SIA Charts Daily Stock Report (siacharts.com)

The SIA Daily Stock Report utilizes a proven strategy of uncovering outperforming and underperforming stocks from our marquee equity reports; the S&P/TSX 60, S&P/TSX Completion and S&P/TSX Small cap We overlay these powerful reports with our extensive knowledge of point and figure and candlestick chart signals, along with other western-style technical indicators to identity stocks as they breakout or breakdown. In doing so we provide our Elite-Pro Subscribers with truly independent coverage of the Canadian stock market with specific buy and sell trigger points.

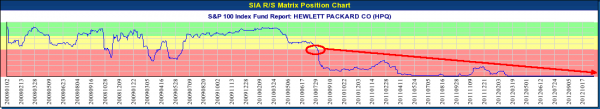

Note: Subscribers can screen all Canadian and U.S. stocks and mutual funds, or as components of equally weighted mutual fund sectors indices (e.g. Income Trusts, Precious Metals), and fund groups by issuer (eg. AGF, Dynamic, Franklin Templeton), all Canadian ETFs, ETF Families by issuer (iShares, Horizons, BMO) or as components of Equally Weighted ETF Sector Indices (e.g. 2020+ Target date, Cdn Equity Lg Cap), and create and monitor their own, or SIA's existing model portfolios. Finally, subscribers benefit from being able to generate BUY-WATCH-SELL Signals on demand with SIA Charts proprietary Favoured/Neutral/Unfavoured, SMAX scoring algorithm (see green-yellow-red graph 1 below).

Subscribers can also use SIA Charts to screen their own firm's in-house research watchlists through SIA Chart's algorithm.

Try SIACharts.com for 14 days. See for yourself how it could dramatically reduce the amount of time you spend in educated guesswork, and reduce your clients' downside risk and, in turn, that of your practice. SIA Charts provides excellent end-to-end support, and regular webinars, to demonstrate how you can leverage this tool to dramatically enhance your client's long-term investment performance.

HEWLETT PACKARD CO (HPQ) NYSE - Nov 21, 2012

GREEN - Favoured / Buy Zone

YELLOW - Neutral / Hold Zone

RED - Unfavoured / Sell / Avoid Zone

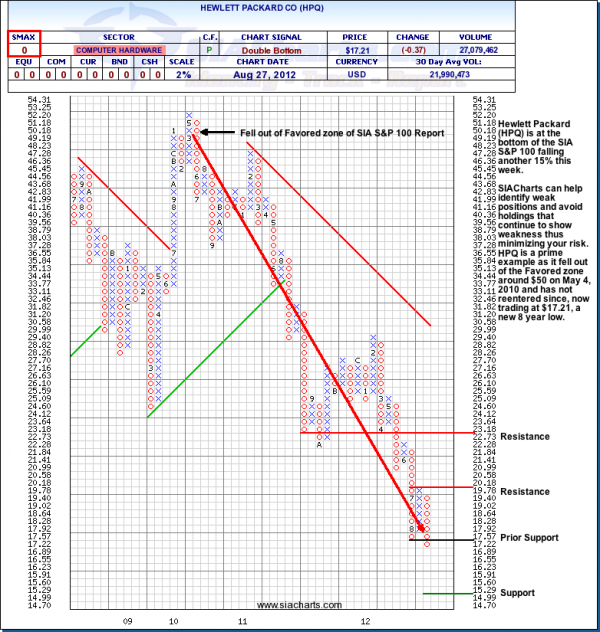

Back on August 27, 2012, SIA Charts' algorithm identified HPQ as a stock to avoid or sell. "Hewlett Packard (HPQ)is at the bottom of the SIA S&P 100 falling another 15% this week.

SIACharts can help identify weak positions and avoid holdings that continue to show weakness thus minimizing your risk. HPQ is a prime example as it fell out of the Favored zone around $50 on May 4, 2010 and has not reentered since, now trading at $17.21, a new 8 year low."

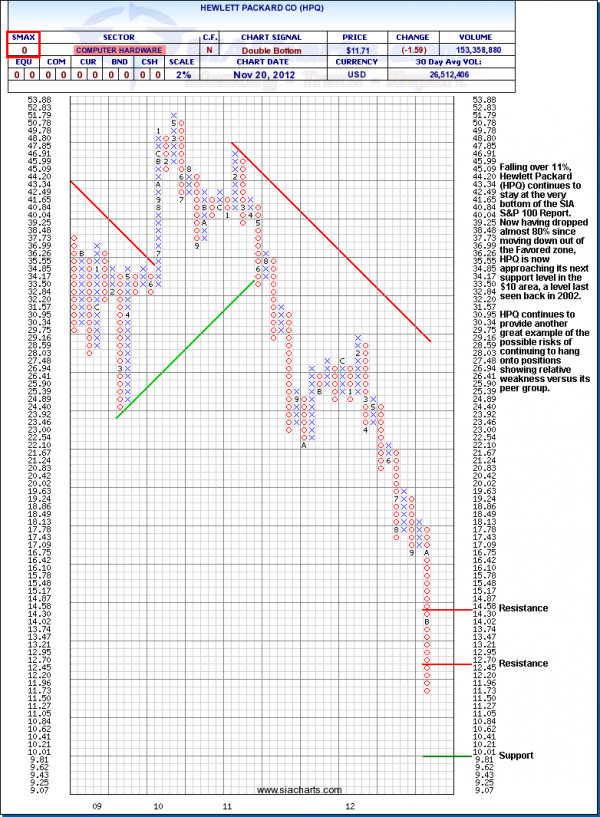

November 20, 2012 - HPQ's troubled top and bottom line sent the stock "Falling over 11%, and Hewlett Packard (HPQ) continues to stay at the very bottom of the SIA SAP 100 Report. Now having dropped almost 80% since moving down out of the Favored zone, HPO is now approaching its next support level in the $10 area, a level last seen back in 2002.

HPQ continues to provide another great example of the possible risks of continuing to hang onto positions showing relative weakness versus its peer group.

Important Disclaimer

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.

Copyright © siacharts.com