Responses to Fourth Quarter Earnings Reports

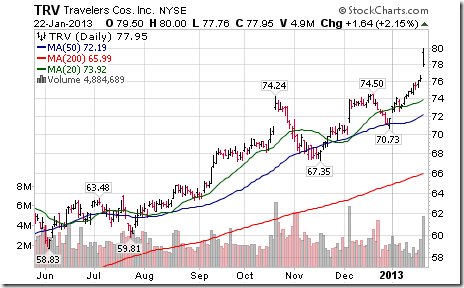

Responses have been strong in both directions. Fortunately, most of the reports have exceeded consensus expectations and equity markets have responded accordingly. Key companies that recorded positive responses yesterday included Freeport McMoran Copper and Gold, Travelers and Dupont.

Stocks responding on the downside included Advanced Micro Devices and Johnson & Johnson.

More of the same after the close yesterday! Google responded to better than expected results by gaining 5.0% to $737.77

IBM gained 5.0% to $205.00 on better than expected results. Nice breakout above resistance at $197.14! IBM is the highest priced stock in the price weighted Dow Jones Industrial Average. Strength in IBM will have a positive impact on the Dow at the opening today.

On the other hand, Texas Instruments fell to as low as $32.50 after reporting lower than expected results last night.

David Skarica’s Comment on Junior Miners

I have enclosed a recent interview I did with Theaureport.com I discuss the opportunities in junior miners along with information on a few I like and own.

To read this article please CLICK HERE

Interesting Charts

U.S. “Gassy” stocks and related ETFs are responding to strength in natural gas prices.

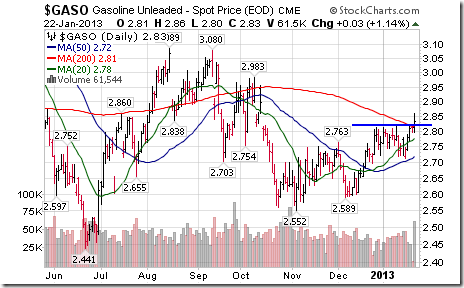

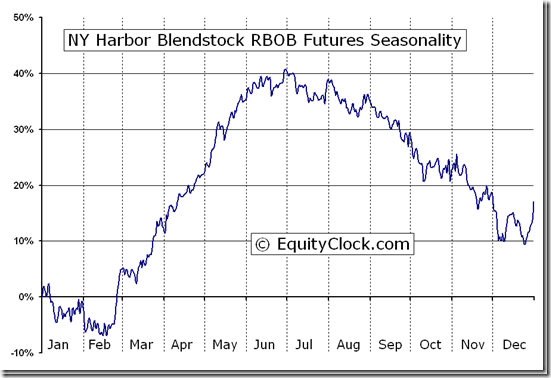

Gasoline prices normally move into a period of seasonal strength in mid-February. However, recent technical action suggests that seasonal influences may have surfaced earlier than usual this year.

The TSX Materials Index and its related ETF led strength in the TSX Composite Index yesterday. ‘Tis the season for the sector to move higher! A breakout by XMA above resistance at $18.13 will attract technical buying.

Thackray’s 2013 Investment Guide

Thackray’s 2013 Investor’s Guide is here. Order through www.alphamountain.com , Amazon, Chapters or Books on Business.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices.

To login, simply go to http://www.equityclock.com/charts/

NY Harbor Blendstock RBOB Futures (RB) Seasonal Chart

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

Horizons Seasonal Rotation ETF HAC January 22nd 2013

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/c0528bd11fb371fd4cd854324906d45b.png)