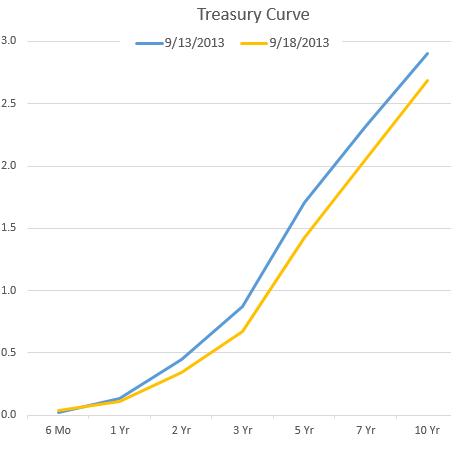

The FOMC announcement to hold the status quo on securities purchases resulted in a flatter yield curve.

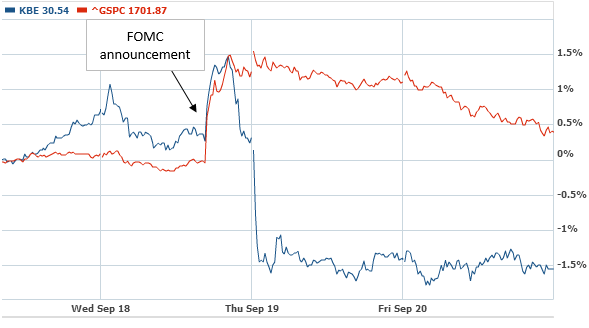

While this surprising decision by the Fed helped a number of "risk-on" assets, it was a negative for banks. Bank shares rallied initially with equity indices, but sold off sharply later in the afternoon and the following day - creating a 2% underperformance gap (h/t George H).

red=S&P500; blue= bank index ETF

The yield curve slope benefits banks because they typically fund themselves through short-term instruments (mostly through deposits), while lending longer term. The higher the spread between the two, the greater the banks' net interest income (see story from May). The market is signaling reduced profitability and potentially weaker lending growth (discussed here). With higher capital requirements (under Dodd Frank, Basel III, Leverage Ratio rule, etc.), banks need to generate larger margins to achieve the same return on capital (ROC). If the curve is not steep enough, some loans no longer meet the ROC threshold.

But what about the lower mortgage rates improving demand for residential loans? Shouldn't that help banks originate more loans and sell them to the GSEs? Unfortunately the Fed's action resulted in just a 14bp decline in the 30y mortgage rate (see post). That's not nearly enough to stimulate demand. The FOMC's decision is therefore likely to be a net negative for US credit growth.

Copyright © SoberLook.com