There's a common market axiom on Wall Street that says that investors should sell on Rosh Hashanah and buy on Yom Kippur. In other words, the ten day stretch between the Jewish New Year and the Day of Atonement is a period of time where bulls should go into hibernation. According to Art Cashin, the reason for the historical weakness in equities during this period is that people of the Jewish religion "wished to be free (as much as possible) of the distraction of worldly goods during a period of reflection and self-appraisal."

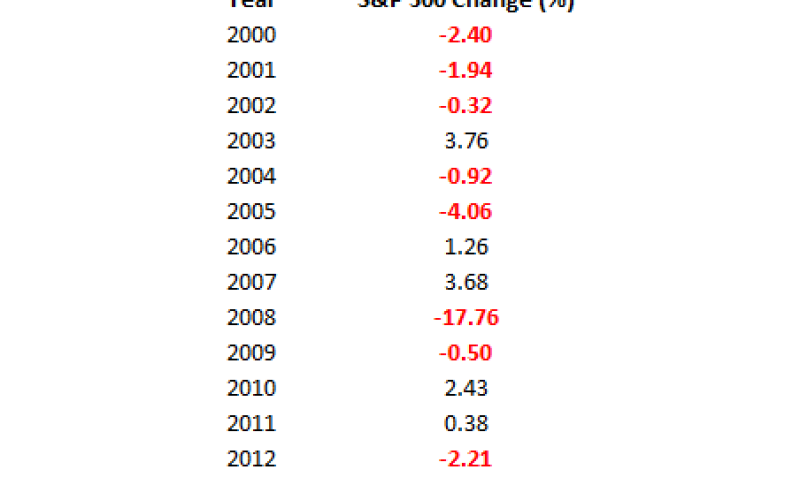

Whatever the explanation for the market's weakness, as with all market axioms, there is some truth to the phrase. The table below shows the historical performance of the S&P 500 from the close before Rosh Hashanah to the close on Yom Kippur going back to 2000. As shown in the table, the S&P 500 has averaged a decline of 1.43% during the period with positive returns in only five out of thirteen years (38%).

While the overall average change is -1.43%, we would note that the 18% decline in 2008 does skew the results a bit. Looking at the median return instead shows that the S&P 500 declines a more modest 0.50% during the period, but it's still negative nonetheless. For the sake of reference, this year, Rosh Hashanah begins at sundown tonight (9/4) and Yom Kippur ends on 9/14.

Copyright © Bespoke Investment Group