One area of the global equity markets that has experienced a significant correction this year is the emerging markets. As the below charts of one, five and ten year returns indicate, the emerging market space (EEM, VWO) has significantly underperformed the U.S. market (S&P 500 Index) for one and five years, but maintains a large performance edge for ten years. Importantly for investors then is determining whether this recent correction is an opportunity to increase exposure to the emerging market space or not.

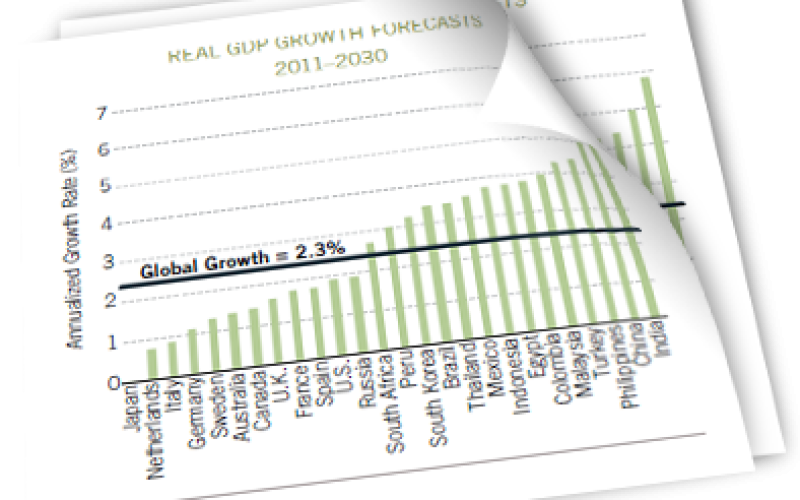

A recent research report published by Fidelity Investments, Secular Outlook for Global Growth: Challenges and Opportunities, outlines some key factors for investors to evaluate for various countries. A large part of the long term future growth potential within a particular market is based on a country's GDP growth expectations.

Population growth and productivity growth are key factors that contribute to a country's overall GDP growth potential. With respect to population growth, the report notes difficulties in comparing one country to another due to differing life expectancies. In summary though, Fidelity notes:

"Working-age populations have risen rapidly for several decades, but almost all countries will experience slower growth and receive less of a direct demographic benefit over the next 20 years. Mature countries such as Japan and parts of Europe—with the U.S. as a notable exception—will experience outright declines in working-age population. In general, growth will be faster in the developing world—Latin America, Africa, emerging Asia, and the Middle East—although China’s demographics are not as constructive (emphasis added)."

From a productivity standpoint the report notes three categories that are key drivers of productivity growth: people, structure and catch-up potential.

- People: "The greater the human capital, the more productive the economy. According to our human capital index, which incorporates measures of educational and scientific achievement as key drivers of future innovation and adoption of new technologies, human capital accumulation over the past two decades should boost global growth in the next 20 years. Human capital tends to be higher in the world’s wealthiest regions, such as the U.S., Japan, and northern Europe. South Korea has the highest human capital ranking, and several emerging economies—including China, Turkey, Thailand, and Vietnam—have also made great strides...""On balance, young populations in the developing world—such as Mexico, Colombia, and the Philippines—will benefit from a maturing phase. Formerly maturing countries—such as China, South Korea, and Thailand—will be disadvantaged as their populations enter the aging phase. Already aging societies—such as Russia, Germany, and Japan—will feel the most negative effects on productivity as their demographics deteriorate further (as noted in the below chart)."

- Structure: "Complex economies tend to be more competitive, use technology more effectively, and have better business climates and more nurturing institutions (source: Hausmann, Hidalgo, et al.). As a result, higher complexity typically means higher productivity. Greater variety and more sophisticated products in a country’s output signal a more complex economic structure. For example, Japan has the highest complexity ranking, while a number of African countries rank very low. Complexity should contribute slightly to higher global growth over the next 20 years as increasingly complex emerging economies—such as South Korea, China, Hungary, and Thailand—offset stagnating complexity in the most advanced economies."

- Catch-up Potential: "In theory, less advanced economies should grow faster than more mature economies, thanks to their ability to grow off a lower base, adopt existing technologies, and catch up or converge to the higher income levels of developed countries. In practice, however, this convergence does not occur automatically but is conditional on other factors, such as the people and structure of an economy.""Once we account for these other growth determinants, catch-up potential has been—and will continue to be—a positive contributor to global GDP growth. After the rapid growth in recent decades of larger developing economies, such as China, India, and South Korea, higher per capita incomes now leave less catch-up potential for the next 20 years. While smaller poor economies in Africa and other regions will still benefit, catch-up potential will generally contribute much less to global growth."

If an investor's time horizon is three to five years (or longer), data would seem to support that some emerging or developing economies will be leaders in global growth. As with individual stocks, the direction of the growth rate plays a key role in a country's potential return as well. As the GDP charts earlier in the post show, GDP growth in countries like China and India having been slowing recently. This decrease in the growth rate can cause short term market disruptions. Also, as the ten year performance chart above shows, emerging markets have done quite well relative to U.S. equities, but are emerging market indices mean reverting?If so, the dangers of catching a falling knife are certainly present.

There are many additional factors one most consider, such as financial data quality, the political stability or lack there of, etc. However, it does appear some of the emerging economies do offer return opportunities for investors, albeit, these markets are likely to remain more volatile than developed market equities. It is estimated that the emerging markets will continue to capture a larger share of the world's GDP and at some point this will likely have a positive impact on emerging equities.

Source:

Secular Outlook for Global Growth:

Challenges and Opportunities

Fidelity Investments

By: Irina Tytell, PhD, Senior Research Analyst

Lisa Emsbo-Mattingly, Director of Asset Allocation Research

Dirk Hofschire, CFA, SVP, Asset Allocation Research

June 2013

http://tinyurl.com/ka9gqvx