Upcoming US Events for Today:

- No Significant Events Scheduled

Upcoming International Events for Today:

- German PPI for April will be released at 2:00am EST. The market expects a year-over-year increase of 0.2% versus an increase of 0.4% previous.

- Great Britain CPI for April will be released at 4:30am EST. The market expects a year-over-year increase of 2.6% versus an increase of 2.8% previous. PPI Output is expected to show a year-over-year increase of 1.4% versus an increase of 2.0% previous.

- Japanese Merchandise Trade for April will be released at 7:50pm EST. The market expects -¥594.3B versus -¥362.4B previous.

The Markets

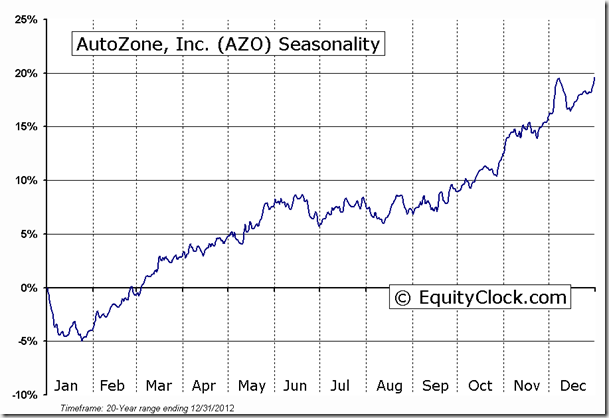

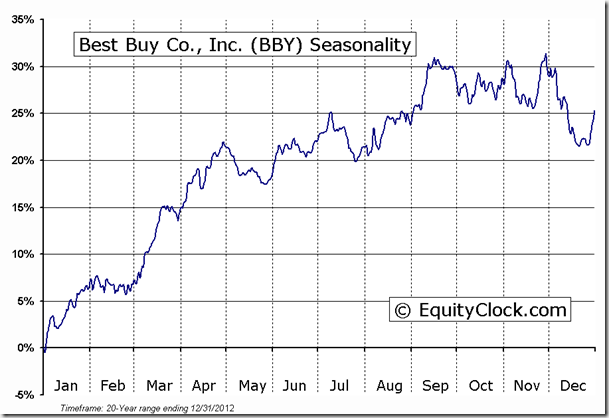

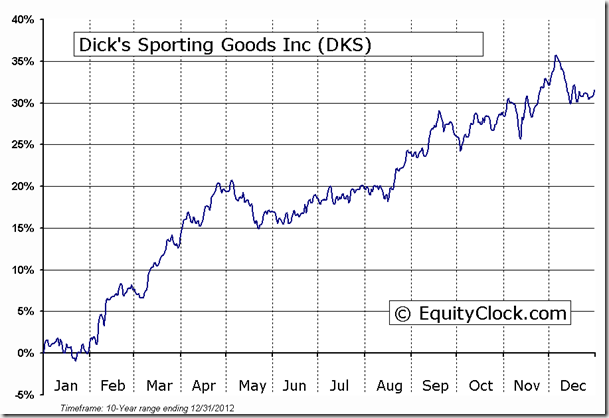

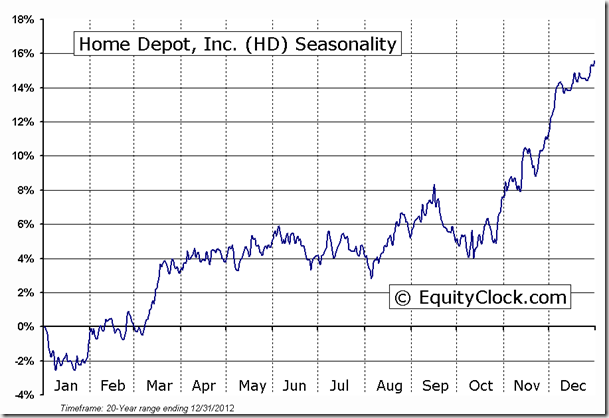

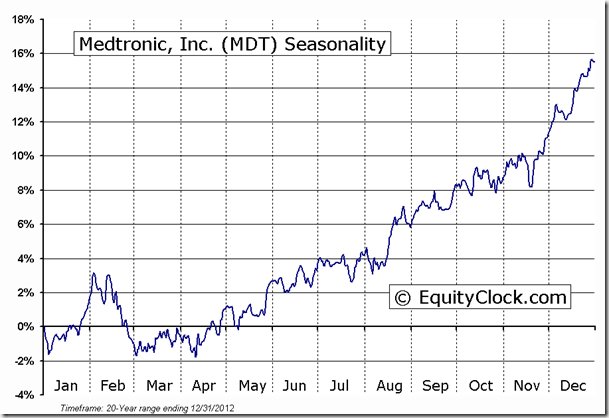

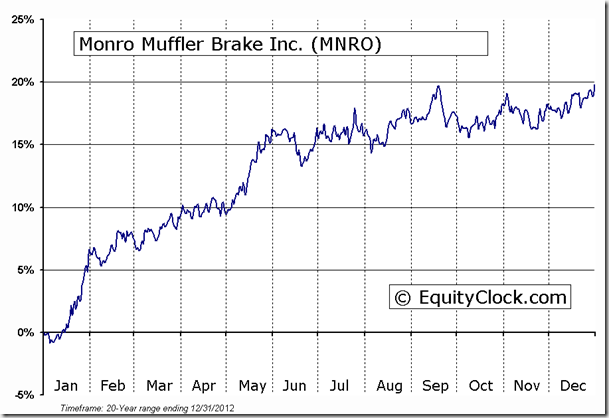

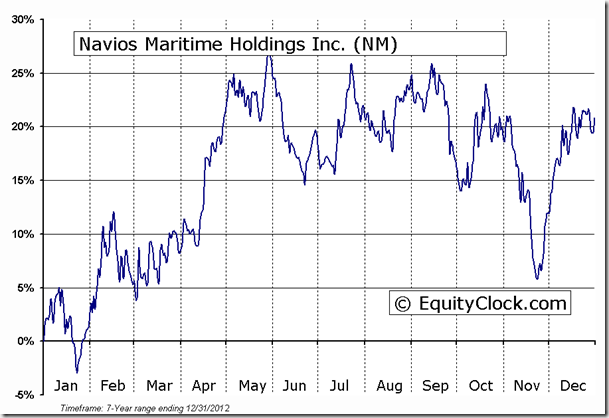

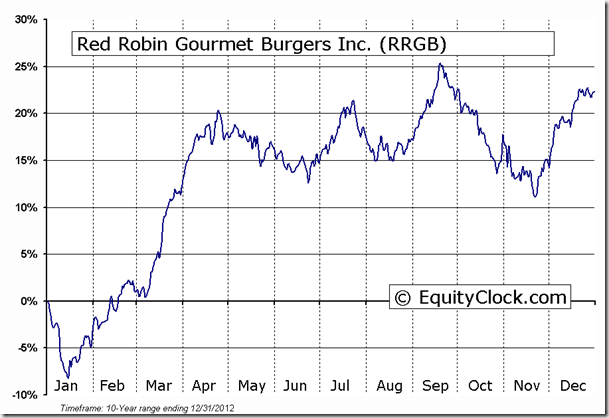

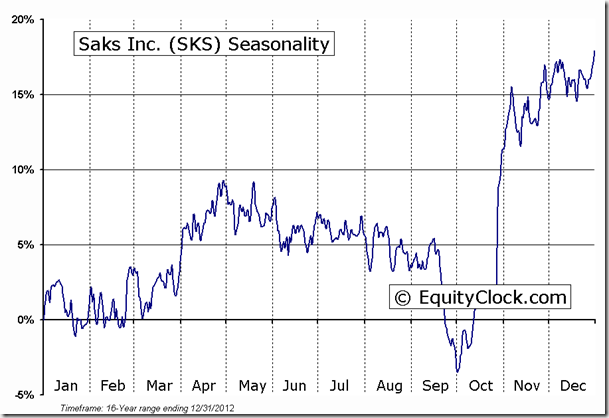

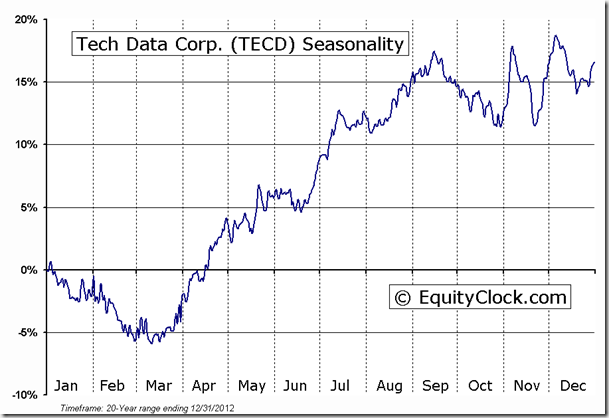

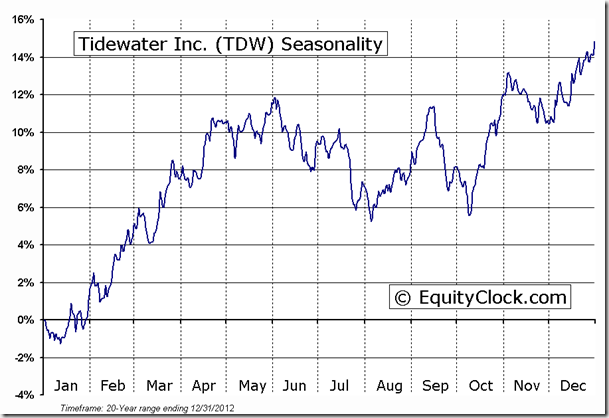

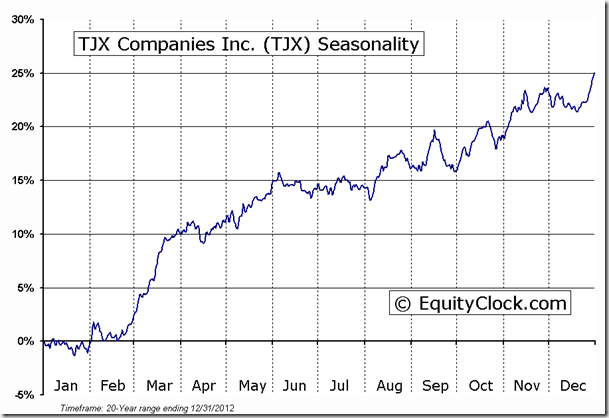

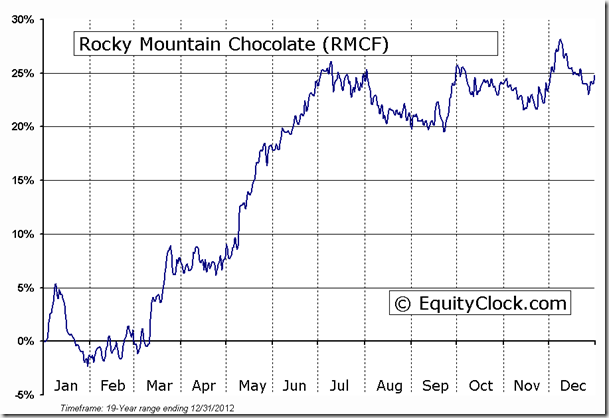

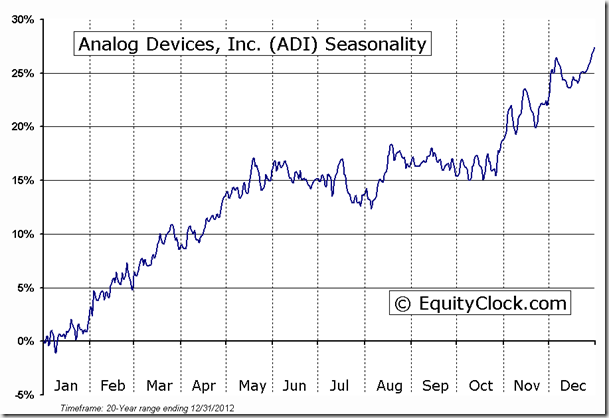

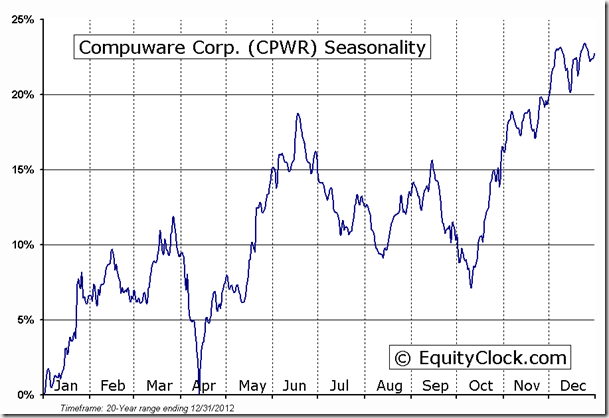

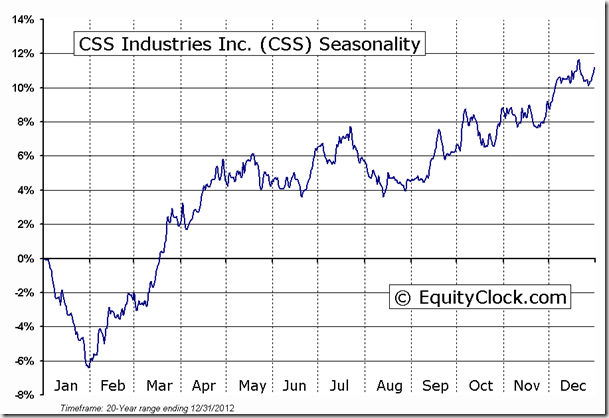

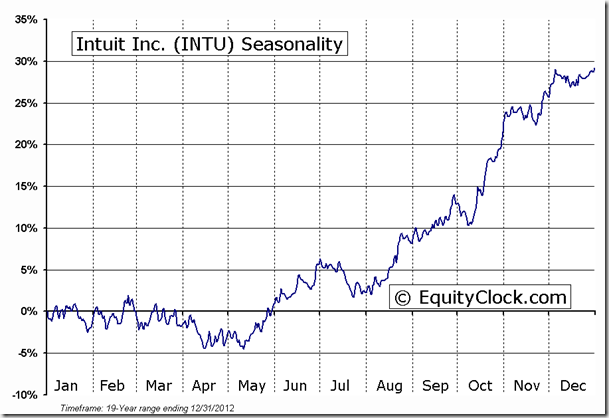

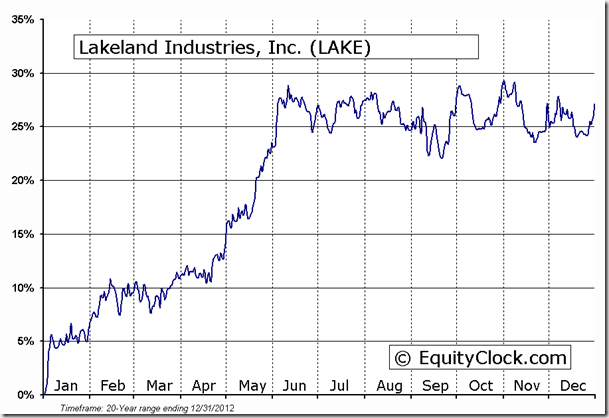

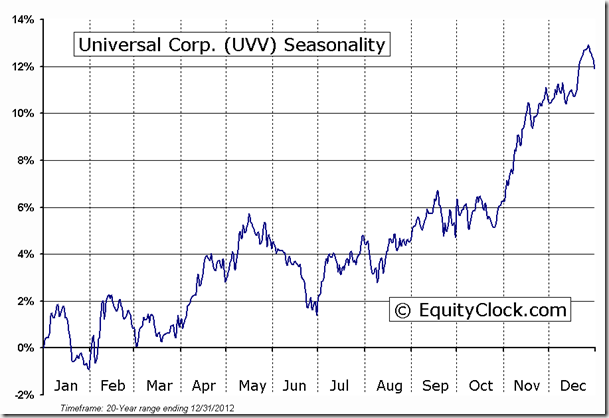

Seasonal charts of companies reporting earnings today:

Sentiment on Monday, as gauged by the put-call ratio, ended bullish at 0.79.

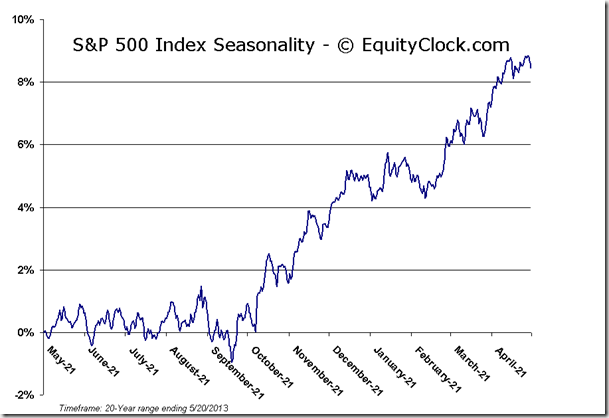

S&P 500 Index

Chart Courtesy of StockCharts.com

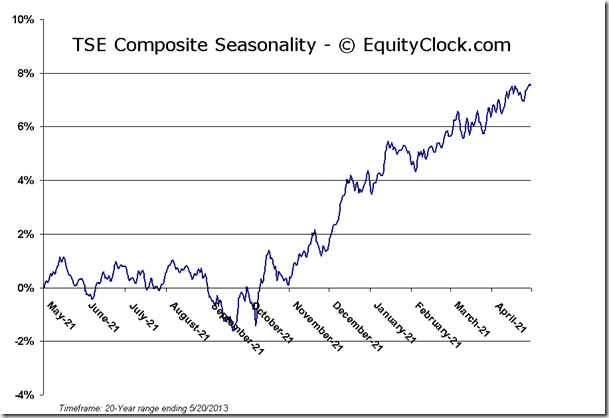

TSE Composite

Chart Courtesy of StockCharts.com

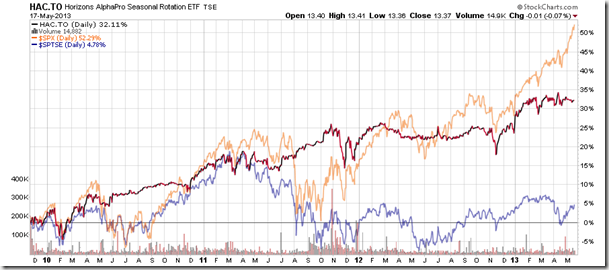

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $13.37 (down 0.07%)

- Closing NAV/Unit: $13.36 (down 0.07%)

Performance*

| 2013 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 5.03% | 33.6% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.