For this week's SIA Equity Leaders Weekly, we are going to take a look at the relationship between Gold Stocks and Gold Bullion as it sits today. For regular readers we touched on this topic on June 27th where we highlighted a strategy for investors in Gold to take advantage of the routine outperformance of either Bullion or Stocks over each other. With recent activity this relationship has changed and as such offers a potential opportunity to those who have Gold holdings.

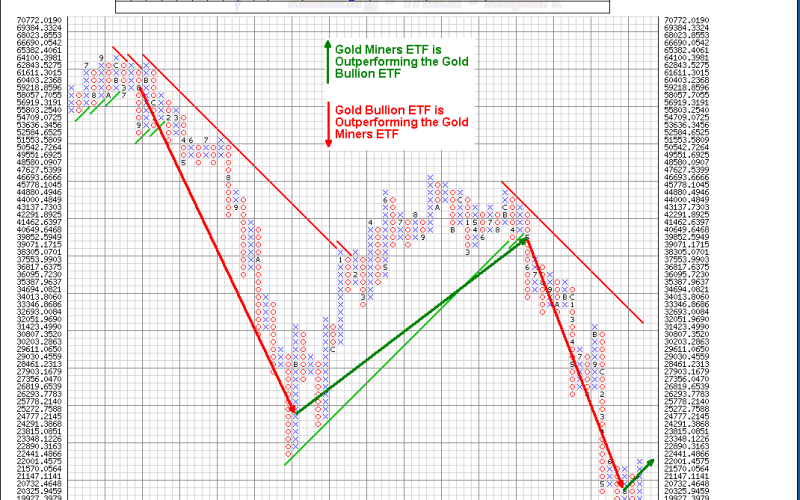

Gold Miners ETF vs. Gold Bullion ETF (GDX^GLD)

Our first chart is a comparison of the Gold Miners ETF, (GDX) vs. the Gold Bullion ETF, (GLD). We can see in this chart that there have been significant changes in outperformance between the two Gold participants that can offer additional return if used. What we see in the current situation though is a transition from Gold Bullion leading to Gold Stocks showing outperformance. This change in relative strength is recent, having started in early August and as such we can now have more confidence that investments in Gold Stock ETF's or strong relative strength Gold Stocks should add more upside potential than physical Gold.

Click on Image to Enlarge

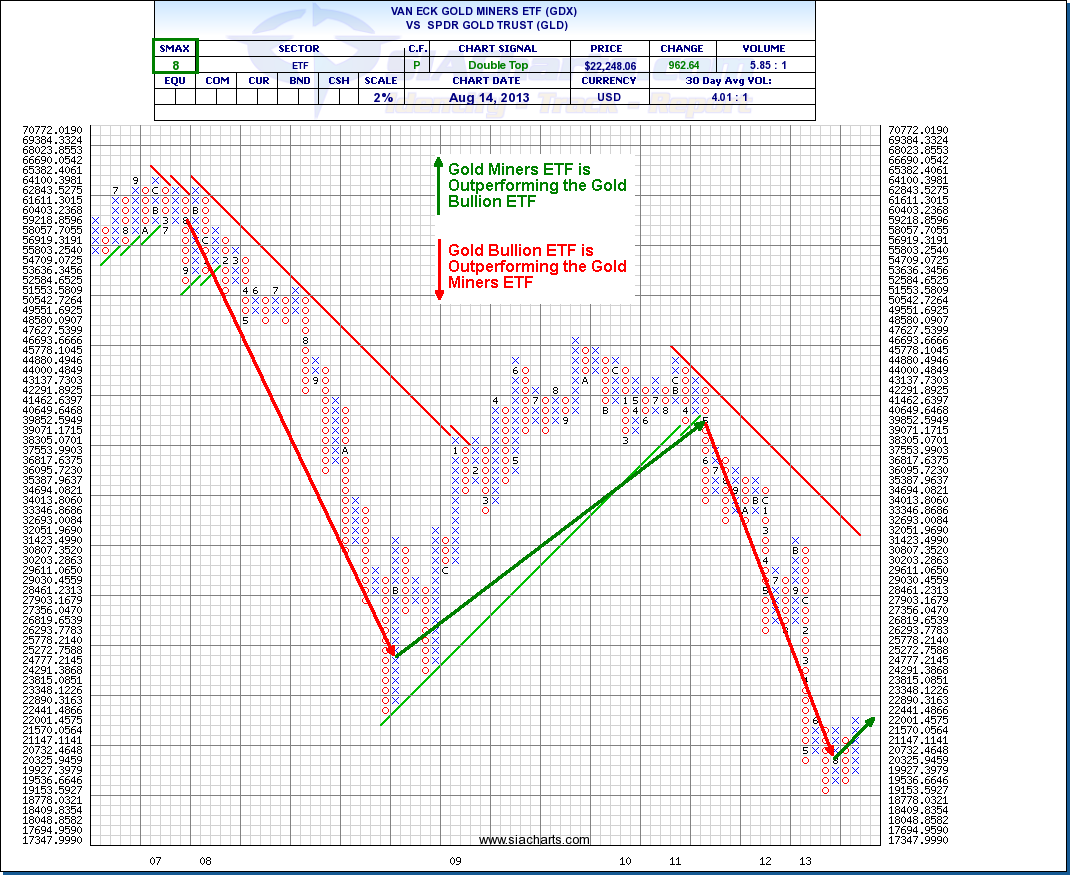

Market Vectors ETF (GDX)

From our observations of the comparison chart between Gold Stocks and Gold Bullion we now know we should be focusing our attention on Stocks. In the second chart this week we will now take a look at a very popular ETF to take advantage of this relative outperformance, GDX.

Looking at the chart we can see that GDX had been under tremendous pressure since the latter part of 2011 and in the first part of 2012 until August of 2013 the downward pressure escalated. Since August though, we see a rare upswing in GDX which has allowed it to take command over Gold Bullion but has also moved it to the Favored Zone of the U.S. Commodity ETF's Report.

Current support for GDX is above $26.45 with additional support above $24.44. The upside though has one material resistance level at $30.99 to breach to give it room to the $37.78 range.

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.

Copyright © SIACharts.com