by Catherine Wood, AllianceBernstein

Catherine Wood and Michael Shavel

As robots increasingly take over processes currently performed by humans, we believe that an inflection point in manufacturing automation is imminent. Transport and healthcare will quickly follow, with enormous social, economic and hence investment implications.

When 1950s science fiction writers peered into the future, they frequently saw a vision of robots from outer space capable of superhuman feats. In reality, science largely veered away from spacecraft and robots, and towards information and communications. Many believe, however, that we are now just a step away from a new era of automation which will make at least some of that old science fiction look prophetic.

Driverless cars, robotic surgery and “service robots” that can replace occupations as disparate as hotel receptionists and home care staff will become a reality within 15 years, in our view. These applications of science will revolutionize service industries which have been largely untouched by technology up to now. The knock-on effects on society are likely to be profound.

Take self-driving cars, already being built and used on the roads in prototype form by firms as diverse as Google and Volkswagen. Given that an estimated 90% of accidents stem from human error, widespread adoption of such vehicles could dramatically reduce deaths and injuries. The reduction or elimination of the need for a driver would also open up a whole new era of mobility for the growing elderly population in developed societies. And driverless cars can use the roads more efficiently—safely driving bumper to bumper, for example—while they can be parked away from home, ready to be summoned by smartphone. These changes will likely open the way for a wholesale remodeling of cities.

Even more sci-fi, perhaps, is the idea of gadgets that do away with the drudgery of many manual tasks. Companies such as iRobot are already producing household aids like automatic vacuuming and floor-washing devices. One of its founders, Rodney Brooks, hopes soon to launch an affordable robot that can be trained to undertake a number of tasks, such as packaging or light manufacturing, replacing human employees. Such a robot might be equipped with “eyes” to help it judge distance stereoscopically like a human.

But it’s not just boring repetitive tasks that are likely to be automated. Robots are also making an impact on highly skilled tasks like surgery. A California-based company, Intuitive Surgical, is selling systems that combine 3D high-definition vision technology with robotics to allow surgeons to undertake much less invasive surgery.

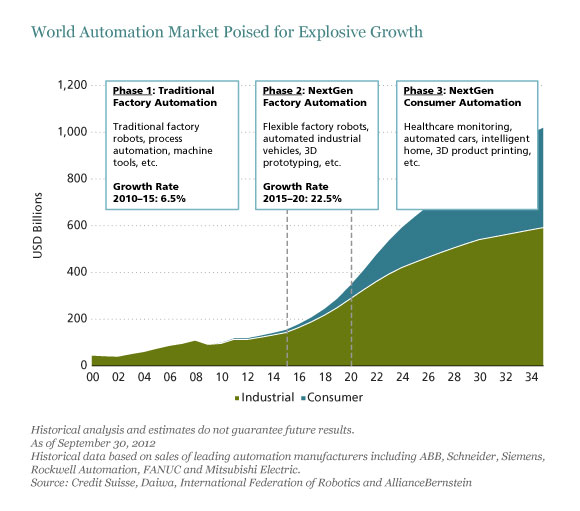

We predict there will be two clear phases to this automation revolution. The first phase is likely to be driven by industrial companies as they deploy increasingly sophisticated robots to enable more efficient and flexible manufacturing. The evidence suggests we are close to an inflection—the Japanese motor industry already boasts nearly 1,600 robots for every 10,000 human employees. We think other areas of manufacturing will quickly catch up, pushing the growth rate in the world market for automated products from around 6.5% a year to well over 20% after 2015 (Display). By 2020, we expect a second phase to kick in, when automation finally spreads to services.

Since these trends will unfold over a longer time horizon than is usual for many equity investors, we believe a thematic investing approach is vital. By looking across industries and regions—with analysis that covers scientific, financial and economic developments—investors will be well positioned to tap stocks that will benefit from the robot revolution. Our next blog will look in more detail at the catalysts that are sparking this revolution and the sort of size of market that investors should soon be aiming at.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Catherine Wood is Chief Investment Officer—Thematic Portfolios and Michael Shavel is Research Associate—Thematic Portfolios, both at AllianceBernstein.

Copyright © AllianceBernstein