Pre-opening Comments for Tuesday January 8th

U.S. equity index futures are slightly lower this morning. S&P 500 futures were down 2 points in pre-opening trade.

Monsanto gained $3.94 to $99.88 after reporting higher than consensus fiscal first quarter earnings. The company also raised its fiscal 2013 guidance.

ManuLife (MFC $14.03) is expected to open higher after Bank of America/Merrill upgraded the stock from Neutral to Buy.

Celgene added $1.27 to $87.00 after RBC Capital and Piper Jaffray upgraded the stock. In addition Stiffel Nicolaus and Wallachbeck raised its target price.

Ilinois Tool (ITW $62.44) is expected to open lower after JP Morgan downgraded the stock from Neutral to Underweight.

Boeing fell $1.38 to $74.75 after BB&T downgraded the stock from Buy to Hold.

CF Industries eased $0.80 to $209.29 after BMO Capital downgraded the stock from Outperform to Market Perform.

Technical Watch

Celgene Corp. (NASDAQ:CELG) – $87.00 added 1.4% after RBC Capital and Piper Jaffray upgraded the stock. The stock has a positive technical profile. Intermediate trend is up. The stock closed at an all-time high yesterday. The stock trades above its 20, 50 and 200 day moving averages. Short term momentum indicators are overbought, but have yet to show signs of peaking. Strength relative to the S&P 500 Index has been positive since last June. Preferred strategy is to accumulate the stock at current or lower prices.

Interesting Charts

The China trade continues to work.

China related stocks and ETFs continue to advance.

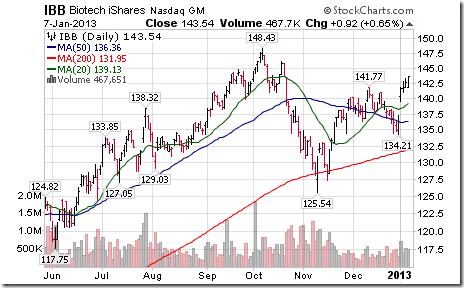

Biotech iShares closed at a new high yesterday, typical of strength at this time of year. Biotech stocks move higher in anticipation of the annual San Francisco Biotech Showcase, the largest biotech conference of the year. The conference this year is from January 7th to January 9th.

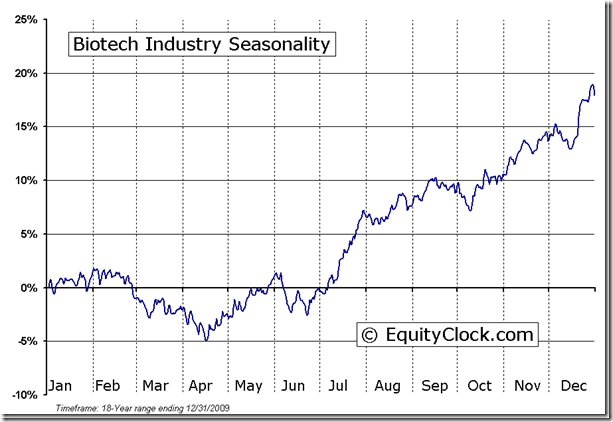

Not surprising, the Biotech sector has a history of losing momentum following the conference. Take seasonal profits on news!

Biotech Industry Seasonal Chart

FP Trading Desk Headline

FP Trading Desk headline reads, “U.S. downgrade expected without Grand Bargain in next two months”. Following is a link to the report:

Thackray’s 2013 Investment Guide

Thackray’s 2013 Investor’s Guide is here. Order through www.alphamountain.com , Amazon, Chapters or Books on Business.

Keith Richards’ Blog

I’ve covered some technically attractive sectors lately, including 4 International markets and 2 commodities that look set for bullish action. Visit www.smartbounce.ca for more details.

BTW—I was on BNN MarketCall Tonight last Friday. Here’s the clip: http://watch.bnn.ca/#clip837585

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

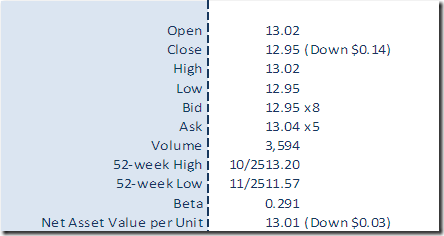

Horizons Seasonal Rotation ETF HAC January 7th 2013

![clip_image001[1] clip_image001[1]](https://advisoranalyst.com/wp-content/uploads/HLIC/cf63658b8ad7f55a342ab8a19ede35cb.png)