by Russ Koesterich, iShares

As a general rule, if you aren’t prone to thrill seeking, you tend to stay on the ground while others bungee jump. In a similar vein, investors who want to avoid the ups and downs of financial markets tend to favor bonds over equities. Unfortunately, in recent weeks, many bond investors have suffered a nasty surprise.

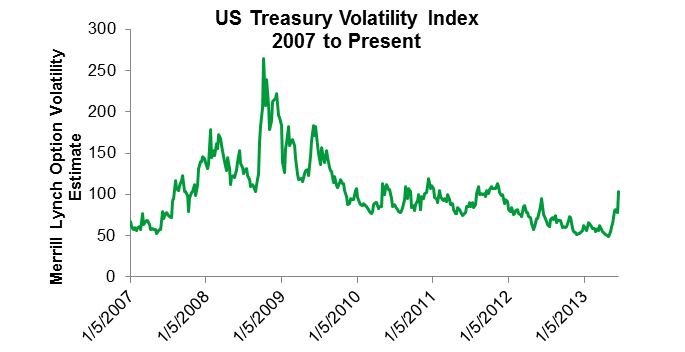

The prospect of less monetary accommodation from the Federal Reserve (Fed) has sent bond market volatility to its highest level since late 2011, as the chart below shows.

But while the recent volatility spike has been a shock to many, it’s important to put it into context.

To start with, bond market volatility is rising from an unusually low level. Over the last couple of years, bond markets were unusually calm. In fact, as the chart above shows, the doubling of volatility since the spring represents a return to long-term average volatility rather than a bond market crisis. (The same is true of recent equity market volatility, which has also now reverted back to its long-term average.)

In addition, bonds aren’t the only more volatile asset class. Every asset class, from stocks to gold, has experienced a pronounced spike in volatility as investors digest the possible impact of the Fed tapering its bond buying program. And though tapering isn’t likely to derail the recovery, I expect that volatility is likely to continue in coming months as investors accustomed to ever looser monetary conditions adapt to tighter money.

So where does this leave bond investors worried about more of the same rocky road ahead? Here are three portfolio positioning suggestions:

1. As I’ve been recommending all year, be mindful of your bonds’ duration. While I believe rates may pull back in the near term and I expect the 10-year Treasury note to finish the year around 2.5%, the long-term direction of interest rates is higher. This suggests investors may want to consider owning bonds with shorter maturities, which should be less sensitive to rising rates.

That said, investors should also recognize that an eventual hike in the Federal Funds rate will likely impact shorter duration funds. Accordingly, investors should also consider floating rate products, which should adjust to increasing short-term rates. These are accessible through funds such as the iShares Floating Rate Note Fund (FLOT).

2. Consider more tactical allocations and bond funds. In an environment with steadily declining interest rates, a “buy-and-hold” mentality worked. But in today’s more volatile interest rate environment, particularly with its upward bias, investors may benefit from a more flexible and opportunistic approach. This is especially true for investors looking to potentially increase income and reduce volatility.

One solution to consider along these lines is the BlackRock Strategic Income Opportunities Fund (SIO), which employs an adaptable investment approach across fixed income sectors without constraints on maturity, sector, quality or geography.

3. Overweight equities. To be sure, equity markets have also suffered recently and are generally more volatile than bonds. But I still prefer stocks over bonds in the long term, even for more income-oriented investors.

The main reason: valuation. Bonds still look expensive by almost any metric. In contrast, global equities appear reasonably priced. In addition, while investors will be taking on more risk by opting for equities over bonds, stocks can potentially provide a portfolio with some better long-term inflation protection.

The author is long FLOT

Source: Bloomberg

Russ Koesterich, CFA, is the iShares Global Chief Investment Strategist and a regular contributor to the iShares Blog. You can find more of his posts here.

Bonds and bond funds will decrease in value as interest rates rise and are subject to credit risk, which refers to the possibility that the debt issuers may not be able to make principal and interest payments or may have their debt downgraded by ratings agencies.

Securities with floating or variable interest rates may decline in value if their coupon rates do not keep pace with comparable market interest rates. Narrowly focused investments typically exhibit higher volatility and are subject to greater geographic or asset class risk. The funds are subject to credit risk, which refers to the possibility that the debt issuers will not be able to make principal and interest payments or may have their debt downgraded by ratings agencies. The funds’ income may decline when interest rates fall

In addition to the risks above, the BlackRock Strategic Income Opportunities Fund also includes the following risks: The fund is actively managed and its characteristics will vary. Investments in noninvestment-grade debt securities (“high-yield” or “junk” bonds) may be subject to greater market fluctuations and risk of default or loss of income and principal than securities in higher rating categories. The fund may use derivatives, such as futures, options, swaps or tender-option bonds, to hedge its investments or to seek to enhance returns. Investing in derivatives entails specific risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. There may be less information available on the financial condition of issuers of municipal securities than for public corporations. The market for municipal bonds may be less liquid than for taxable bonds. A portion of the income may be taxable. Some investors may be subject to Alternative Minimum Tax (AMT). Capital gains distributions, if any, are taxable.

You should consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The Fund’s prospectus, available at www.blackrock.com, contains this and other information about the Fund. The prospectus should be read carefully before investing.

Copyright © iShares