Submitted by Lance Roberts of Street Talk Live,

Last week I was swamped with interviews, both radio and television, to discuss the meaning of the markets hitting new all-time highs. The general consensus of the analysts and economists that I was pitted against was that the rise in capital markets, given weak current economic data and a resurgence of the Eurozone crisis, is clearly a sign of economic strength. This, combined with rising corporate profitability, makes stocks the only investment worth having. My arguments were much more pragmatic.

First, it is worth noting that the markets have only risen to "all-time highs" only on a nominal basis. As I posted in this past weekends newsletter entitled "Why You Can Never Beat The Index" I stated that:

"While the markets have hit an all-time high on a nominal basis (due much to the substitution effect as discussed above), there is still much to go before making up lost ground on an inflation adjusted basis.

The chart below shows the S&P 500 adjusted for inflation. Investors today, if they had been able to get exactly the same performance as the index are now back to where there were effectively in 1997. Of course, the reality is that investors have fared far worse given emotional mistakes, jumping from one investment strategy to another, taking on excess risk, and chasing past returns.

As I explain to my kids in baseball – it is not getting hits that win baseball games but rather having fewer errors than your opponents. In investing – the winner is the person with the fewest errors."

Setting aside for the moment the impact of all other factors and looking at the rise of the index solely as an indication of economic strength - we find a very large disconnect.

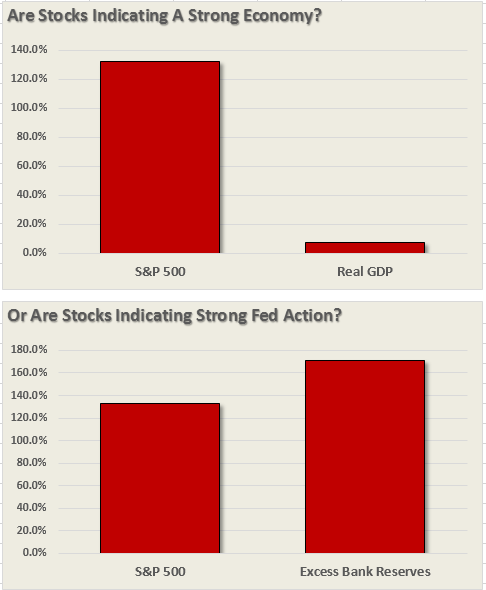

Since Jan 1st of 2009, through the end of March, the stock market has risen by an astounding 67.8%. However, if we measure from the March 9, 2009 lows, the percentage gain doubles to 132% in just 48 months. With such a large gain in the financial markets we should see a commensurate indication of economic growth - right?

The reality is that after 4-Q.E. programs, a maturity extension program, bailouts of TARP, TGLP, TGLF, etc., HAMP, HARP, direct bailouts of Bear Stearns, AIG, GM, bank supports, etc., all of which total to more than $30 Trillion and counting, the economy has grown by a whopping $954.5 billion since the beginning of 2009. This equates to a whopping 7.5% growth during the same time period as the market surges by more than 100%.

However, as shown in the chart above the Fed's monetary programs have inflated the excess reserves of the major banks by roughly 170% during the same period of time. The increases in excess reserves, which the banks can borrow for effectively zero, have been funneled directly into risky assets in order to create returns. This is why there is such a high correlation, roughly 85%, between the increase in the Fed's balance sheet and the return of the stock market.

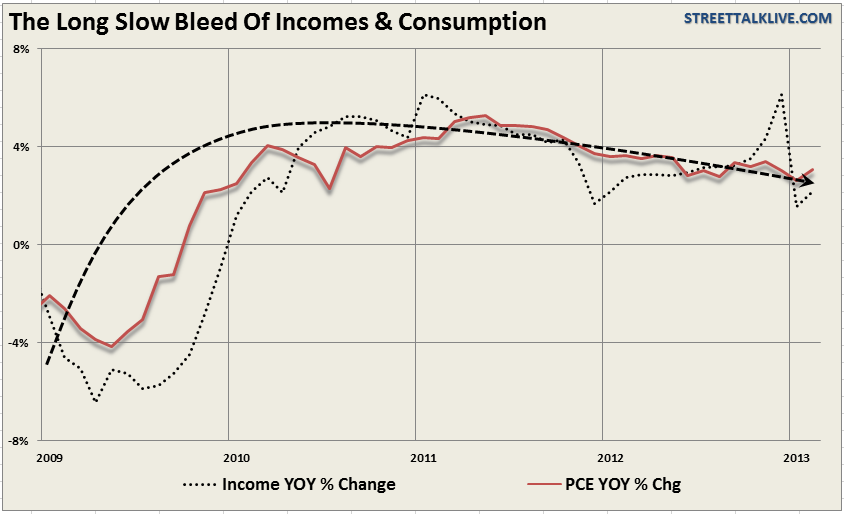

Unfortunately, while Wall Street benefits greatly from repeated Federal Reserve interventions - Main Street has not. Over the past few years as asset prices have surged higher - consumer confidence has remained mired at levels historically associated with recessions. This is reflective of weak growth in personal consumption expenditures which is primarily a function of weak income growth.

As an example - the last two reports on personal incomes and expenditures show that more than half of the increase came from increase in gasoline and food prices. The problem with this, as we have explained previously, is that higher "sales" is not a function of greater volumes of product sold - just simply more dollars spent for the same amount of goods. This is more commonly known as "inflation."

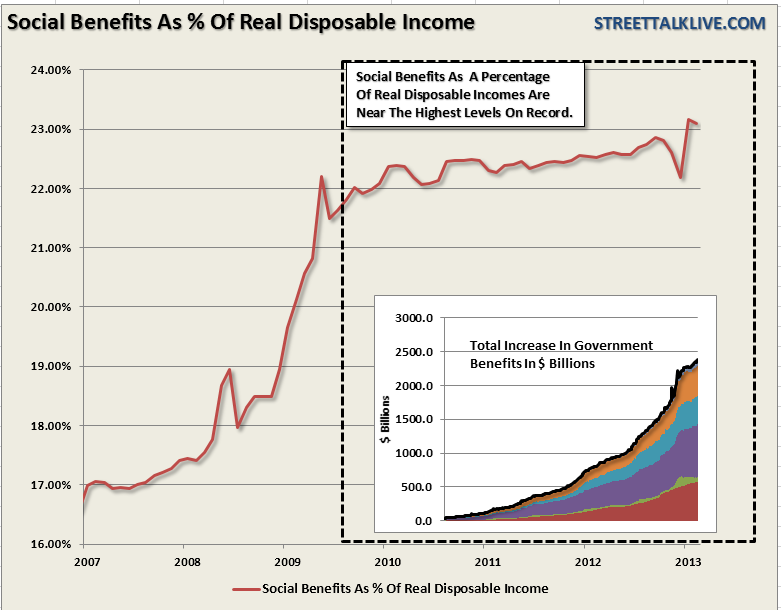

Of course, weak economic growth has led to employment growth that is primarily a function of population growth. Sustained levels of unemployment have reduced the standard of living for many Americans forcing them to turn to social support programs. Food stamp usage and disability claims have soared to record levels along with the percentage of real disposable incomes that are comprised by social benefits as shown below.

It is extremely hard to create stronger, organic, economic growth when the dependency on recycled tax-dollars to meet living requirements remains so high.

Corporate profits have surged since the end of the last recession which has been touted as a definitive reason for higher stock prices. While I cannot argue the logic behind this case, as earnings per share are an important driver of markets over time, it is important to understand that the increase in profitability has not come strong increases in revenue at the top of the income statement. As the chart below shows while earnings per share has risen by over 200% since the beginning of 2009 - revenues have grown by less than 10%.

As expected, since the economy is 70% driven by personal consumption, GDP growth and revenues have grown at roughly equivalent rates. Therefore, the question as to where corporate profitability came from must be answered? That answer can be clearly seen in the chart below of corporate profits per worker which is at the highest level in history.

Suppressed wage growth, layoffs, cost-cutting, productivity increases, accounting gimmickry and stock buybacks have been the primary factors in surging profitability. However, these actions are finite in nature and inevitably it will come down to topline revenue growth. However, since consumer incomes have been cannibalized by suppressed wages and interest rates - there is nowhere left to generate further sales gains from in excess of population growth.

So, while the markets have surged to "all-time highs" - for the majority of Americans who have little, or no, vested interest in the financial markets their view is markedly different. While the mainstream analysts and economists keep hoping with each passing year that this will be the year the economy comes roaring back - the reality is that all the stimulus and financial support available from the Fed, and the government, can't put a broken financial transmission system back together again. Eventually, the current disconnect between the economy and the markets will merge. My bet is that such a convergence is not likely to be a pleasant one.