by Scott Minerd, Chief Investment Strategist, Guggenheim Partners LLC

The scale of the quantitative easing (QE) program proposed by the Bank of Japan (BoJ) is mind numbing. As part of the larger shift in policy by Japan to stimulate inflation, informally known as ‘Abenomics’, the Japanese central bank is planning to expand its balance sheet to the equivalent of over 60% of the country’s GDP. This is roughly double the current size of the BoJ's balance sheet. For comparison, the Federal Reserve's balance sheet is currently equivalent to approximately 25% of GDP. The radical new policies undertaken by the BoJ are likely to continue to have unexpected and perverse effects on global financial markets.

Japanese government bond yields have declined as a result of the actions by the BoJ, which has led domestic Japanese investors to seek higher yields in overseas markets. Japanese institutional investors have turned to purchasing large volumes of foreign debt, which has helped push interest rates lower elsewhere in the world. This explains why interest rates in the United States and in Europe have fallen in recent days despite the ongoing economic headwinds in those regions. These cycles in capital flows usually take months to play out, so investors may not see the full effects of this trend until the third or fourth quarter of 2013.

Economic Data Releases

A Weak Job Report for March

- Non-farm payrolls increased only 88,000 in March, the least since June 2012. The previous two months were revised upward by 61,000.

- The unemployment rate reached a four-year low of 7.6% due to a declining labor force.

- Average hourly earnings were unchanged in March, and weekly working hours ticked up slightly.

- Initial jobless claims rose to a four-month high of 385,000 for the week ended March 30.

- The ISM Services Index declined to 54.4 in March, showing the slowest expansion since August 2012.

- NFIB Small Business Optimism declined in March to 89.5, a larger-than-forecast fall.

- Job openings in the U.S. rose to 3.93 million in February, the most since May 2008.

- The trade balance unexpectedly narrowed in February, partially due to falling oil imports.

Eurozone Services and Retail Sales Down, Inflationary Pressure Recedes in China

- Services PMIs were revised to show a faster contraction in the eurozone and France, and a slower expansion in Germany. However, Italy’s March services PMI unexpectedly improved.

- Retail sales in the eurozone fell 0.3% in February, and were down 1.4% from a year earlier.

- Industrial production in Germany rose 0.5% in February, the best month since July 2012.

- Industrial production in the U.K. beat expectations with 1.0% growth in February.

- Central banks in Europe, the U.K., and Japan left their benchmark interest rates unchanged. The Bank of Japan announced an unprecedented asset purchase program.

- China’s official non-manufacturing PMI indicated accelerating expansion in March at 55.6.

- China’s 12-month change in CPI fell to 2.1% in March after February’s 10-month high of 3.2%.

Chart of the Week

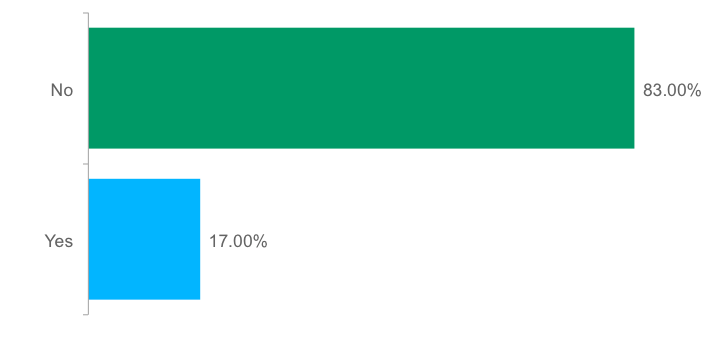

Searching for Yield

The BoJ’s latest stimulus has ignited a rally in the domestic stock market, and also lifted global bond markets. Since the BoJ’s announcement, widespread yield curve flattening has been seen in many countries, with dramatic declines in long-term government bond yields. Countries with strong currencies and higher yields, such as emerging markets and European peripheral nations, have enjoyed strong gains in government bond prices. Further depreciation of the yen will likely incentivize Japanese investors to chase higher yields in oversea markets, and we can anticipate additional fund flows out of Japan and into global bond markets.

SELECTED COUNTRIES’ 10-YEAR GOVERNMENT BOND* PRICE RETURNS SINCE THE BOJ’S ANNOUNCEMENT OF NEW ASSET PURCHASE PROGRAM

Source: Bloomberg, Guggenheim Investments. Data as of 4/9/2013. *Note: Sovereign bonds for Turkey, Brazil are in U.S. dollars, other bonds are in local currencies.

This article is distributed for informational purposes only and should not be considered as investing advice or a recommendation of any particular security, strategy or investment product. This article contains opinions of the author but not necessarily those of Guggenheim Partners or its subsidiaries. The author’s opinions are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC. ©2013, Guggenheim Partners. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.

Copyright © Guggenheim Partners LLC