The five years that came to a close at the end of March will go down in financial history — and it was an extraordinary period for the group of bonds variously known as high yield, low grade, or junk.

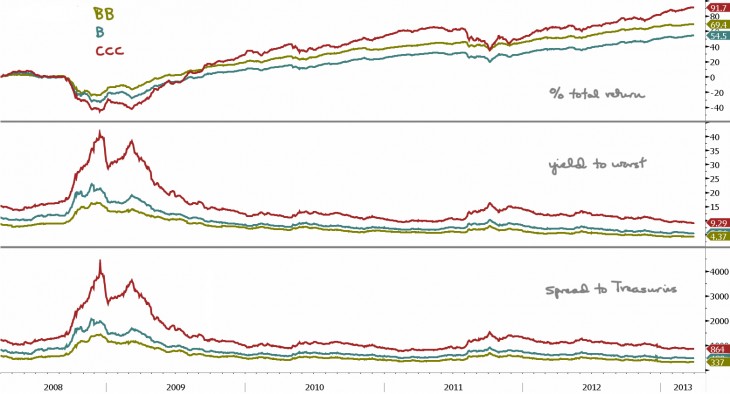

The colors in the chart are carried from panel to panel, representing the Merrill Lynch indexes for BB, B, and CCC bonds. (Here’s a crowd-sourced summary of the most common ratings systems. The three categories shown here extend from “speculative” to “highly speculative” to “extremely speculative.”)

The top panel shows the returns and is interesting in several respects. First, notice how the market held together for many months up until the Lehman debacle. Not much warning from the market pricing mechanism even as the environment was deteriorating rapidly. Second, these bonds bottomed well in advance of stocks. (For your scorecard, from that bottom to 3/31, the CCCs returned 247%.) Finally, notice that the junkiest bonds produced the best return and the least junky the next best; those in the middle had the worst returns. That’s unusual.

In the middle panel are the absolute yields. They are, of course, the foundation of subsequent returns. The smart money that stepped up when the CCCs were at 40% yields had an opportunity for out-sized profits (and had nerve, which is not easy to come by) that are definitely not available today. The yields on BBs and Bs are now half what they were in March of 2008, making it virtually impossible to replicate the returns you see in the chart. (Yields on CCCs have only come down from 15.3% to 9.3%.)

The bottom panel plots the spread versus Treasuries for each part of the market. As the yields on junk bonds were skyrocketing, they were plummeting on Treasuries. Spreads in the thousands of basis points are unusual even for these low quality bonds.

Today we have a situation where investors have flocked in, even as the valuation picture has worsened as the yield cushion against inevitable problems has been depleted. Nothing will necessarily happen tomorrow or the next day, but there’s no margin for error if something untoward does occur. (Chart: Bloomberg terminal.)