by Kurt Feuerman, AllianceBernstein

As the global recession and financial crisis move further back in the rearview mirror, companies have been more proactive about using their balance sheets in ways that enhance shareholder value. But we think they can do a lot more.

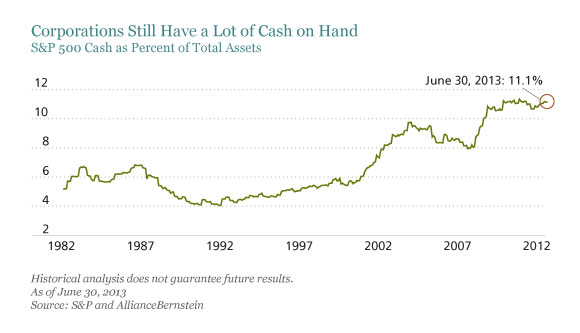

As the market tumbled and liquidity dried up post-2008, companies became very conservative in weathering the storm, hunkering down and building up massive cash reserves on their balance sheets. By mid-2013, US companies were sitting on cash that was equivalent to about 11% of their total assets (see Display), a more than three-decade high, earning almost nothing. What’s more, a long decline in interest rates has made borrowing much cheaper.

When corporations don’t put their healthy balance sheets to work in productive ways, shareholders get restless.

Thankfully, that trend has changed. With borrowing costs still very low and business conditions stable to improved, management teams have been more receptive to using debt to buy back shares, increase dividends and make acquisitions.

Each of these actions can boost shareholder value. Share buybacks shrink the total number of shares outstanding, providing a shot in the arm for earnings per share by helping them grow more rapidly in the years ahead, all things being equal. Dividend payments provide attractive income to investors, and acquisitions—if done thoughtfully—can create new avenues for business growth.

But there’s more to do. It’s getting somewhat harder to find companies that seem content to ignore low interest rates and high cash balances, but we still see some firms doing exactly that—even good companies that already represent attractive investments.

They can do better for their shareholders.

Let’s use QUALCOMM as an example. The telecom giant is a well-run business, but the company management’s strategy for returning capital to shareholders has been pretty underwhelming. The firm sits quietly in San Diego with a net cash balance equivalent to about $18 per share, and $6 of that isn’t held offshore—making it more accessible. Without borrowing a cent or repatriating any offshore cash, QUALCOMM could buy back 9% of its shares outstanding. By issuing relatively cheap debt, it could leave more cash on hand and accomplish the same goal.

We believe that buying back shares would benefit both the stock and shareholder value. The company did report $1.5 billion in share repurchases for the second quarter. But since these purchases were used to offset the exercise of company stock options, the average number of shares outstanding actually rose compared with the same quarter in 2012 and, for that matter, the first quarter of 2013.

So, from the perspective of outside shareholders, no shares were repurchased. Even as Qualcomm’s corporate earnings have exploded in recent years, its stock price has languished. In fact, it’s trading at a discount to the S&P 500 Index in terms of P/E ratio—despite strong growth forecasts relative to the S&P 500.

Apple took a different route—but only after a lot of convincing. It was a longtime holdout from buybacks, offering similar justifications to those we’ve heard from Qualcomm and other companies. These include the need for sufficient cash reserves to make operational investments and acquisitions in a rapidly evolving industry. We acknowledge the need for some liquidity, but it’s telling to us that Apple eventually relented and borrowed against its cash reserve to buy back a substantial number of shares.

Other companies still resist share repurchasing, even when their stocks are undervalued and they have more than enough cash on hand to shrink bloated share bases. Qualcomm’s management has raised its dividend in recent years, a modest positive. But it doesn’t shrink the share base—and it certainly doesn’t help the company take advantage of its stock’s low P/E ratio.

In our view, truly shrinking a company’s share base by buying back outstanding shares is likely to lead to higher earnings per share later on. And since corporate cash is earning less than the dividend yield on the stock, it could actually save money. Whether a company uses cash, relatively cheap debt issuance or a combination of both to increase shareholder value, we think investors would welcome the news.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Kurt Feuerman is Chief Investment Officer of Select US Equity Portfolios at AllianceBernstein.

Copyright © AllianceBernstein