The Invisible Regime... Has Become Unhinged

From Hugh Hendry, CIO of The Eclectica Fund.

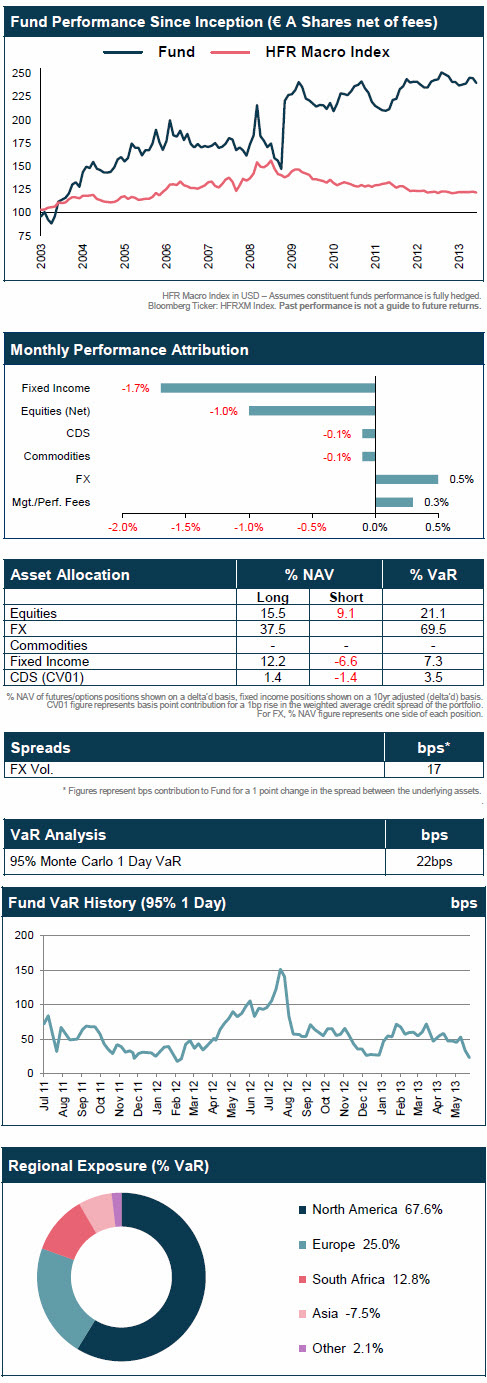

This year we have pursued five macro themes: long the US dollar, short China, long Japanese equities, long low variance equities and long interest rate contracts at the short end of G10 fixed income markets.

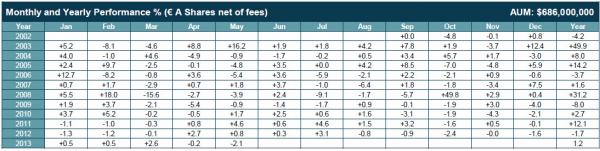

Towards the end of May, however, the Fund experienced a sharp rise in its volatility from an annualised rate of 4% to 7%. The invisible regime of low volatility and low correlations that had been so supportive of risk markets for at least the last year started to become unhinged.

The catalyst came from the announcement that the US Federal Reserve may soon tighten its monetary policy following yet another better than forecast US employment figure. The jobless rate in America is down to a four-year low. This purported change of policy however created a chain reaction that spread across global financial markets.

As cross-asset correlations rose, the Fund became less diversified. This necessitated that we reduce our risk exposures across all trades; G10 receiver trades and Japanese and low variance equities were closed completely as their severe price reaction challenged their intermediate up-trends.

As a consequence, the Fund fell by 2.1%. The main negative contributors were the short-end interest rate swaps and afore-mentioned equities, offset by modest gains from FX positions as the dollar strengthened and volatility trended higher in EM currencies.

In the Far East, by contrast to the bullish American outlook, the evidence of an economic slowdown in China continued to mount and commodity exporting countries that rely heavily on sales to the Middle Kingdom came under heavy selling pressure. China accounts for 27% of total Australian exports, mostly raw materials, and the country finds itself in China's slipstream. Unfortunately, in a break with the recent past, it was the currency markets, and not our 3yr interest rate contracts, that benefited the most from the move. The Australian dollar recorded its seventh worst monthly performance (-7.7%) of the past 20 years. But instead of enjoying some of this move, the spectre of tighter US monetary policy contaminated the outlook for rates globally and our 2y1y swap positions rose rather than fell costing the Fund 57bps.

In Japan, rising bond yields were also the culprit. Volatility surged as Japanese 10-year rates went from 30bps to trade over 1% at one point in May, before closing at 0.85%. As it costs the government about a quarter of its total tax revenues just to pay the interest on its debt at current levels, the unsettling disorder in the bond market was rapidly interpreted as a threat to public finances and GDP growth. Japanese stocks saw heavy profit taking with the TOPIX recording a 17% slide in late May. The Fund recorded a loss of 31bps from Japanese equities.

Heading into June, we retained a slightly larger short China position, we boosted our long position in the US dollar and re-directed it to reflect an outright short of emerging market currencies.

We also transformed our Australian rates trade into a bullish curve steepener (that is to say, we added a short ten year leg). A similar position was initiated in Korea. These countries remain unique in having a developed world FX profile and overnight rates which remain high by international standards, giving the authorities considerable leeway to cut overnight interest rates. Ten-year rates, however, are liable to be dragged higher by US Treasuries. So if the respective central banks do react to the slowdown evident in China by cutting short term rates, this could give rise to further steepening.

Copyright © Hugh Hendry, The Eclectica Fund