Upcoming US Events for Today:

• No Significant Events Scheduled

Upcoming International Events for Today:

• German GDP for the Fourth Quarter will be released at 2:00am EST. The market expects a year-over-year increase of 0.4% versus an increase of 0.9% previous.

• German Economic Sentiment for February will be released at 4:00am EST. The market expects 105.0 versus 104.2 previous. • • The survey on Current Conditions is expected to show 108.8 versus 108.0 previous. The survey on Business Expectations is expected to show 101.6 versus 100.5 previous.

• Canadian CPI for January will be released at 8:30am EST. The market expects a year-over-year increase of 0.7% versus an increase of 0.8% previous.

• Canadian Retail Sales for December will be released at 8:30am EST. The market expects a decline of 0.5% versus an increase of 0.2% previous.

The Markets

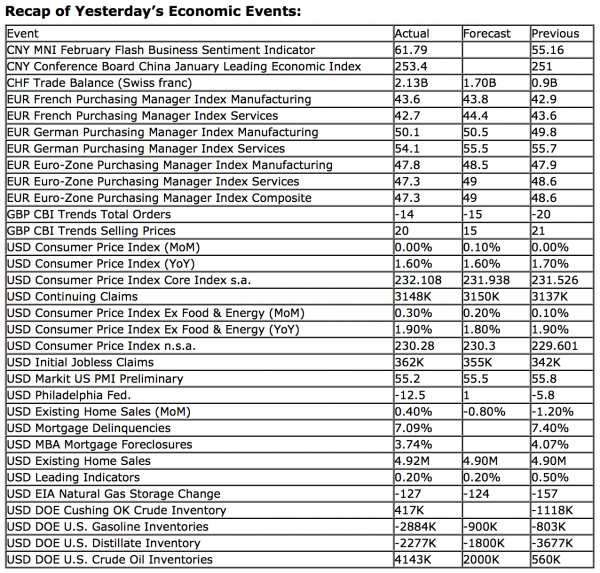

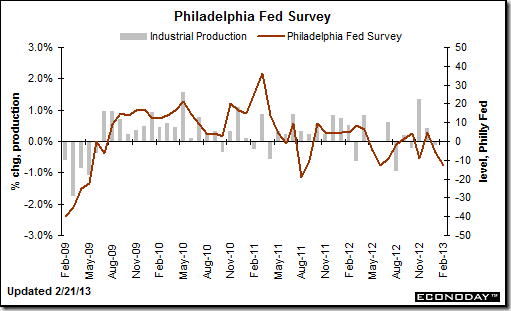

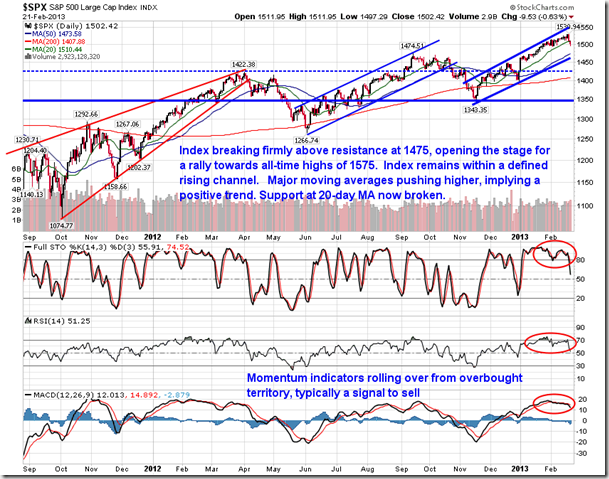

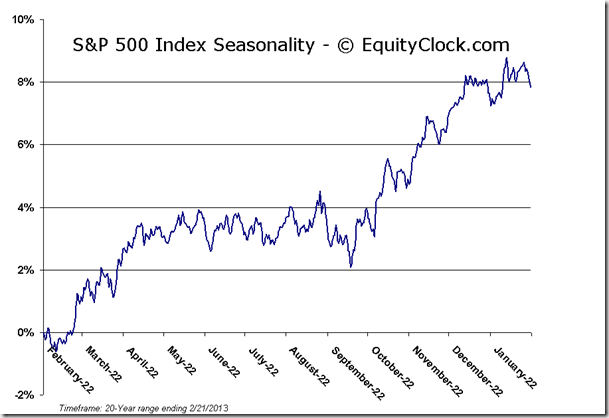

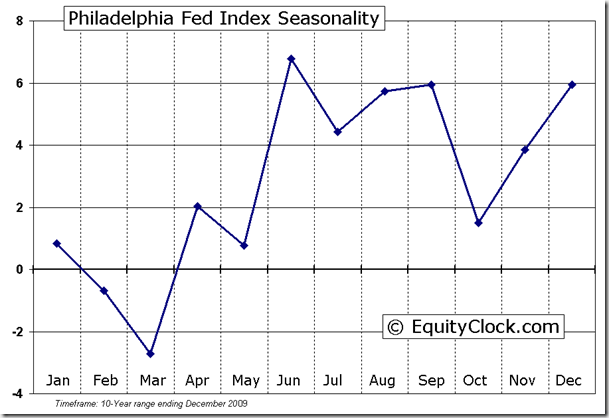

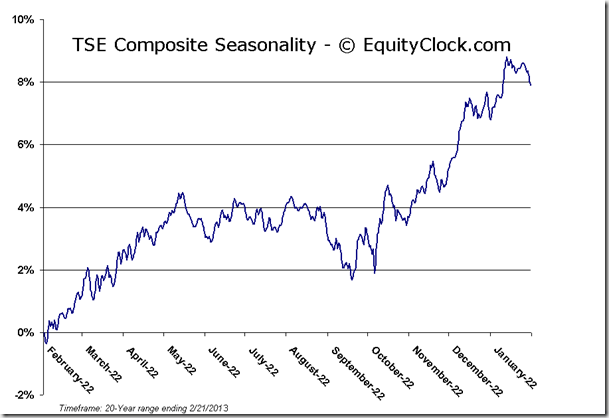

Equities sold off significantly for a second day as investors continued to digest comments from the Fed and weak economic reports had analysts reassessing forecasts. Euro-Zone PMI’s continued to deteriorate in February, emphasizing the struggle that the European economy continues to realize as it battles with significant deficits and harsh austerity measures. News in the US wasn’t much better with the Philly Fed Index reporting a –12.5 for the present month. Analysts were expecting a positive print, rebounding from a number of sub-zero reports dating back to the spring of last year. The manufacturing gauge has primarily struggled in negative territory over the last few months as a result of a couple of major weather events, such as the recent blizzard and Hurricane Sandy in the Fall. Manufacturing activity seasonally picks up in the Spring, lifting equity markets in the process as economic activity shows signs of improvement.

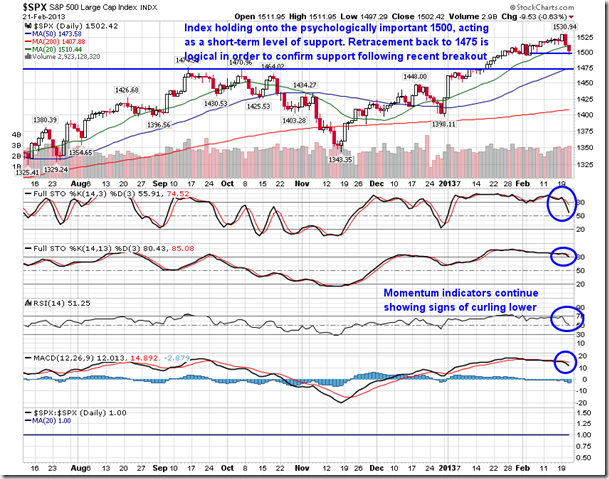

The declines in equity markets pushed a number of benchmarks below 20-day moving averages, emphasizing weakness in the short-term. The Dow Jones Industrial Average, Nasdaq Composite, and S&P 500 are all trading below this short-term term moving average and momentum indicators continue to trend lower. The S&P 500 managed to retain a close above 1500, ideally providing a short-term level of support as weak short investors are shaken out of positions. Recent breakout levels of 1475 on the S&P 500 and 13,600 on the Dow Jones Industrial Average remain logical retracement levels to confirm previous resistance as new support.

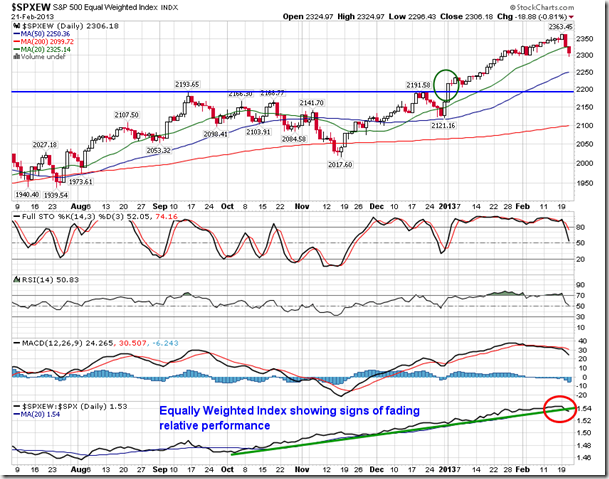

Meanwhile, the S&P 500 Equally Weighted Index is showing initial signs of deteriorating relative performance compared with the Capitalization weighted index, indicating narrowing market breadth as defensive assets start to take a leadership role in market activity. The Equally Weighted index has outperformed the Capitalization Weighted index since the beginning of October, providing a leading indication of market strength ahead. Typically in risk-on periods the equally weighted index outperforms while in risk-off periods the benchmark lags.

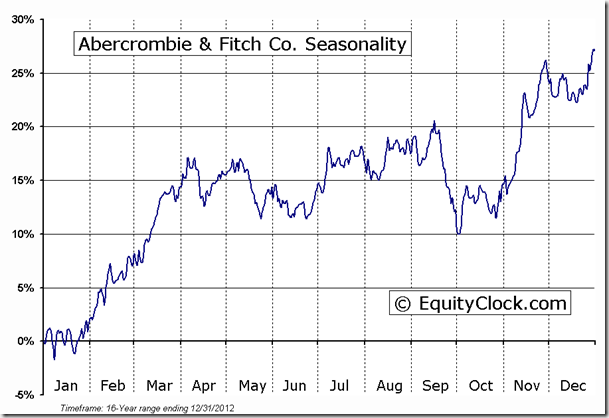

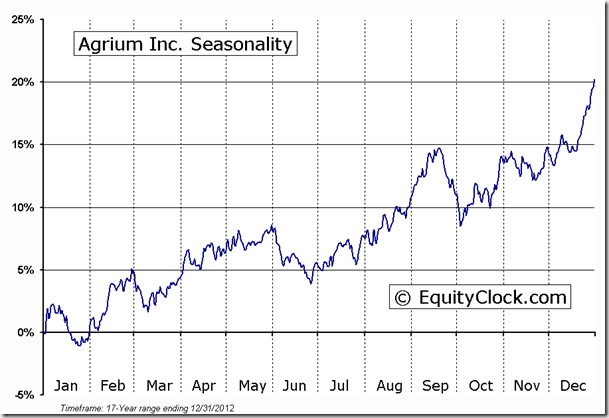

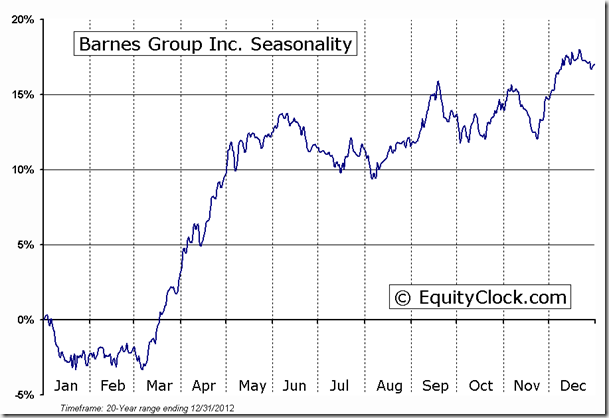

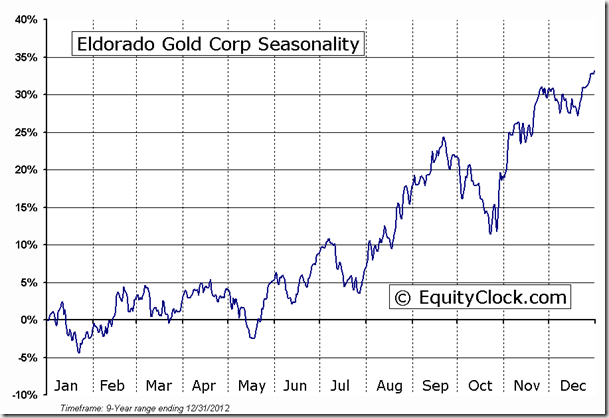

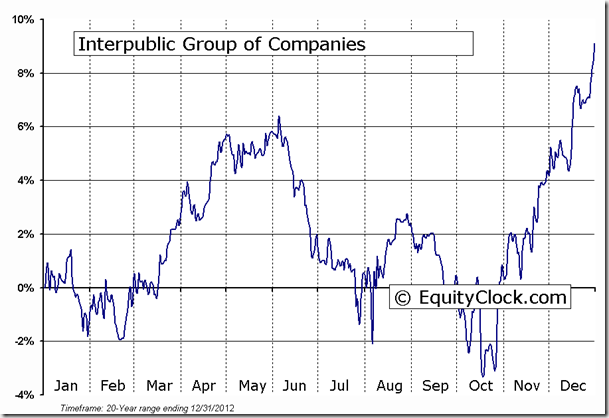

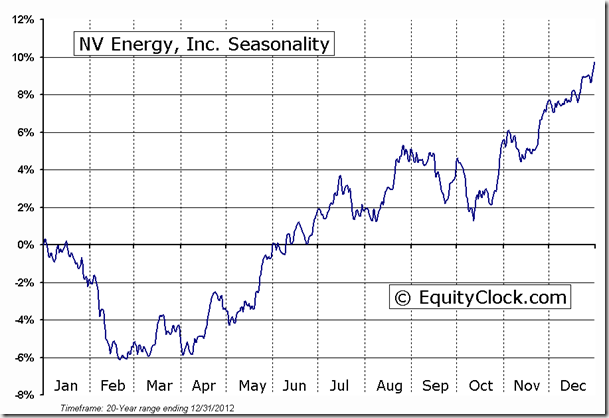

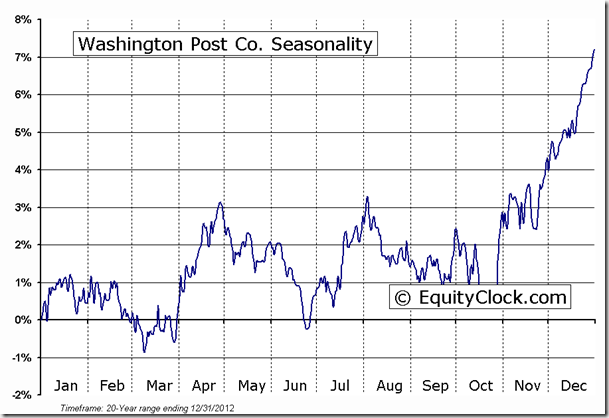

Seasonal charts of companies reporting earnings today are as follows:

Sentiment on Thursday, as gauged by the put-call ratio, ended bearish at 1.10. Investors remain hedged via put-options.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $13.16 (down 0.30%)

- Closing NAV/Unit: $13.14 (down 0.67%)

Performance*

| 2013 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 3.30% | 31.4% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.