For this weeks edition of the SIA Equity Leaders Weekly, we are going to focus in on the U.S. Equity market again as multiple indices are moving on to new multi-year or all-time highs. With U.S. Equity still holding the number one rank in our asset allocation model and continuing to outperform other asset classes, we want to take a look at the indice charts to see if this trend will continue.

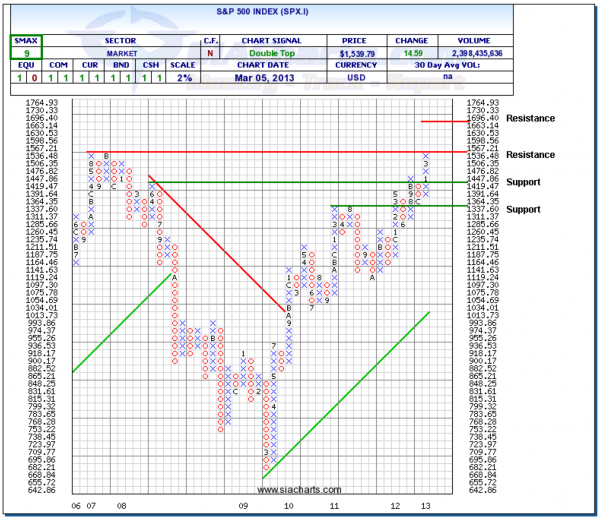

S&P 500 Index (SPX.I)

We wrote about the SPX.I on January 3rd and February 7th of 2013 and are updating it again as it continues to move upwards. In these past articles, we highlighted the first target resistance level at 1567.21 which the S&P 500 is now currently up against. A move above this would see new all-time highs and give it some room to move towards the next resistance level around 1700. However, in the short-term, a psychological barrier could happen around 1600 as well.

Support can now be found below at 1419.47 and again at 1337.60. An SMAX score of 9 out of 10 still shows positive near-term strength.

Click on Image to Enlarge

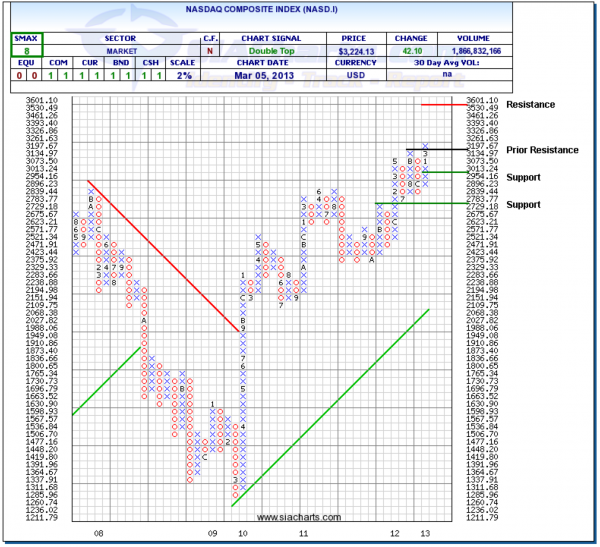

NASDAQ Composite Index (NASD.I)

Other major U.S. indices, the Dow and the Nasdaq Comp, have both moved on to new all-time highs. The NASD.I has been dragged down somewhat from AAPL's 40% loss over the past 6 months, but has still been able to break through prior resistance at 3197 to new highs. NASD.I next resistance above is found at 3600, but again may be slowed from the cap-weighting of some of the major tech companies.

To the downside, support can be found at 2954.16 and at 2729.18. Specific investment opportunities can be found in the Favored zone of the SIA Nasdaq 100 Index Fund Report which include GILD (up 78% since entering Favored zone), VMED (up 55% since entering Favored zone), and EXPE (up 64% since entering Favored zone) which are all drastically outperforming the NASD.I and other benchmarks since entering the Favored zone.

Click on Image to Enlarge