be bought at present. As the chart above shows perfectly, while some commodities are breaking out, others still remain in a downtrend.