by Don Vialoux, Tech Talk

Editor’s Note: Mr. Vialoux is scheduled to appear on BNN’s Money Talk tomorrow evening

Interesting Charts

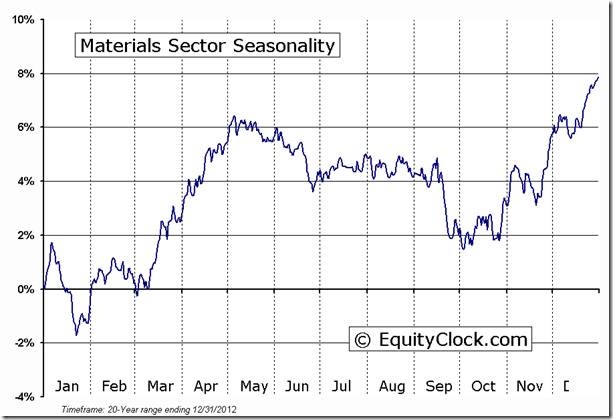

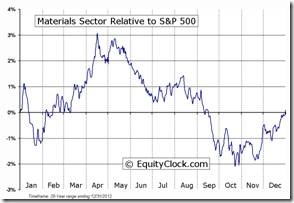

Finally, the Materials sector has started to show its typical strong seasonality for this time of year following a six week period of underperformance.

Chemical stocks such as Monsanto, Dupont, Dow Chemical and Air Products & Chemicals are driving the Index. Chemicals have a 68% weight in the industry.The S&P Chemical Index broke above 386.34 to reach an all-time high.

Monsanto, largest holding in the Materials Index, broke above resistance at $104.19 to reach a five year high.

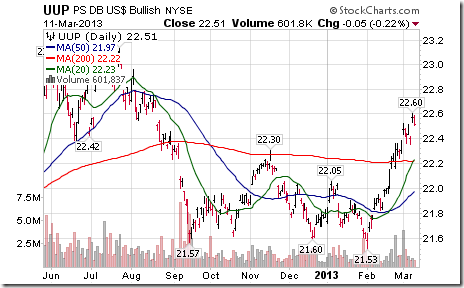

Weakness in the U.S. Dollar Index contributed to strength in the Materials sector. Most chemicals are priced in U.S. Dollars.

The VIX Index broke below support to reach a six year low.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. Notice that most of the seasonality charts have been updated recently.

To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Materials Sector Seasonal Chart

MATERIALS Relative to the S&P 500 |

Thackray Market Letter

Brooke’s latest monthly letter was published over the weekend. Highlights are as follows:

· S&P 550 Technical Status

· HAC holdings on February 28th

· Sector updates on the U.S. Dollar, Gold, Silver, Platinum, Consumer Discretionary, Retail, Financials, Canadian Banks, Industrials, Materials, Energy

Brooke’s letter is free. Subscribe by visiting www.alphamountain.com

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

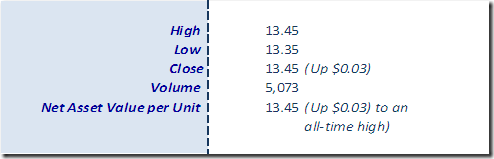

Horizons Seasonal Rotation ETF HAC March 11th 2013