by Steve Visscher, Mawer Investment Management

Wouldn’t life be great if you could quit your job and make one billion dollars?

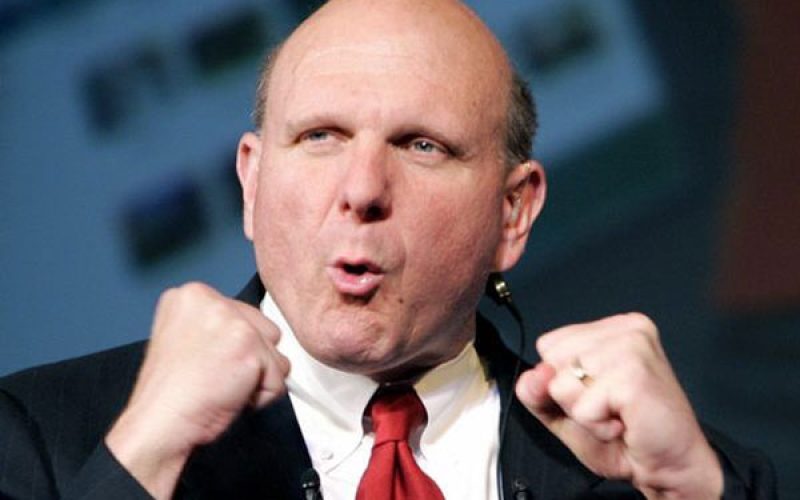

Welcome to the world of Microsoft CEO Steve Ballmer. After recently announcing his intention to resign next year as CEO, Microsoft shares surged higher, instantly adding billions of dollars to the value of the company. Seeing shareholders celebrate his departure may have hurt his ego, but Ballmer’s personal stake in Microsoft shares increased in value by almost $800 million that day. Not quite $1 billion, but a pretty nice going away present.

I was asked by a client why the resignation of a CEO would make Microsoft’s business worth 7% (or approximately $20 billion) more than the day before. They didn’t sell more software. They didn’t announce a new contract or unveil a new product. One man simply announced he would retire with no hint of who would replace him. Is that worth $20 billion?

This question prompted a discussion on the different ways to measure the value of a business. Why not calculate Microsoft’s business value in the same way we just calculated my net worth? Add up the business assets and subtract the liabilities. Since the retirement announcement had no financial impact, the value of Microsoft should not have changed.

But we don’t believe this methodology is very useful. Would you buy a lemonade stand based on the value of the lemons and drinking cups, or would you value it based on the amount of cash flow that you could generate? This is how Mawer values businesses. We believe every business is ultimately worth the sum of its future cash flows, recognizing that a dollar today is more valuable than a dollar tomorrow.

If we apply that framework to Microsoft, its dramatic rise in value following a retirement announcement may not seem so absurd. New leadership has the potential to re-shape a corporate culture, revive a brand image, and build a more effective capital allocation framework – all factors that could materially enhance the cash-flow generating ability of the company.

Time will tell if Microsoft’s managerial changes will pan out. The important point for investors is to employ a valuation framework that embodies forward-looking analysis rather than rely solely on current conditions.

Steven Visscher