July 9, 2013

by Michelle Gibley, CFA, Director of International Research, Schwab Center for Financial Research

Key Points

- Water demand is likely to continue to rise along with global population and incomes.

- Water infrastructure and technology investment can make fresh water more accessible while improving the efficiency and reducing the cost of delivery.

- We believe that investing in water—particularly in companies in the industrials sector—can be a good, long-term theme for investors.

Governments and businesses are increasingly investing in water infrastructure and technology to meet growing demand. As a result, we believe that companies tied to meeting water demand have good long-term investment potential.

Consumers in the United States often take for granted their access to a clean and plentiful water supply. However, access to water varies globally, and useable water isn't always available where and when it's needed. For example, China has 20% of the world's population and yet is estimated to have only 7% of its freshwater reserves. The country is now spending an estimated $40-65 billion and may relocate hundreds of thousands of people in order to divert water as part of the giant South-North Water Transfer Project.

What types of companies are in the water sector?

Companies in the "water sector" are roughly 50% industrials, 40% utilities and 10% other, and the consensus earnings growth forecasts for most over the next five years are in the 5-15% range. We favor companies in the industrials sector, as they're most likely to benefit from an investment cycle to upgrade infrastructure and improve the efficiency of water use. Industrials companies in the water sector are multinational and often headquartered outside of the United States, so investors may need to look beyond our borders to get good exposure to the group, or use diversified vehicles such as mutual funds or exchange-traded funds (ETFs). Utilities companies are typically a lower-growth way to invest in the water theme and tend to be domestically oriented.

Addressing demand will require investment

Water infrastructure and technology investment can make fresh water more accessible while improving efficiency and reducing the cost of delivery. Areas of potential business and government investment include:

- Irrigation. Water use is inefficient in some regions, with roughly 15–35% of water withdrawals for irrigation estimated to be unsustainable.1 As of 2012, less than 20% of the world's cultivated area was covered by irrigation, according to the United Nation's World Water Development Report 4 (WWDR4). According to the Food and Agriculture Organization of the United Nations (FAO), global agriculture water consumption (including both rained and irrigated agriculture) will increase an estimated 19% by 2050.2 Sub-Saharan Africa and the southern United States have potential to expand irrigation,3 and drip irrigation (using pipes that release water directly onto plant roots) and systems to manage usage and recapture water for re-use could help improve efficiency.

- Pipelines. Approximately half the water pipelines in the United States are in poor to fair condition, and have deteriorated in the past two decades due to insufficient investment. Nearly 44% of water pipelines are over 40 years old and 9% are over 80 years old, according to the Environmental Protection Agency. One EPA report projects that water-infrastructure spending will reach $41.5 billion in 2020, while infrastructure needs will grow to $125.9 billion—representing an $84.4 billion funding gap.

- Industry. Water utilities are likely to raise their prices if demand and capital spending increase, which could in turn incentivize industry to invest in ways to find more efficient ways to use water (and wastewater). Additional investment could be catalyzed by the US energy renaissance. Fracking is encouraging more exploration, development and refining of natural gas, and subsequently catalyzing investment in new factories (particularly chemical factories) to take advantage of cheap energy prices in the United States relative to global standards.

- Desalinization. Since the 1960s, plants have been converting salt water to fresh water. While desalinization costs have been falling, there's still room for improvement; energy is the single largest expense, accounting for nearly 50% of the cost, according to the Pacific Institute. As a result, there will likely be investment and innovation to make desalinization even more cost competitive in the future.

- Sanitation and drinking water. The World Health Organization (WHO) states that by the end of 2011, almost 2.5 billion people lacked access to an improved sanitation facility (meaning, flush toilets or connection to septic or sewer systems), with 761 million of these people using public or shared sanitation facilities and another 693 million using facilities that do not meet minimum standards of hygiene. As a result, WHO estimates 2 million annual deaths due to diarrheal disease attributable to unsafe water, sanitation and hygiene.

Where is the demand for water coming from?

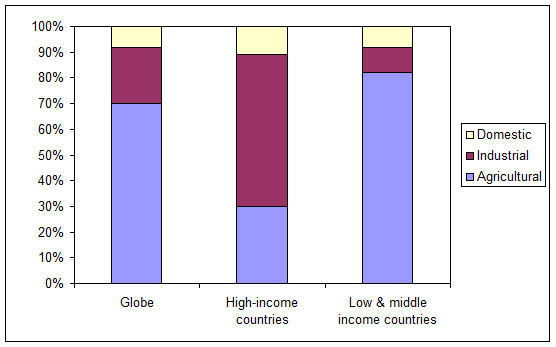

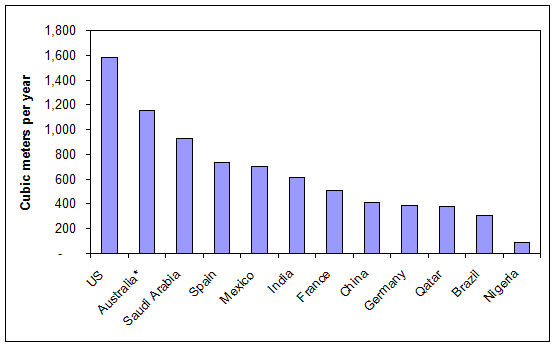

On a global basis, 70% of water is used for agriculture irrigation, 22% is used for industries, and 8% is used by households. Wealthier countries dedicate a greater percentage of water to industrial use, while low- and middle-income countries devote more to agriculture.4 The United States consumes the most water per capita, and while water use typically grows as national incomes rise, at some point it levels off as people begin to conserve.

More water goes to industrial use as incomes rise

Source: The United Nations World Water Development Report 4, UNESCO 2012.

A number of trends could support future demand for water:

- Population growth. The world's population surpassed seven billion in 2011 and is expected to increase to nine billion by 2040.5 By 2025, 1.8 billion people are expected to be living in countries or regions with "absolute" water scarcity and two-thirds of the world population could be under "stressed" conditions.6

- Income growth. Water consumption typically rises in tandem with household incomes, in part because people start consuming more meat and dairy products. A meat-based diet is more water-intensive than a grains-based diet, as one pound of meat requires multiple pounds of grains to produce.

- Urbanization. Small private wells and septic tanks might work in rural areas, but cities require more advanced infrastructure to deliver fresh water to homes and carry away wastewater. Wastewater treatment also requires large amounts of energy. Additionally, with urbanization comes convenience, typically at a cost of increased food waste (which means more water going to produce food that nobody eats).

- Economic development. As the global economy grows, so do the manufacturing and services that support it. Currently, coal-powered energy plants are the largest industrial consumer of water.

Total annual water use per capita

Source: FAO AQUASTAT database as of June 2013. Data as of most recent date available for 2005-2010 period, except Australia, as of 2000.

What are possible downsides to water investment opportunities?

While it seems likelier that global demand for water will increase in the future, there's a chance that reduced demand or other factors could make water companies a less attractive investment target. Risks include:

- Many companies in the water sector (both domestic and international) depend heavily on government funding, which faces budget constraints.

- Many companies in the sector also need access to debt financing, which could become more expensive if interest rates rise.

- Many companies in the sector have water as only one business line, and so factors outside of the water business can influence their outlooks.

- If utilities shift from coal to natural gas for fuel, they may need less water.

- Strategies to reduce food waste, including better storage, transportation, food processing and consumption trends, could reduce water needs.

- Reduced support for biofuels could reduce water demand.

- Changing consumption patterns—demand could fall if wealthy consumers shift away from meat-based diets, or demand could rise if resistance to genetically modified seeds results in a shift away from their use and results in lower crop yields and the need to produce more food.

1. Millennium Ecosystem Assessment, "Ecosystems and Human Well-being: Synthesis", 2005.

2. Food and Agriculture Organization of the United Nations, "The Post 2015 Water Thematic Consultation—Water Resources Management System Framing Paper", February 2013.

3. United Nations World Water Development Report 4, UNESCO, 2012.

4. United Nations World Water Development Report, UNESCO, 2003.

5. World Population Prospects: The 2012 Revision, United Nations.

6. UN-Water, "Coping with Water Scarcity: Challenge of the Twenty-First Century", 2007.

Important Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market, economic or geopolitical conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

International investments involve additional risks, which include differences in financial accounting standards, currency fluctuations, political instability, foreign taxes and regulations, and the potential for illiquid markets.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.

Thumbs up / down votes are submitted voluntarily by readers and are not meant to suggest the future performance or suitability of any account type, product or service for any particular reader and may not be representative of the experience of other readers. When displayed, thumbs up / down vote counts represent whether people found the content helpful or not helpful and are not intended as a testimonial. Any written feedback or comments collected on this page will not be published. Charles Schwab & Co., Inc. may in its sole discretion re-set the vote count to zero, remove votes appearing to be generated by robots or scripts, or remove the modules used to collect feedback and votes.

Copyright © Schwab.com