Prepared by SIACharts.com

For this week's edition of the SIA Equity Leaders Weekly we are going to take a look at a newer area of strength in recent months, International Equity. Both ETF's that we will highlight have a common theme: yield. Yielding equities have been strong in the U.S. and Canada so seeing them now as a major contributor overseas as well, continues to show the relative strength of yield.

First Trust Dow Jones Global Dividend (FGD)

The first chart we are going to look at is the First Trust Dow Jones Global Dividend ETF. The FGD has been in a consolidation pattern for the last 2 years and is currently sitting at the top of the range below its breakout at $24.48. Should this level be taken out, the next major test for FGD is in the mid $28's. To the downside support is found above $21.74 and $19.69.

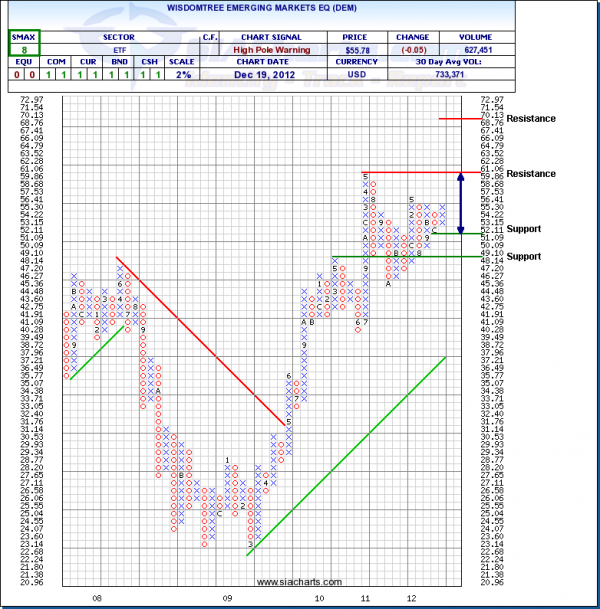

WisdomTree Emerging Markets Income ETF (DEM)

The second chart we are going to look at is the WisdomTree Emerging Markets Income ETF. This name like our first chart focuses on larger income producing names. Unlike FGD though, the chart does remain below its 2 year highs by 7.5% or so. This relative underperformance to the Developed International name is in line with the broader strength in the developed space.

Looking at the chart the first major test to the upside is at $61.06 with room to the $70 range from there. To the downside support is above $51.09 and $48.14.

Those looking for new holdings in the International space can look to these names as possible choices but again keep in mind that Developed countries continue to have an edge on Emerging within the International asset class.

Copyright © SIACharts.com