The Fed released minutes of their meeting early “because the U.S. central bank accidentally sent the report to congressional aides and trade organizations.”. Remember, it’s okay for Congress to inside trade so this is a big deal.

I am sure that no one called no one on Wall Street to tip them off either. (feel the wave of sarcasm?)

The publicly traded market system is rigged. This isn’t the first “accident” that’s happened in this administration. Information being leaked to people with the ability to trade on it has happened in other administrations. This issue isn’t confined to a political party-it’s a function of crony capitalism and big government.

Not only is it rigged, it’s deliberately stacked against participants. There are regulations that make stealing legal. When an individual investor puts an order into the marketplace, they are automatically at a huge disadvantage.

Former Fed Governor Laurence Meyers has a consulting service. People pay him big money to find out what he thinks about future Fed policy. Guess who he’s talking to? Other insiders at the Department of Justice and SEC routinely pass information to cronies. There is a revolving door between Wall Street, K Street and the federal bureaucracy.

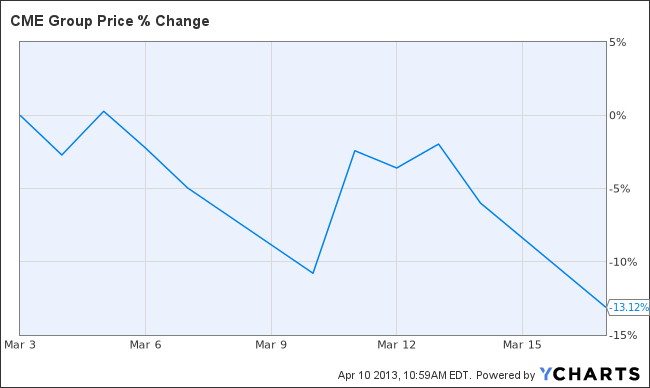

Recall back in March of 2008, a DOJ official leaked an internal memo that caused $CME to fall $140 bucks in one day.

That official later became CEO of Wachovia. Now he’s the Undersecretary of Finance. Now he’s the Deputy Mayor for Economic Development in NYC. Who do you think was short when the memo was released? Just a coincidence that Steel has held these kinds of positions in and out of government? Where do you think his next job will be?

In 2007, then NY Fed President Tim Geithner alerted Bank of America about a coming rate cut before the rest of the market knew about it. I am sure B of A didn’t do anything with the information.

The whole system stinks and the public is rapidly losing confidence in it. That’s one cause of the outrage over the “big banks”. Meanwhile, bureaucrats at the Department of Labor, and other agencies are suspected of cooking the books. Are they counting correctly? Are they totaling correctly? How come unemployment numbers look the way they do? GDP? Housing? Everything coming out of the US government database is suspect.

Market participants ask, “Who got the number before I did?”

Having information milliseconds before someone else means billions of dollars in profit. That’s why firms pay extremely high fees to service providers for faster connections. It’s why exchanges are able to charge for co-location. Demand is almost inelastic.

The lack of confidence in public markets is dangerous to a free market capitalistic system. I remember speaking with a Russian who was going to establish a startup market in Russia back in 2005. I asked him how he was going to ensure that the market back offices cleared correctly. He said they weren’t “ready for that yet.” That’s because there were too many people skimming. Even today, the lion’s share of Russian IPOs are done in Germany or London because there is more confidence in the fairness of their systems.

Lack of faith causes people to pull money away from public markets and into private ones. This lowers standards of living for society because costs to get and deploy capital go up. Since the Jon Corzine theft of customer money, futures volume has dropped. Much of that drop can be attributed to Corzine not being charged, and remaining a free independent citizen. Many former futures market customers have begun using private markets to transfer their risk. Just because volume is down doesn’t mean trading isn’t taking place-it’s just gone underground.

That has implications for everyone as transparent prices are harder to ascertain. Risk is harder to transfer. The wave of uncertainty in the marketplace inspired by our government puts a chill into productivity.

Years ago, whenever a trader complained that someone was getting inside info, the cause of the complaint was they lost money on a trade. Today, there are too many instances of information being released to cronies ahead of the market.

In the quest for transparency, federal agencies have become less transparent. Because of crony capitalism, there are ways to make inroads into information that causes some to profit at the detriment to the many.

When we were all pit trading, we all knew the biggest rats in the pit were the ones that screamed they were the most ethical and above board. They were always the most pious. It’s not any different anywhere else.

UPDATE

The Wall Street Journal published a list of who got the minutes early here. Don’t think they will be donating their profit from the information to any charities or back to the people who they traded against.

Banks, trade groups and lobbying firms:

American Bankers Association

American Council of Life Insurers

Barclays Capital

BB&T

BNP Paribas

Capital One

Carlyle Group

Citigroup

The Clearing House Association

The Cypress Group

Fifth Third Bank

FINRA

Goldman Sachs

The Gray Company

Guggenheim Partners

HSBC

Independent Community Bankers of America

IntercontinentalExchange

J.P. Morgan Chase

King Street

National Association of Realtors

Nomura

PNC

Regions Bank

Rich Feuer Anderson

Roberts Raheb & Gradler

Securities Industry and Financial Markets Association

Standard & Poors

Sullivan & Cromwell

UBS

U.S. Bank

Wells Fargo

Whitmer & Worrall

Williams & Jensen

Government agencies or public-oriented entities:

Austria Federal Ministry of Finance

Bank of Japan

Conference of State Bank Supervisors

Congress (House & Senate)

Consumer Financial Protection Bureau

European Central Bank

Federal Housing Finance Agency

National Credit Union Administration

Treasury Department

White House