Pre-opening Comments for Thursday January 17th

U.S. equity index futures are higher this morning. S&P 500 futures are up 10 points in pre-opening trade. Index futures responded to release of a series of fourth quarter earnings reports overnight including EBay, Bank of America, Citigroup, UnitedHealth Group, Fastenol, Huntington Bankshares, Fifth Third Banks and Blackrock.

Index futures added to gains following release of encouraging economic news at 8:30 AM EST. Consensus for December Housing Starts was 889,000 versus 861,000 in November. Actual was 954,000. Consensus for Weekly Initial Jobless Claims was 370,000, down from 372,000. Actual was 335,000.

Boeing fell another $1.25 to $73.09 after the FAA grounded the company’s fleet of 787 aircraft flying in the U.S. due to safety concerns. In addition, BB&T downgraded the stock from Hold to Underweight.

Stillwater (SWC $13.76), a platinum/palladium producer is expected to open higher after Wells Fargo initiated coverage with an Outperform rating.

Yum Brands fell $0.45 to $65.50 after Argus downgraded the stock from Buy to Hold.

Cott (COT $8.75) is expected to open lower after JP Morgan downgraded the stock from Overweight to Neutral.

Newmont Mining (NEM $44.75) is expected to open higher after BB &T initiated coverage with a Buy rating.

Credit Suisse initiated coverage on the Agriculture sector. Agrium, Monsanto and Potash Corp. were given an Outperform rating. Intrepid Potash, CF Industries and Mosaic were given a Neutral rating.

Cisco Systems fell $0.25 to $20.78 after JP Morgan downgraded the stock from Neutral to Underweight.

Goldman Sachs eased $0.09 to $141.00 after Sandler O’Neil downgraded the stock from Buy to Hold

Technical Watch

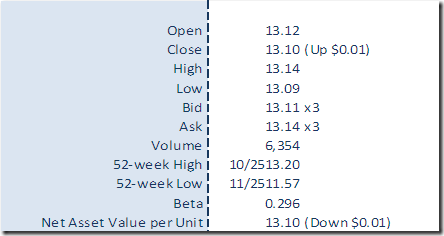

Stillwater Mining Co. (NYSE:SWC) – $13.84 is expected to open higher after Wells Fargo initiated coverage with an Outperform rating. The stock has a positive technical profile. Intermediate trend is up. Resistance at $14.07 likely will be broken shortly. The stock trades above its 20, 50 and 200 day moving averages. Strength relative to the S&P 500 Index has been positive since mid-October. Short term momentum indicators are overbought. Preferred strategy is to accumulate the stock at current or lower prices.

Interesting Charts

The U.S. energy sector continues to show positive real and relative returns. Nice breakout by Energy SPDRs yesterday!

Gold is showing early technical signs of bottoming:

· Strength relative to the S&P 500 Index has turned slightly positive

· Gold recently moved above its 20 day moving average.

· Short term trend remains negative but turns at least neutral on a break above $1,695.40.

Gold stock and related ETFs have a similar, but slightly more positive technical profile to gold. Strength relative to the S&P 500 is more clearly defined. A move above $20.75 will complete the pattern.

Higher silver, platinum and palladium prices are a bonus for gold equities.

Mr. Vialoux on BNN’s Market Call yesterday

The focus was on the energy sector. Following is a link to the interview:

http://watch.bnn.ca/#clip845326

http://watch.bnn.ca/#clip845168

http://watch.bnn.ca/#clip845176

Keith Richards’ Blog

This week, I look at longer termed patterns for the US$, C$ and Euro. I also look at the recent “full speed ahead” action in the markets, featuring a longer termed outlook courtesy of Seasonal expert and friend, Brooke Thackray. Visit www.smartbounce.ca for details.

Weekly Select Sector SPDRs Review

Technology

· Intermediate trend is up.

· Units remain above their 20, 50 and 200 day moving averages

· Strength relative to the S&P 500 Index remains negative.

· Short term momentum indicators are overbought and showing signs of rolling over.

Materials

· Intermediate trend is up. Units are near a 17 month high at $39.18

· Units remain above their 20, 50 and 200 day moving averages

· Strength relative to the S&P 500 Index is positive, but showing signs of change

· Short term momentum indicators are overbought.

Consumer Discretionary

· Intermediate trend is up. Units reached an all-time high on Tuesday

· Units remain above their 20, 50 and 200 day moving averages.

· Strength relative to the S&P 500 Index changed from neutral to positive

· Short term momentum indicators are overbought

Industrials

· Intermediate trend is up. Units reached an all-time high on Tuesday

· Units remain above their 20, 50 and 200 day moving averages

· Strength relative to the S&P 500 Index remains positive

· Short term momentum indicators remain overbought.

Financials

· Intermediate trend is up. Units closed at a four year high.

· Units remain above their 20, 50 and 200 day moving averages.

· Strength relative to the S&P 500 Index remains positive

· Short term momentum indicators are overbought.

Energy

· Intermediate trend is up. Units broke to a three month high yesterday.

· Units remain above its 20, 50 and 200 day moving averages

· Strength relative to the S&P 500 Index has changed from neutral to positive.

· Short term momentum indicators are overbought

Consumer Staples

· Intermediate trend is neutral. Units are testing their all-time high at $36.184

· Units remain above their 20, 50 and 200 day moving averages

· Strength relative to the S&P 500 Index has been negative, but is showing early signs of change.

· Short term momentum indicators are overbought.

Health Care

· Intermediate trend is up. Units are near their all-time high at $41.88.

· Units remain above their 20, 50 and 200 day moving averages.

· Strength relative to the S&P 500 Index remains neutral

· Short term momentum indicators are overbought

Utilities

· Intermediate trend is up. Resistance is at $35.77.

· Units remain below their 200 day moving average, but above their 20 and 50 day moving average.

· Strength relative to the S&P 500 Index remains negative.

· Short term momentum indicators are overbought and rolling over.

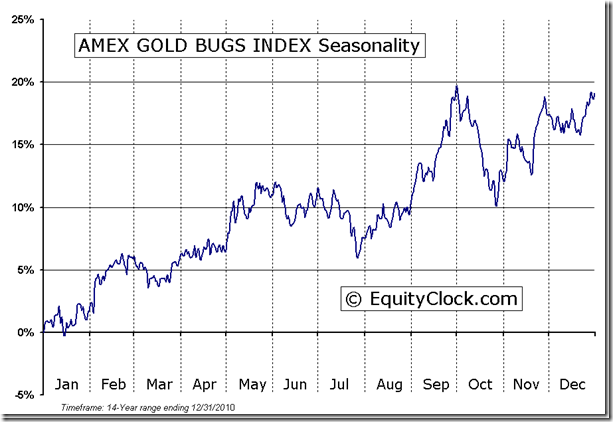

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices.

To login, simply go to http://www.equityclock.com/charts/

Following is an example:

AMEX GOLD BUGS INDEX ($HUI) Seasonal Chart

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

Horizons Seasonal Rotation ETF HAC January 16th 2013

![clip_image001[1] clip_image001[1]](https://advisoranalyst.com/wp-content/uploads/HLIC/679332bb21d364189ccd4ccc50ef4d2d.png)