by William Smead, Smead Capital Management

We have noticed that there has been a dearth of stock splits among the S&P 500 index companies in the last 5 years. Our observation is that the natural habitat for stock splits is normally a multiple-year market upswing and numerous stocks trading over $60 per share. What does the history of stock splits tell us about where we are in the long-term stock market cycle for the S&P 500 index? Who will the marginal buyer of common stocks be in the near term and what do stock splits teach us about who the marginal buyer is? Does the history of stock splits give comfort to the long duration common stock owner despite the recent strength in the S&P 500 index?

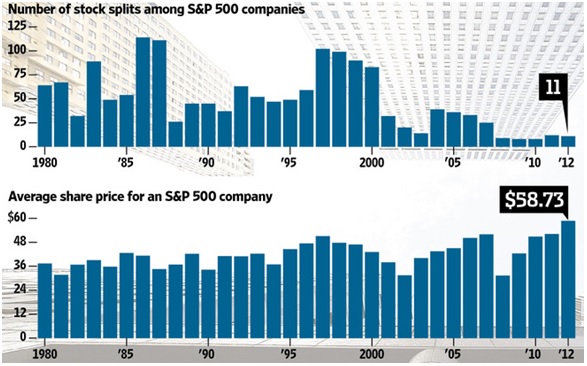

Source: The Wall Street Journal

The chart shows 33 years of stock-split history and average share price for the S&P 500 index. A few observations as you look at the chart. First, the average share price is higher today than it has ever been. Second, stock splits peaked in 1986-87 and 1997-2000. This was four years into the bull market which started in 1982 and six years into the one which started in 1991. Third, stock splits have been lower each of the last five years than in any single year over the 28 years prior.

The S&P 500 index rose from 676 on March 9th, 2009 to over 1660 recently and very few companies which enjoyed immense price appreciation split their stock. Notice that the average price of a share had risen to $57.83 and that was before the gains of 2013. This price appreciation did not trigger stock split enthusiasm on the part of S&P 500 companies. Think of Apple (AAPL), Google (GOOG), Priceline (PCLN), Amazon (AMZN) and Chipotle (CMG) all trading for more than $200 per share.

Here are the most obvious reasons, to us, for splitting your stock: 1) Companies want to keep the share price in reach of individual investors. For example, do parents want to buy McDonalds (MCD) at around $100 per share for their kid’s custodial account? A round lot of 100 shares would cost $10,000. 2) Stock splits establish a confidence about the future that management has for their company. Numerous academic studies have shown that stocks which split their shares outperform the S&P 500 index over the following three years. Therefore, the lack of stock splits shows that S&P 500 companies are not interested in attracting individual investors or signaling their confidence about the future. They must feel they have plenty of upside in their stock by attracting institutional investors who have relatively unattractive alternatives and are under-represented in the US large cap space.

Institutional investors came into 2012 with incredibly low ownership of large cap US equities. The NACUBO study of $1 trillion of endowments and foundations showed that at the end of 2010, institutions had 15% of their dollar-weighted portfolio in US equity (small, mid and large). In our opinion, the large cap portion of their long-only portfolio was likely in the 5 to 6% range. To give you a feel for the pulse of institutional capital flows, Lipper shows that US large-cap equity funds have been net liquidated for 47 consecutive months through April of 2013. We believe we are very early in the process of bringing institutional investors back to large cap equity and the positive flows are still on the horizon. Time is needed. Institutional investors change course like a large sea-going ship—slowly and with the help of numerous tugboats. From our deck, we can only imagine what it feels like as an investor trapped out of the opportunities that this market environment has been providing as compared to value we find executing the discipline in our equity portfolio.

The marginal buyers of common stocks in the US, for the foreseeable future, are under-invested institutions and ultra high net worth investors who employ wide asset allocation. They have seen their portfolio results suffer from the low level of US large-cap equity exposure. We see a number of years of increased allocation to US large cap equities by these investors. In our view, that could take years and gives us great psychological comfort with our portfolio as long duration common stock owners. Keep your eye on the annual stock split totals, because history shows that they should coincide with individual investor enthusiasm.

Best Wishes,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com