By Martin Sbilieau of "A View From The Trenches"

The Year 2012 In Perspective

Today, I want to summarize what we covered over the year. During 2012, I sought to address both theory and market developments. Under an Austrian approach, I discussed many macroeconomic topics: the effect of zero interest rates, the myth of decoupling (between the US and the Euro zone), collateralized monetary systems (as imposed by the European Central Bank), the technical (but not realistic) possibility of a smooth exit from the Euro zone, the destruction of the capital markets by financial repression, the link between the futures, repo and gold markets and consumer prices (I don’t like the word “consumer prices”, but it is better than speaking of a “price level”), insider trading, circular reasoning in mainstream economics, high-frequency trading, what can precipitate the end game to this crisis, the technicalities of a transition to a gold standard, the conditions for a successful implementation of the gold standard, and the flawed logic behind the Chicago plan, as proposed by Benes & Kumhof.

Let’s now briefly follow up on each of the market themes I covered in 2012:

1.-There has been no decoupling: The Euro zone is coupled to the US dollar zone

At the end of 2011, when the collapse of the banking system in the Euro zone (courtesy of M. Trichet) was dragging the rest of the world, the Swiss National Bank established a peg on the Franc to the Euro and the Federal Reserve extended and cheapened its currency swaps with the European Central Bank. These two measures –indirectly- coupled the fate of the assets in the balance sheets of the Euro zone banks to the balance sheets of the central banks of Switzerland and the US.

As in any other Ponzi scheme, when the weakest link breaks, the chain breaks. The risk of such a break-up, applied to economics, is known as systemic risk or “correlation going to 1”. As the weakest link (i.e. the Euro zone) was coupled to the chain of the Fed, global systemic risk (or correlation) dropped. Apparently, those managing a correlation trade in IG9 (i.e. investment grade credit index series 9) for a well-known global bank did not understand this. But it would be misguided to conclude that the concept has now been understood, because there are too many analysts and fund managers who still interpret this coupling as a success at eliminating or decreasing tail risk. No such thing could be farther from the truth. What they call tail risk, namely the break-up of the Euro zone is not a “tail” risk. It is the logical consequence of the institutional structure of the European Monetary Union, which lacks fiscal union and a common balance sheet. I am not in favour of such, but in its absence, to think that the break-up is a tail risk is to hide one’s head in the sand. And to think that because corporations and banks in the Euro zone now have access to cheap US dollar funding, the recession will not bring defaults, will be a very costly mistake. Those potential defaults are not a tail risk either: If you tax a nation to death, destroy its capital markets, nourish its unemployment, condemn it to an expensive currency and give its corporations liquidity at stupidly low costs you can only expect one outcome: Defaults. The fact that they shall be addressed with even more US dollars coming from the Fed in no way justifies complacency.

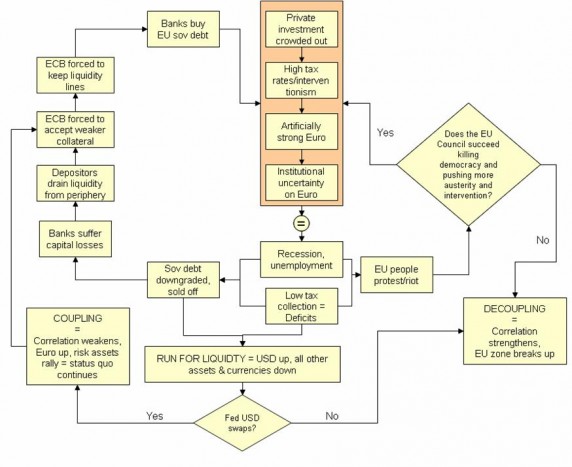

In January of 2012, I laid out an analytic framework to visualize the dynamics between these two currency zones. I reproduce the figure below without comment, as it is self explanatory:

In February, I anticipated that the European Central Bank was eventually going to need to floor the value of sovereign debt. It took about seven more painful months to see this take place, with the announcement of the Open Monetary Transactions. With this in mind, I suggested not to chase the stock rally and warned that shorting the euro would be a painful trade.

2.- Manipulation in the gold market

From my years at the Universidad de Buenos Aires, I always remember professors J. M. Fanelli and Daniel Heymann, because they used to and still think that policy makers (in Argentina) had no choice but to “manage” the price of the US dollar (vs. the peso) to fight inflation. The value of the US dollar, in pesos, was a signal that shaped inflation expectations, according to them. In the same fashion, I am convinced that those at the helm of the G7 central banks believe that to shape inflation expectations and avoid the burst of the bond bubble, they need to manage the price of gold. And that is exactly what they have been doing (via swaps, leases from their deposits at below market rates), since Standard & Poor’s downgraded the sovereign risk rating of the US. They are wrong of course and in time, it will prove to have been an expensive decision. The proof? Movements like the $100/oz drop upon the announcement of the second Long-term Refinancing Operation at the end of February. Nobody who lives marked to market would ever dump so much gold in seconds in a market, let alone do so sustainably and predictably, as it often happens, between 10am and 11am ET. I am convinced that had it not been for this manipulation, gold would have had a stellar performance this year. But how serious can I sound debating a counter-factual statement?

3.-Liquidity will not fund capital expenditures but share buybacks, dividends

In March, we were perhaps the first to suggest that the US dollar liquidity enabled by the Fed via swaps was going to be used to buy back shares and distribute dividends, rather than finance capital expenditures (I say “perhaps” because a few days later David Rosenberg expressed the same view). This is a typical outcome of financial repression. Nations under financial repression generate bankrupt companies owned by wealthy owners. Time will tell but so far, numerous articles have been suggesting that this trend is taking place (Eric Beinstein, from JP Morgan, shows evidence to the contrary, in his latest Credit Markets Outlook report). Because of this, I proposed that as a trading theme, one should buy the product, rather than the producers, which is a winning trade in inflationary environments. Therefore, the suggestion was to buy gold, rather than gold miners.

4.-To defend their currency, the Euro zone destroyed its capital markets

(At this stage, I think no comments are needed on this point, which I made in March.)

5.- Sovereign debt owned by other sovereigns is a concern

In March too, I noticed that the situation in 2012 resembles that of 1931, as Greece and increasingly other peripheral EU countries owe to other governments, the IMF and the European Central Bank. Private investors have been wiped out and just like in 1931 (when France, for political reasons, allowed the KreditAnstalt to go bankrupt), when the next bailout is due, political conditions will be demanded that no private and rational investor would demand.

6.-Canada’s story will be different

In April, I proposed that the Canadian context was different and that rather than expect contagion from the banking system to the government, in Canada, we should expect contagion from the government to the banking system. I still expect this deterioration to be triggered by an exogenous development (i.e. outside Canada) and the reaction of the Canadian dollar to the revised unemployment rate on December 7th may be telling us that this view has merit.

7.- September marked a tectonic shift

I will not elaborate on the points below. I wrote extensively about them in September (see here, here and here), but I need to mention them because they are very relevant for the next year. These points, I must clarify, are my best case scenario, because the necessary condition for their validity is that Spain and any other peripheral country in need of a bailout asks for one and receives the support of the European Central Bank (ECB) in exchange :

-The market will arbitrage the rates of core Europe and its periphery, converging into a single Euro zone target yield (with higher German rates).

-We will no longer be able to talk about “the” risk-free rate of interest, when we refer to the US sovereign yield. Inflation expectations will pick up

-The Canadian dollar should not rise significantly above the US dollar (i.e. above $1.04 per 1 CAD).

-The ECB backstop (i.e. purchase of sovereign debt) generates capital gains for the banks of the Euro zone and transforms risky sovereign debt into a carry product (i.e. an asset whose price is mostly driven by the interest it pays, rather than its risk of default, because this risk has been removed by the central bank)

This implies that in the future, sterilization at low rates or the suggested negative deposit rates at the European Central Bank, under Open Monetary Transactions, will not be feasible. Banks will demand high rates in exchange, if they are to sell the debt to the central bank.

Epilogue

In my next letter, and likely the last one of the year, I will address the topic of why we have not yet seen high or hyper inflation and what is necessary, in general, to see this phenomenon take place. The letter will go dedicated to Peter Schiff. In it, I will seek to show that unlike Keynesian economists believe, not only are high nominal interest rates compatible with high inflation, but in fact they are a necessary condition for high inflation to exist and morph into hyperinflation. This is a paradox to mainstream economics…and, coming from Argentina, I love paradoxes.

A final observation, on method

As my approach is within the Austrian school, you may have noticed that I use praxeology. ( “a theorem of a praxeological science provides information that has been derived by sheer reasoning; it is the product of pure logic without the assistance of any empirical observation”, I. Kirzner). Hence, you find almost no statistics in my articles. My aversion to them is due to my view that the national accounting system used to date is simply a barbaric relic of mercantilist doctrine. But that’s a story for another time… I walk through problems using simple axioms and test their logic with identities (i.e. balance sheets). Mainstream economists, on the other hand, use equations. Hence, they need to “torture” their stats to prove their propositions, because they are inductive. I use deduction.

Copyright © A View From The Trenches"