by David Templeton, Horan Capital Advisors

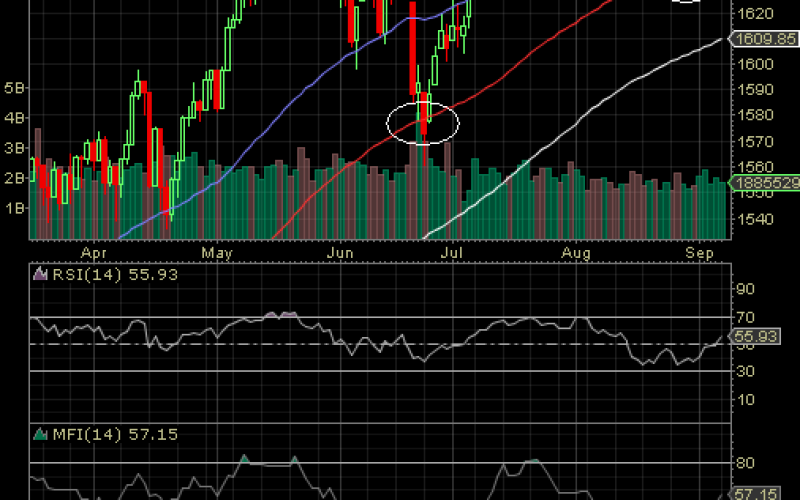

As we wrote in a post one week ago it appeared the selling pressure on the S&P 500 Index was waning. We cited the different levels of the Money Flow Index (MFI) and the Relative Strength Index (RSI) this year versus this same time last year. In another post we cited the importance the market has attributed to the 100 day moving average. In fact, the positive market action so far this September began with the bulls successfully defending this 100 day M.A. support level last week.

With many investors having returned from summer vacation, today saw a strong bounce in the market, some of this driven by perceived positive developments on the situation in Syria. The bounce today places the market index close just above the 50 day moving average of 1,666 and above the August 26th intraday high of 1,669. These technical levels are important in today's market environment due to the increased influence of algorithmic trading activity. Additionally, the MACD has been positive for two trading days along with improved measures for the RSI and the MFI. Certainly more technical improvement needs to occur to repair the damage incurred in August.

A number of events are on the horizon that could derail the positive action that has occurred so far in September, such as, the situation on Syria, the federal government's debt ceiling issue, Fed tapering and the elections in Germany on September 22, just to name a few. Economic and company fundamentals will ultimately play a crucial role in sustaining the market's advance. For now though, we have passed the peak 2Q earnings season with technical factors playing a key role in the market's direction for the balance of September.

Copyright © Horan Capital Advisors