How would the market react therefore if there was full disclosure? Physical gold would trade at a premium. As an example, at the verge of the collapse of the currency board in Argentina, the premium for holding USD bills under the mattress vs. USD in the bank (i.e. paper USD), was expressed in terms of an opportunity cost: Banks were offering 20% per annum to retain USD deposits in savings accounts! In other words, those holding to their USD under the mattress, were foregoing a 20% return rate, for not taking risks….Now, let me ask you this: Do you see gold ETFs paying a dividend? There you go!

Finally, if there was full disclosure, gold would have to enter into backwardation, which is exactly what mainstream economics seeks to discourage, because the backwardation would once and for all bring to light the fact that gold is money.

The systemic risk of the manipulation: A flow analysis

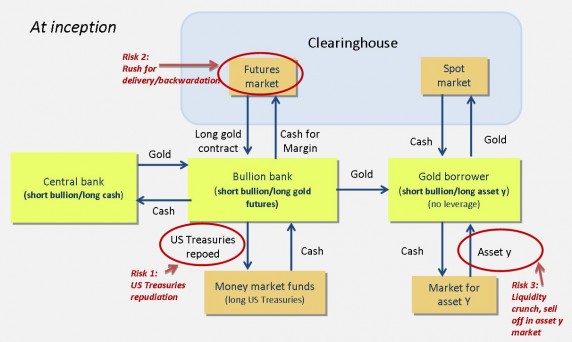

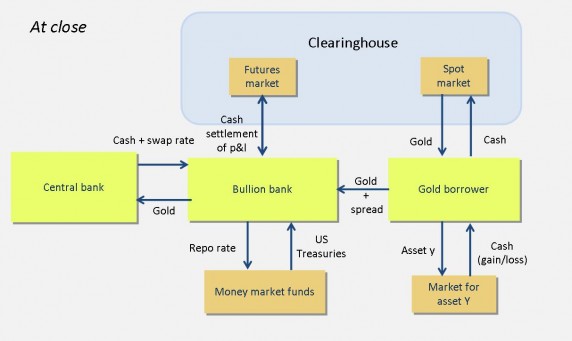

The manipulation is also not without risk. The graphs below should illustrate this point:

The graphs above show the flows involved in the manipulation and the positions taken by the players. At inception of the conversion of bullion into fiat gold, the central bank assumes a short bullion/long cash position. The Bullion bank enters into a short bullion/long gold futures position, partly or fully financed via Treasuries repoed with money market funds, to cover the swap with the central bank as well as the margin for its long futures position. The gold borrower that sells the gold in the spot market to fund the purchase of asset y is therefore short bullion/long asset y. There are three main risks to this scheme that give the manipulation a systemic dimension. The systemic implication is tangible and should not be ignored, because we have proof of its actual costs. A clear example was the loss that UK taxpayers suffered when Mr. Gordon Brown, as Chancellor of the Exchequer, sold 400 metric tons belonging to the UK government. The sale was on purpose pre-announced, driving the price of gold down, to bail out those who had been profiting from the manipulation. Member of Parliament Nigel Farage had something to say about this:

Is this ever going to end?

The first graph above shows three events/risks that would crush the manipulation, possibly unleashing a systemic crisis, which should be enough ground to forbid the manipulation altogether. I will then proceed to elaborate on them and seek to reach a conclusion as to which one of them is the most likely to occur.

Event 1: Repudiation of US Treasuries

Description: This is a risk to the money market funds that are long US Treasuries through repurchase agreements. The repurchase agreements provide cash to the bullion banks who use it to either swap for gold or establish margins for their long gold futures position. In our example above and to keep things simple, I assumed that the gold borrower does not use leverage. This would be unusual and it is to be expected that the counterparties to the bullion banks also use leverage from repoeing US Treasuries. If there was a sell off, a repudiation of US Treasuries, bullion banks and their counterparties would have to unwind their positions and rush to purchase back the bullion they sold multiple times.

What could trigger it?: The repudiation of US Treasuries could be triggered by a ratings downgrade, or an outright sell off by the market, forcing the Fed to acknowledge their role as the only buyer regardless of the unemployment rate, caused by political instability in the US.

Mitigants: The current degree of financial repression would rise exponentially. Already Standard & Poors is under pressure and Egan Jones was banned from rating US Treasuries. Margin requirements could be lowered, shorting of US Treasuries could be forbidden and ultimately, the Fed could intervene bailing out the money market funds, as I explained before.

Likelihood: This event is unlikely to be triggered in the near term.

Event 2: Rush for delivery of physical gold

Description: This is a risk to all those who are short bullion. As the expansion of fiat vs. physical gold grows, the risk to a rush for delivery rises. In this case, gold futures would trade at a discount vs. bullion. Those short bullion could quickly face insolvency causing an exponential rise in counterparty risk within the market and eventually the crash of the clearinghouse. The clearinghouse would then have to be bailed out by a central bank(s) and bullion could be outlawed and confiscated.

What could trigger it?: As I write, there is already a rotation going on, from paper gold to bullion. I may even venture to suggest that stop losses are increasingly absent, as the manipulation renders price signals irrelevant. During the first week of March, the $1,570/oz level was broken twice on bearish news, only to find minimal sensitivity, forcing the shorts to cover. This behaviour is typical from segmented, broken markets, where price is no longer the relevant signal and volume becomes the guideline. Having said this, an event that could trigger the rush for delivery could be an “accident”, just like the one the world witnessed in 1972, when Russia announced it had purchased 440 million bushels of wheat. The purchase surpassed the total U.S. commercial wheat exports for that year. In similar fashion, we could see the disclosure of an upwards revision in the gold reserves held by a central bank in the East that would seriously challenge the integrity of the reports issued by central banks in the West with respect to their bullion holdings.

Mitigant: In 1972, the world was divided. Today, all central banks are on the same expansionary program and the systemic impact of a rush for delivery in gold would likely affect all currency zones. I would therefore not expect emerging central banks to report their actual gold purchases and holdings. They have more to benefit from keeping these in secret, profiting from the cheap prices the manipulation causes.

Likelihood: This event is unlikely to be triggered in the near term.

Event 3: Liquidity crunch

Description: This is a widespread, macro risk. Its scope surpasses that of the gold market. For this reason, mitigating it is impossible, when all central banks are engaged in the monetization of sovereign debts. This is the risk of having malinvestments surface their ugly heads and causing a wave of defaults. Central banks would once more, but with a very publicly low marginal efficiency, flood markets with liquidity. And this liquidity would quickly find its way into bullion, triggering the events no.1 and 2 above.

What could trigger it?: In my view, political and social unrest in Europe would cause a selloff in European risk, compromising the balance sheet of the Fed, which is coupled indirectly via USD swaps and directly via funding of European banks. These banks also raise funds from US money market funds.

Mitigant: The mitigant here is only political. It depends on how longer the status quo can force the Euro zone to live under high unemployment, taxes and austerity.

Likelihood: I see this event as the most likely to put an end to the manipulation, although I do not see it occurring in the near term.

Is Eric Sprott’s prophecy valid?

In recent interviews, Mr. Sprott has made the point that as the manipulation comes to end, the premium on physical precious metals vs. fiat precious metals will be as high as the leverage (i.e. credit multiplier) that suppressed it.

The manipulation just described somehow resembles the suppression of the value of the US dollar in Argentina during the convertibility of the peso, after the 1994 Mexican peso crisis. Officially, the Argentine peso was convertible to US dollars at a 1:1 ratio. But the credit multiplier for US dollar deposits was legally capped at 3x in March 1995 (this was a simple calculation, because Argentina lacks any sophisticated shadow banking system). As it became evident that this situation was unsustainable and the public began a run on US dollar deposits, US dollar bills (under the mattress) began to trade at a premium against US dollars in bank accounts, as I explained above. First, limits on withdrawals were established at the end of 2001 and eventually a bank holiday was declared. When the holiday was lifted and the system imploded, the US dollar overshot to 3.80 pesos, but after a few months, it settled back to around $3.00…exactly the ratio implied by the credit multiplier that caused the crash. This simple and real example tells me that Eric Sprott’s claim is spot on. The chart below (source: Bloomberg) on the USD in terms of ARG peso, makes my point very clear:

However, I expect a financial repression like never seen before unleashed before the prophecy finally becomes reality. Something to keep in mind: The repression of the price of the USD in Argentina lasted seven years in a context with (a) no shadow banking system, (b) full disclosure of the credit multiplier and (c) a market price for the opportunity cost of holding USD bills under the mattress. Seven years, folks! This suggests two things: (1) It will take a period far longer than most are willing to accept until the day of reckoning comes, and (2) when that day comes, the crash will be far more formidable than anyone can imagine.

Conclusions

This extensive letter was the third of a series on the manipulation of the price of gold. I am confident that through them, I established the following conclusions:

-According to mainstream economics, the manipulation is a necessary policy tool, to achieve the global monetization of sovereign deficits. Without manipulation, inflation expectations would be shaped by the gold market, causing the fall of fiat money.

-The manipulation consists in inventing a new fiat currency, fiat gold, with a credit multiplier.

-To hedge the manipulation, one can trade the expansion or contraction of the credit multiplier in gold

-The creation of fiat gold, per se, is not manipulation. The manipulation consists in keeping the credit multiplier undisclosed and misrepresenting reserves of bullion.

-The manipulation of gold engenders serious systemic risks that could eventually lead to the crash of a clearinghouse. The costs are tangible.

-The most likely event to put an end to the manipulation is a wave of corporate defaults.

-When the manipulation ends, the premium in physical gold vs. fiat gold will approximate the credit multiplier.

Martin Sibileau