Upcoming US Events for Today:

- ADP Employment Report for March will be released at 8:15am. The market expects 205,000 versus 198,000 previous.

- ISM Non-Manufacturing Index for March will be released at 10:00am. The market expects 56.0, unchanged from the previous report.

- Weekly Crude Inventories will be released at 10:30am.

Upcoming International Events for Today:

- The Bank of Japan Rate Decision will be released. Consensus is that there will be no change in rates of 0% to 0.1%

- Euro-Zone CPI for March will be released at 5:00am EST. The market expects a year-over-year increase of 1.7% versus an increase of 1.8% previous.

The Markets

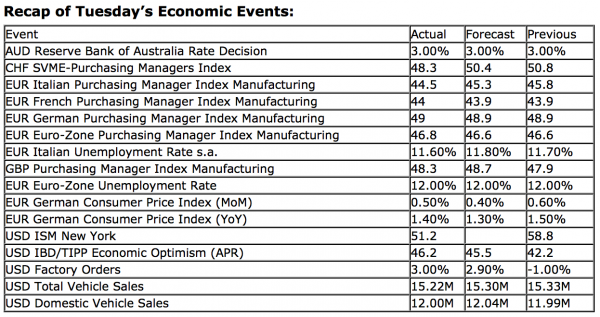

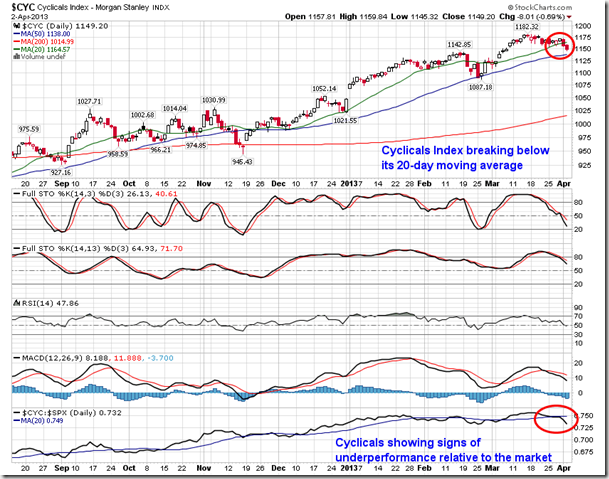

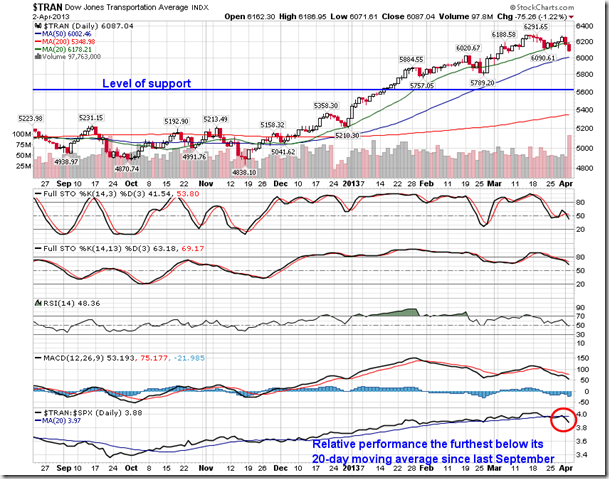

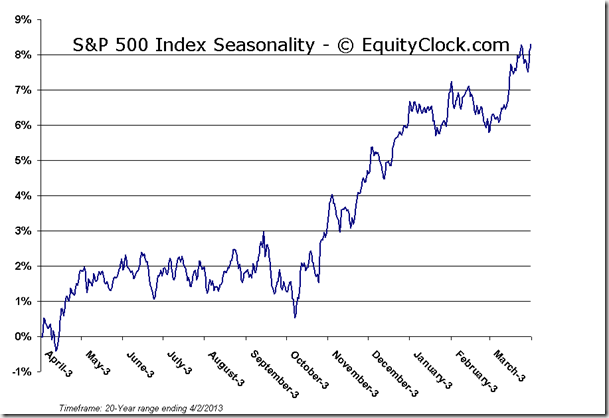

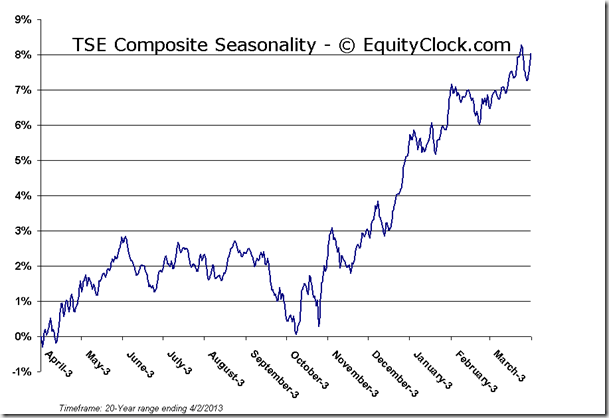

Stocks snapped back from Monday’s losses, supported by a rally in the Health Care sector and strength in Consumer stocks on the back of strong automobile sales for March. Performance on the day was once again dominated by defensive sectors (Consumer Staples and Health Care), while the three key cyclical sectors that are indicative of strength in the economy (Industrials, Materials, and Energy) finished negative, despite the fact that the S&P 500 and Dow Jones Industrial Average charted new all-time closing highs. Equity market struggles continue to be realized in cyclical assets. The Morgan Stanley Cyclicals Index has fallen below its 20-day moving average and underpformance versus the S&P 500 is increasingly becoming evident. Two notable benchmarks of risk sentiment are also showing much of the same. The Dow Jones Transportation Average and the Philadelphia Semiconductor Index have both recently broken below their 20-day averages and underperformance against the market is becoming prominent. The Semiconductor index is also showing a head-and-shoulders topping pattern, a bearish setup which points down to around 400 on the charts. As well, the relative trend of the Dow Jones Transportation Average is the furthest below its 20-day average since last September, just as the market was beginning to correct into the middle of November. Cyclical underperformance is a significant warning signal for broad market weakness ahead and given the time of year when a seasonal peak is typical, a pullback of 5% or greater in the months ahead is well within the realm of expectations.

Turning to the weekly and monthly charts of the S&P 500, the market is the most overbought in years. According to the 14-Week Relative Strength Index (RSI), the current reading above 70 is the highest since the first quarter of 2011. The market defined a substantial multi-month peak shortly thereafter, just prior to a plunge correction in the month of August. As well, the 14-Month RSI is showing the most overbought level since mid-2007, just prior to the declines related to the most recent recession. The market has a history of showing substantial corrections following significant overbought peaks, such as what is presently being realized. With the period of seasonal weakness for equities just around the corner, ranging from May through to October, a correction appears imminent. Whether the correction occurs at present levels or higher remains up to speculation.

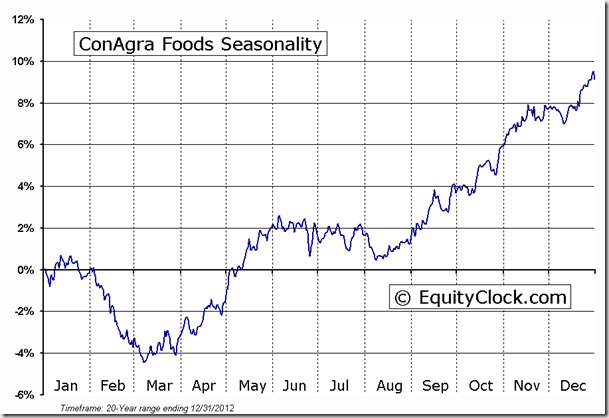

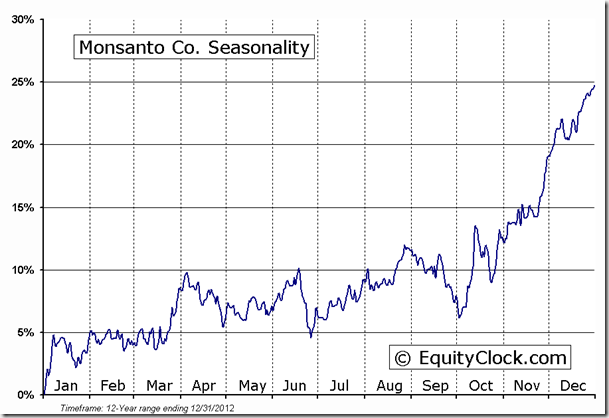

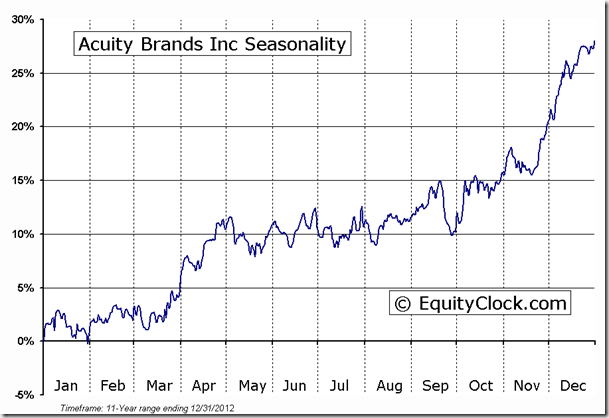

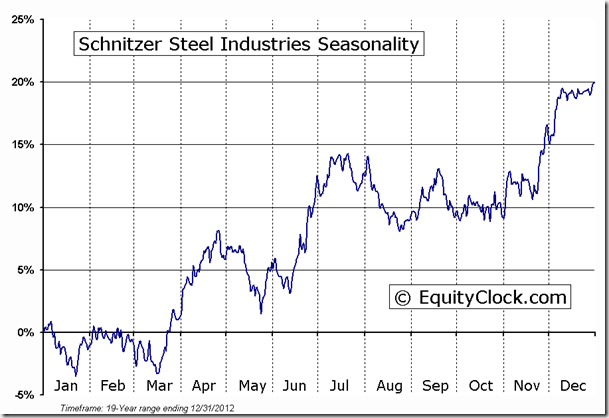

Seasonal charts of companies reporting earnings today:

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.87.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

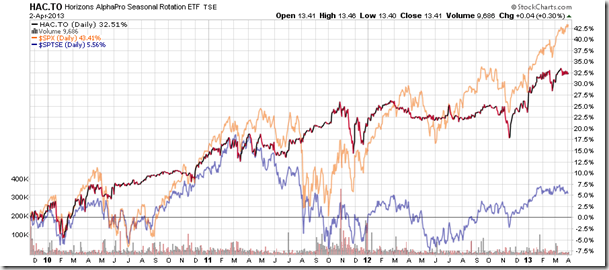

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $13.41 (up 0.30%)

- Closing NAV/Unit: $13.41 (up 0.21%)

Performance*

| 2013 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 5.45% | 34.1% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.