High-Yield Bank Loans: Look Before You Leap

by Ashish Shah, AllianceBernstein

Dec 10, 2012

by Ashish Shah, Gershon Distenfeld and Ivan Rudolph-Shabinsky

High-yield bank loans are a hot topic again in capital markets, with features touted as ideal for today’s environment. But we think it makes sense to take a closer look at what bank loans really are—and aren’t. In our opinion, there are a few holes in the case for piling into high-yield loans.

High-yield loans have been in the spotlight before. They were popular in 2010, too, and the rationale was similar to today’s. Bank loans pay floating coupon rates, so they’re expected to beat bonds if interest rates rise. Since loans are higher than bonds in the capital-structure pecking order, investors should be able to recover more of their investment in the event of a default. And bank loans offer relatively attractive yields at a time when yield is a commodity.

Many investors are ready to jump in with both feet. Our advice: take a good look before you do.

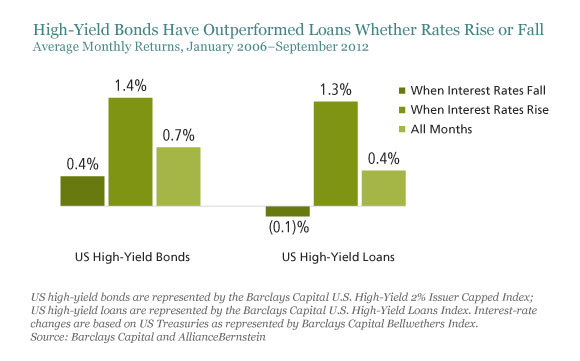

High-yield loans didn’t keep pace with high-yield bonds back then. In fact, loans have trailed bonds over the past seven years by almost 30% cumulatively. As the display below shows, that works out to an average outperformance of 0.3% a month: 0.7% versus 0.4%. Loans also trailed in tough credit markets such as the one in 2008—despite being higher in the capital structure. In falling rate environments, loans have underperformed bonds dramatically—by about half a percent per month when Treasury bonds have posted positive returns. Of course, to be fair, the concern today is more about rising rates. But even in months when interest rates have risen, high-yield loan returns have still trailed high-yield bond returns.

In falling rate environments, loans have underperformed bonds dramatically—by about half a percent per month when Treasury bonds have posted positive returns. Of course, to be fair, the concern today is more about rising rates. But even in months when interest rates have risen, high-yield loan returns have still trailed high-yield bond returns.

That’s because rising rates are often accompanied by improving credit conditions, which can make it more advantageous for a company to refinance its loan. High-yield loans can be refinanced at any time (more on that in an upcoming post), and borrowers refinance when it benefits them, not investors. Management hands investors their money back and moves on.

High-yield bonds still feel some impact from rising rates, don’t they? They do, but historically much less than you might think.

It’s not so much interest-rate sensitivity, or duration, that’s had the biggest effect on high-yield bonds. Changing credit conditions have been a much bigger influence. That’s why we think the concern about rising rates has been overstated.

Still, some investors might feel more comfortable with bonds that are even more resilient against rising rates. One solution might be short-duration high-yield bonds—specifically, those with higher credit ratings of B and BB. Over time, these bonds have delivered stronger returns than loans (see display below). In fact, they’ve nearly matched the broader high-yield bond market. And they’ve done it with a lot less risk. We’re not saying there’s no place for high-yield loans in a diversified portfolio. However, in our view, jumping in too deep would be a mistake. That’s especially true if it means jumping out of high-yield investments that our research indicates could be more effective.

We’re not saying there’s no place for high-yield loans in a diversified portfolio. However, in our view, jumping in too deep would be a mistake. That’s especially true if it means jumping out of high-yield investments that our research indicates could be more effective.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Ashish Shah is Director of Credit, Gershon Distenfeld is Director of High-Yield Debt and Ivan Rudolph-Shabinsky is Portfolio Manager—Credit, all at AllianceBernstein.

Copyright © AllianceBernstein