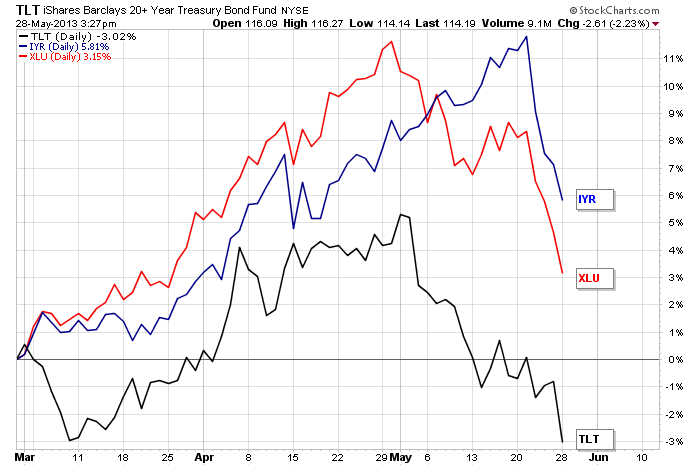

by Stockcharts.com

The Utilities SPDR (XLU) and the 20+ Year T-Bond ETF (TLT) both peaked in early May and declined sharply the last four weeks. The Real Estate iShares (IYR) continued higher into mid May, but peaked last week and fell sharply the last four days. Interest rate sensitive issues are not having a good time right now.