A Sweet Find on an African Adventure

By Frank Holmes, CEO and Chief Investment Officer, U.S. Global Investors

After traveling nearly 6,000 miles by plane, helicopter and jeep, Evan Smith, portfolio manager at U.S. Global, is walking along a dirt path in Kenema past dilapidated shops covered with rusted, corrugated metal. He can hardly believe he has arrived at his destination. Surrounded by hundreds of miles of forest and savannah, it's tough to imagine an agricultural diamond-in-the-rough nearby.

Kenema is in Sierra Leone, a country in the Western part of sub-Saharan Africa with 5.6 million people recovering from a decade-long civil war that ended 11 years ago. Today, the rural people, mostly farmers and fishermen, are peaceful and friendly, says Evan, who explored the opportunity for the Global Resources Fund (PSPFX).

To get here, Evan flew from San Antonio, Texas to the largest city in Sierra Leone, Freetown, making stops in New York City, Ghana and Liberia. Then he boarded a four-person helicopter to fly east 150 miles, enduring heart-pounding drops and lifts between clouds and mountains before safely arriving at a cocoa plantation development.

The heart of Africa has been beating strong in recent years due to elevated commodity prices and resilient domestic demand, despite the global economic slowdown. Among the sub-Saharan African countries, Sierra Leone was the fastest growing country last year, according to the World Bank. Its economy experienced growth that is as rare today as Fancy Red diamonds. GDP increased a whopping 18 percent.

Non-profit organizations are taking note of the country’s progress. The Freedom House recently categorized Sierra Leone as a free country, which is unusual in sub-Saharan Africa. Among 50 countries and 900 million people, only 13 percent of people are considered free under the organization’s definition.

Sierra Leone is also becoming more attractive for business. In the World Bank’s Doing Business 2013 report, the country ranked 140, up from 148. One of its main findings this year is that “among the 50 economies with the biggest improvements since 2005, the largest share—a third—are in sub-Saharan Africa.”

Looking ahead, these countries are expected to be among the fastest growing economies in the world. The International Monetary Fund estimates that out of the top 20 countries with the highest projected compound annual growth rate from 2013 through 2017, 10 are in this area of the world.

This is the growth Agriterra is looking to capture in its development of a cocoa plantation that Evan traveled across the Atlantic Ocean to check out. Agriterra is a London-based company that invests in African agricultural businesses to serve the fast-growing economies of frontier markets, such as Mozambique and Sierra Leone.

When Evan toured the grounds, he snapped pictures of the initial stages of development, as the company nurtures 250,000 seedlings in a technically advanced and irrigated nursery. Each cocoa sprout is planted in its own bag, under a canopy of screens which provides just the right amount of light. An irrigation system nourishes the plants, delivering the perfect amount of water and fertilizer.

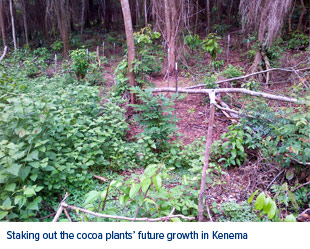

After a few months, the seedlings will be mature enough to be transplanted to an area that provides the right amount of shade. You can see a three-meter grid of stakes designating where each plant will go in this photo below.

You may not think about where your Godiva chocolate originates, but the areas are limited. Cocoa grows best along the equator belt between the Tropic of Cancer and Tropic of Capricorn. Tropical conditions of plentiful rain and high humidity are ideal and “shading is indispensable in a cocoa tree's early years,” says the International Cocoa Organization (ICC).

While Sierra Leone is geographically situated along this band, it isn’t among the largest cocoa-producing countries. Most of the world’s chocolate originates from beans grown in Côte d'Ivoire, Ghana and Indonesia. Cocoa has traditionally been raised on small, individually owned farms, many of which have aging plants and therefore, lower yields. But with Agriterra’s advanced applications and solid operations, the development seems to be off to a sweet start.

So why is an oil and materials manager getting his boots dirty in Sierra Leone? The cocoa plantation is only one example of a company producing a commodity that we believe will be sought by the world’s growing middle class population. As more and more people reach this status, consumption of discretionary items, including chocolate, should increase.

Rather than limit the fund to energy and materials stocks, the portfolio managers take a multi-faceted approach, looking at 10 industries. By including companies such as grain processors, plantations and ranch lands, and agriculture companies, such as chemical and fertilizer stocks, we believe the fund can enhance returns with less volatility.

That’s why we keep our eyes open and boots on the ground because you never know where in the world you’ll find a sweet or savory opportunity.