Pre-opening Comments for Wednesday August 14th

U.S. equity index futures were lower this morning. S&P 500 futures were down 4 points in pre-opening trade.

Index futures weakened following release of the July Producer Price Index. Consensus was an increase of 0.3% versus a gain of 0.8% in June. Actual was no change. Excluding food and energy, consensus was an increase of 0.2% versus a gain of 0.2% in June. Actual was an increase of 0.1%.

Deere added $0.84 to $84.75 after reporting higher than consensus fiscal third quarter results.

Macy’s fell $1.50 to $84.75 after reporting lower than expected second quarter results. The company also reduced its revenue and earnings guidance for the year.

Encana (ECA $17.39) is expected to open higher after Global Hunter initiated coverage with an Accumulate rating.

Transocean (RIG $47.46) is expected to open lower after ISI Group downgraded the stock from Strong Buy to Neutral.

Interesting Charts

Chinese equity indices and related ETFs continued to move higher on a real and relative basis.

Concern about “tapering” by the Fed triggered higher interest rates yesterday. The yield on 10 year Treasuries once again is testing its recent high at 2.737%.

Interest sensitive bonds and equities and their related ETFs quickly responded by moving lower

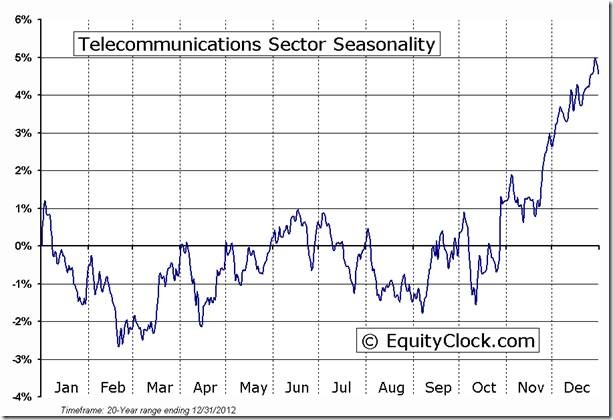

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. Notice that most of the seasonality charts have been updated recently.

To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Telecommunications Sector Seasonal Chart

FP Trading Desk Headline

FP Trading Desk headline reads, “Ned Goodman ditches bank stocks for gold”. Following is a link to the report:

http://business.financialpost.com/2013/08/08/ned-goodman-ditches-bank-stocks-for-gold/

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

Horizons Seasonal Rotation ETF HAC August 13th 2013

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/84e6beeee345b666d94a098122fe3002.png)