Submitted by Lance Roberts of Street Talk Live blog,

Recently I wrote a post titled "Earnings & Profits Per Share Discuss Overvaluation" which discussed that when looking at NIPA profits the deviation from their long term growth trend suggests overvaluation. Specifically I stated:

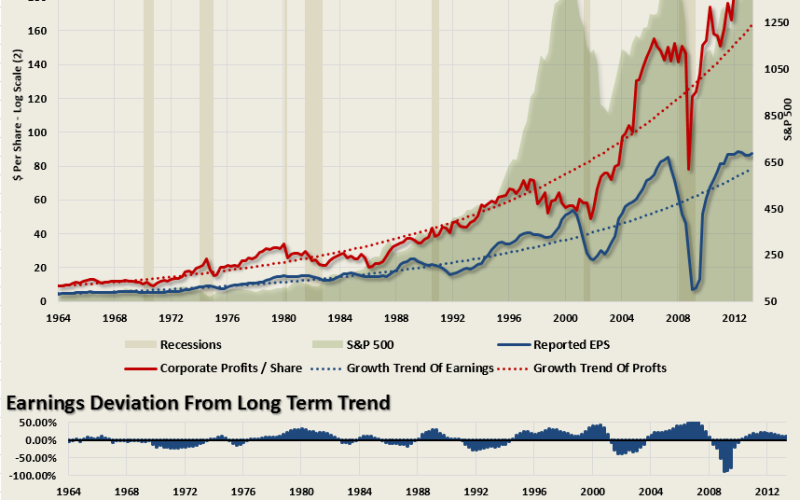

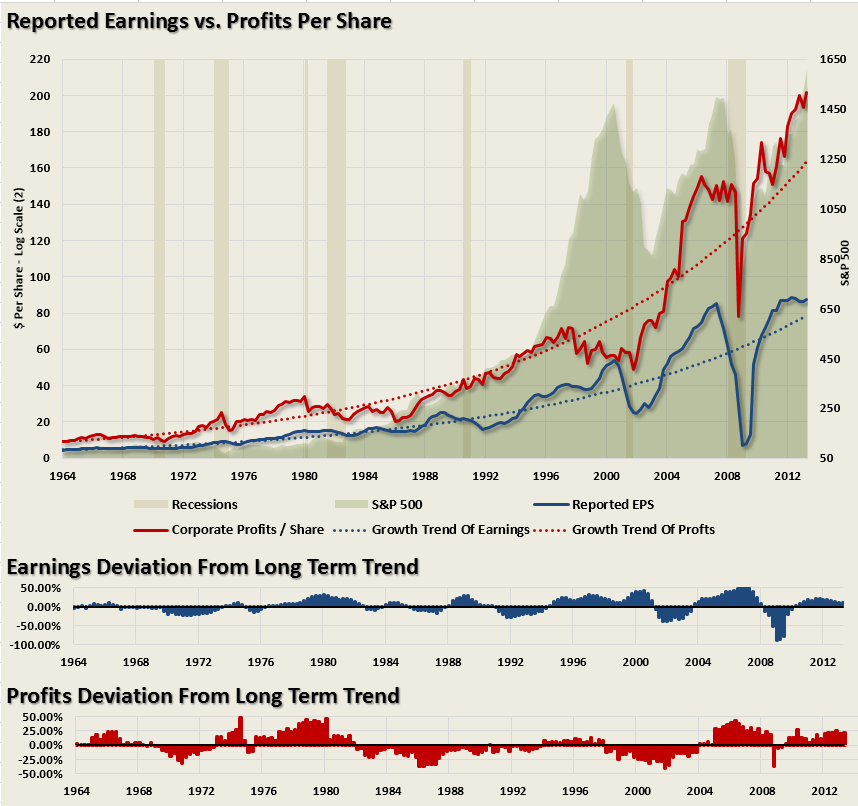

"As you will notice each time that corporate profits (CP/S) and earnings per share (EPS) were above their respective long term historical growth trends the financial markets have run into complications. The bottom two graphs shows the percentage deviations above and below the long term growth trends.

What is important to understand is that, despite rhetoric to the contrary, "record" earnings or profits are generally fleeting in nature. It is at these divergences from the long term growth trends where true buying and selling opportunities exist.

Are we currently in another asset "bubble?" The answer is something that we will only know for sure in hindsight. However, from a fundamental standpoint, with valuations and profitability on a per share basis well above long term trends it certainly does not suggest that market returns going forward will continue to be as robust as those seen from the recessionary lows"

The reason I discussed this particular metric was due to a recent article by Jeremy Siegel on market valuations based on corporate profits rather than Robert Shiller's cyclically adjusted P/E (CAPE) ratio. Siegel stated:

"I believe the Cape ratio’s overly pessimistic predictions are based on biased earnings data. Changes in the accounting standards in the 1990s forced companies to charge large write-offs when assets they hold fall in price, but when assets rise in price they do not boost earnings unless the asset is sold. This change in earnings patterns is evident when comparing the cyclical behaviour of Standard and Poor’s earnings series with the after-tax profit series published in the National Income and Product Accounts (NIPA).

For the 2001-02 and 2007-09 recessions, S&P reported earnings dropped precipitously due to a few companies with huge write-offs, while NIPA earnings were more stable. Yet before 2000, the cyclical behaviour of the two series was similar. Downward biased S&P earnings send average 10-year earnings down and bias the Cape ratio upward. In fact, when NIPA profits are substituted for S&P reported earnings in the Cape model, the current market shows no overvaluation."

My point is that regardless of the metric that you use; deviations from the long term growth trend are unstainable and will eventually mean revert. Mebane Faber wrote an excellent piece in this regard noting that Siegel is likely missing the bigger picture. Faber noted:

1. He talks about write downs and how that biases CAPE. The problem is, even if you ignored the bear market, even if the earnings decline of 2008,2009, 2010 never happened, effect on PE10 / CAPE would be mild- it would go from 23.7 to 21.2. In other words it is still expensive! (This was a month ago).

Today SocGen put out an excellent piece titled “To Ignore CAPE is to Deny Mean Reversion”

They use the MSCI earnings index that doesn’t include the writedowns and they come to the same conclusions as using the S&P series.

2. CAPE isn’t really a short term timing measure for one market. Like most valuation measures, it’s not that helpful telling you what to do for the next 6 months. It makes much more sense to align the indicator with your holdings period. Here is a post we did – Broadening the Window. However, pretty much every value measure we track aligns to say the same thing – US stocks are expensive.

3. But the biggest point that he misses, is that in a global world why focus on just the US? There are well over 40 investable countries in the world, why just settle for one? We have shown numerous times that selecting countries on a relative basis on CAPE works great to not only pick winners, but also to avoid the bubbly losers. And according to CAPE, the US is the second most expensive market we track right now…and according to 1 year PE, it is the 4th most expensive…and according to P/B…etc

If you do a composite across 10PE, 1PE, FCF, P/B, and dividends…the US is still the 4th most expensive…

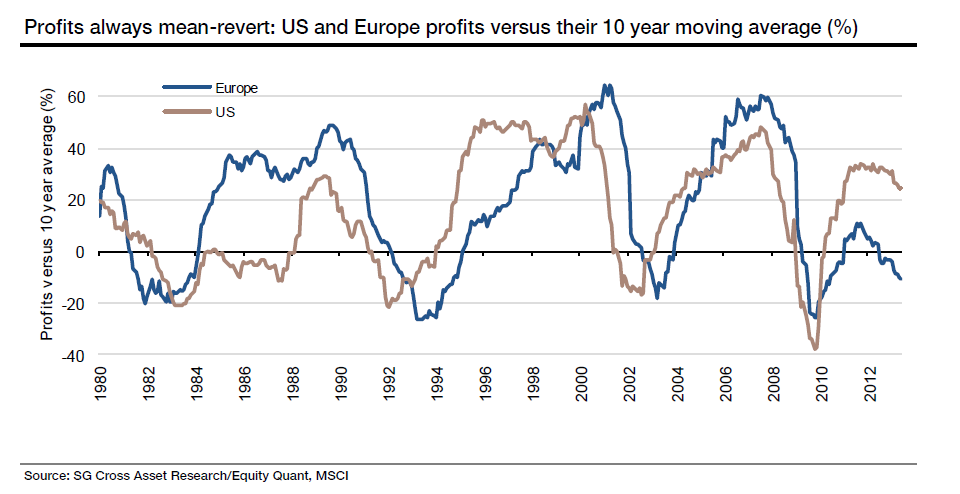

4. Note the potential for margin mean reversion in the below chart from the SocGen piece….which side would you rather bet on?

- See more at: http://www.mebanefaber.com/2013/08/22/what-siegel-is-missing/#sthash.HUlerv1U.dpuf

1. He talks about write downs and how that biases CAPE. The problem is, even if you ignored the bear market, even if the earnings decline of 2008,2009, 2010 never happened, effect on PE10 / CAPE would be mild- it would go from 23.7 to 21.2. In other words it is still expensive! (This was a month ago).

Today SocGen put out an excellent piece titled “To Ignore CAPE is to Deny Mean Reversion”

They use the MSCI earnings index that doesn’t include the writedowns and they come to the same conclusions as using the S&P series.

2. CAPE isn’t really a short term timing measure for one market. Like most valuation measures, it’s not that helpful telling you what to do for the next 6 months. It makes much more sense to align the indicator with your holdings period. Here is a post we did – Broadening the Window. However, pretty much every value measure we track aligns to say the same thing – US stocks are expensive.

3. But the biggest point that he misses, is that in a global world why focus on just the US? There are well over 40 investable countries in the world, why just settle for one? We have shown numerous times that selecting countries on a relative basis on CAPE works great to not only pick winners, but also to avoid the bubbly losers. And according to CAPE, the US is the second most expensive market we track right now…and according to 1 year PE, it is the 4th most expensive…and according to P/B…etc

If you do a composite across 10PE, 1PE, FCF, P/B, and dividends…the US is still the 4th most expensive…

4. Note the potential for margin mean reversion in the below chart from the SocGen piece….which side would you rather bet on?

- See more at: http://www.mebanefaber.com/2013/08/22/what-siegel-is-missing/#sthash.HUlerv1U.dpuf

1. He talks about write downs and how that biases CAPE. The problem is, even if you ignored the bear market, even if the earnings decline of 2008,2009, 2010 never happened, effect on PE10 / CAPE would be mild- it would go from 23.7 to 21.2. In other words it is still expensive! (This was a month ago).

Today SocGen put out an excellent piece titled “To Ignore CAPE is to Deny Mean Reversion” They use the MSCI earnings index that doesn’t include the writedowns and they come to the same conclusions as using the S&P series.

2. CAPE isn’t really a short term timing measure for one market. Like most valuation measures, it’s not that helpful telling you what to do for the next 6 months. It makes much more sense to align the indicator with your holdings period. Here is a post we did – Broadening the Window. However, pretty much every value measure we track aligns to say the same thing – US stocks are expensive.

3. But the biggest point that he misses, is that in a global world why focus on just the US? There are well over 40 investable countries in the world, why just settle for one? We have shown numerous times that selecting countries on a relative basis on CAPE works great to not only pick winners, but also to avoid the bubbly losers. And according to CAPE, the US is the second most expensive market we track right now…and according to 1 year PE, it is the 4th most expensive…and according to P/B…etc

If you do a composite across 10PE, 1PE, FCF, P/B, and dividends…the US is still the 4th most expensive...

4. Note the potential for margin mean reversion in the below chart from the SocGen piece... which side would you rather bet on?

Conclusion from Lapthorne at SocGen:

“At the peak of the cycle, when profits are far above average and the economy is doing well, it is hard to imagine earnings collapsing back below the average, as it is to imagine a depressed region recovering. Mean-reversion in earnings, though sometimes delayed, is as undeniable as the economic cycle itself. Cyclically adjusted (or trend) PE calculations will always give a conservative valuation estimate. But that is exactly the point of valuation – to offer a degree of safety (a margin of error) and to smooth the dangers of the economic cycle. That peak profits typically accompany peak valuations only reinforces the point.

One can always discuss the idiosyncrasies of any particular valuation metric, although we reach similar conclusions to Robert Shiller’s CAPE analysis – but using a more modern time frame and a different (and more generous) earnings series. Our conclusions are that the US equity market is currently expensive. We can also reach a similar conclusion using alternative valuation metrics such as dividend yield, trend PE, and Tobin’s Q.

Most significantly, the downside risk of investing when earnings and valuations are far above historical averages should not be underestimated. from our work, peak earnings go hand-inhand with peak valuations. When earnings revert back to mean (and below), the valuation will also collapse. That many continue to argue against this, and so soon after the collapse of 2008/09, is something we find quite remarkable. “

Jeremy Siegel talks about CAPE in a recent FT article. He has a few criticisms, but misses the bigger picture in my opinion.

1. He talks about write downs and how that biases CAPE. The problem is, even if you ignored the bear market, even if the earnings decline of 2008,2009, 2010 never happened, effect on PE10 / CAPE would be mild- it would go from 23.7 to 21.2. In other words it is still expensive! (This was a month ago).

Today SocGen put out an excellent piece titled “To Ignore CAPE is to Deny Mean Reversion”

They use the MSCI earnings index that doesn’t include the writedowns and they come to the same conclusions as using the S&P series.

2. CAPE isn’t really a short term timing measure for one market. Like most valuation measures, it’s not that helpful telling you what to do for the next 6 months. It makes much more sense to align the indicator with your holdings period. Here is a post we did – Broadening the Window. However, pretty much every value measure we track aligns to say the same thing – US stocks are expensive.

3. But the biggest point that he misses, is that in a global world why focus on just the US? There are well over 40 investable countries in the world, why just settle for one? We have shown numerous times that selecting countries on a relative basis on CAPE works great to not only pick winners, but also to avoid the bubbly losers. And according to CAPE, the US is the second most expensive market we track right now…and according to 1 year PE, it is the 4th most expensive…and according to P/B…etc

If you do a composite across 10PE, 1PE, FCF, P/B, and dividends…the US is still the 4th most expensive…

4. Note the potential for margin mean reversion in the below chart from the SocGen piece….which side would you rather bet on?

Conclusion from Lapthorne at SocGen:

“At the peak of the cycle, when profits are far above average and the economy is doing well, it is hard to imagine earnings collapsing back below the average, as it is to imagine a depressed region recovering. Mean-reversion in earnings, though sometimes delayed, is as undeniable as the economic cycle itself. Cyclically adjusted (or trend) PE calculations will always give a conservative valuation estimate. But that is exactly the point of valuation – to offer a degree of safety (a margin of error) and to smooth the dangers of the economic cycle. That peak profits typically accompany peak valuations only reinforces the point.

One can always discuss the idiosyncrasies of any particular valuation metric, although we reach similar conclusions to Robert Shiller’s CAPE analysis – but using a more modern time frame and a different (and more generous) earnings series. Our conclusions are that the US equity market is currently expensive. We can also reach a similar conclusion using alternative valuation metrics such as dividend yield, trend PE, and Tobin’s Q.

Most significantly, the downside risk of investing when earnings and valuations are far above historical averages should not be underestimated. from our work, peak earnings go hand-inhand with peak valuations. When earnings revert back to mean (and below), the valuation will also collapse. That many continue to argue against this, and so soon after the collapse of 2008/09, is something we find quite remarkable.

- See more at: http://www.mebanefaber.com/2013/08/22/what-siegel-is-missing/#sthash.XxbZgO7I.dpuf

In the long run valuations mean everything.