By Don Vialoux, TechTalk

November 21, 2012

Upcoming US Events for Today:

- Weekly Jobless Claims will be released at 8:30am. The market expects Initial Claims to show 415K versus 439K previous.

- PMI Flash Manufacturing Index for November will be released at 8:58am. The market expects 51.0 versus 51.3 previous.

- Consumer Sentiment for November will be released at 9:55am. The market expects 84.0 versus 84.9 previous.

- Leading Indicators for October will be released at 10:00am. The market expects an increase of 0.2% versus an increase of 0.6% previous.

- Weekly Crude Inventories will be released at 10:30am.

Upcoming International Events for Today:

- The Bank of England will release its meeting minutes at 4:30am EST.

- China Flash PMI Manufacturing will be released at 8:45pm EST.

The Market

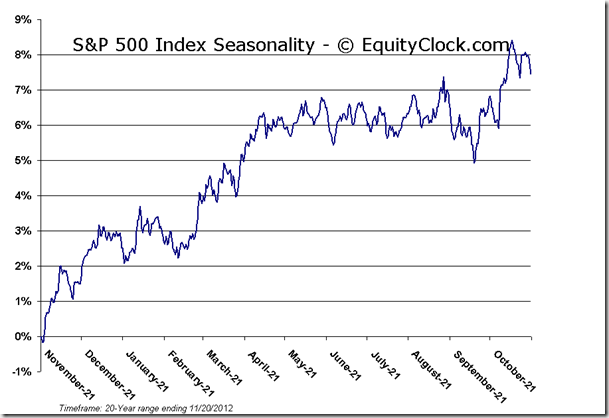

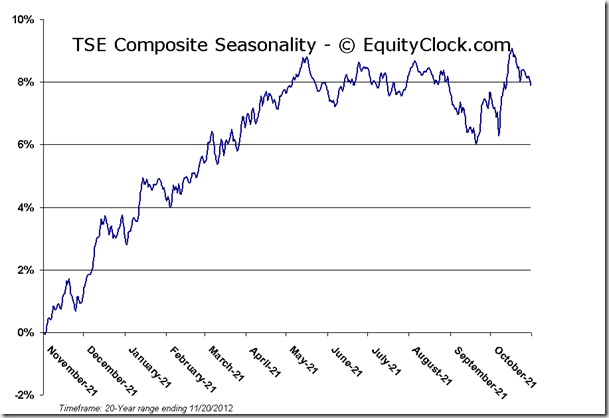

Markets rebounded from sharp intraday losses on Tuesday following comments from Ben Bernanke who indicated that the Fed won’t have the tools to fully avert the effects of going over the fiscal cliff. Equity benchmarks ended near the flatline, retaining the substantial gains accumulated on Monday. The S&P 500 held its closing position above the 200-day moving average while 20-day moving averages across the key benchmarks look to be the next big test to overcome. Momentum indicators are showing signs of rebounding from significantly oversold levels, a process which could take a few weeks to accomplish. Seasonal tendencies for equity markets remain positive through the end of this week, as well as through the end of the month.

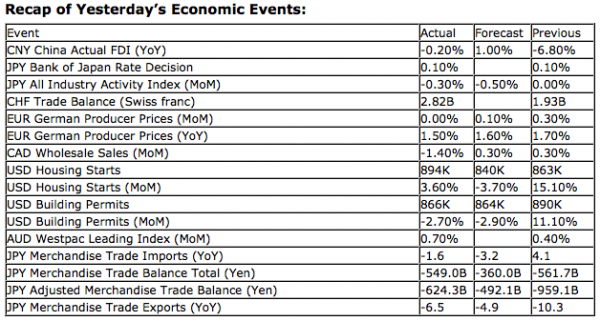

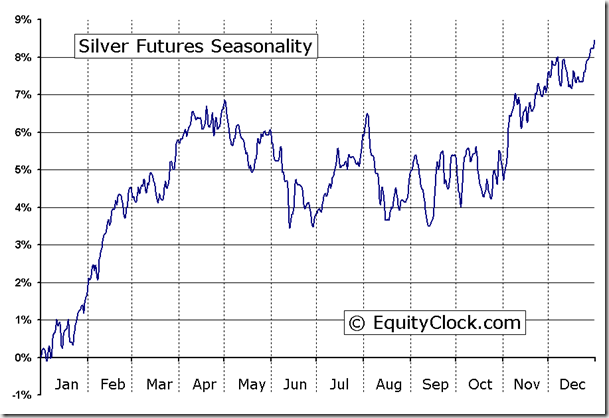

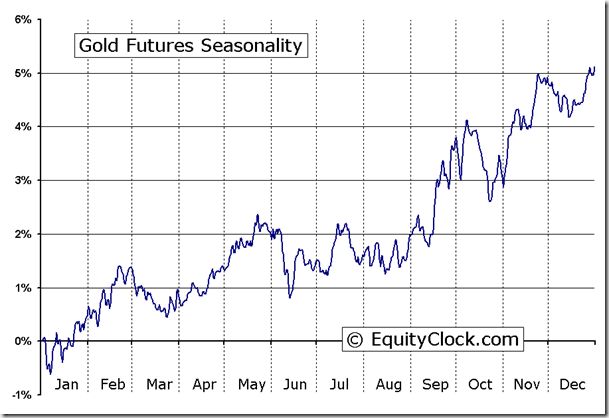

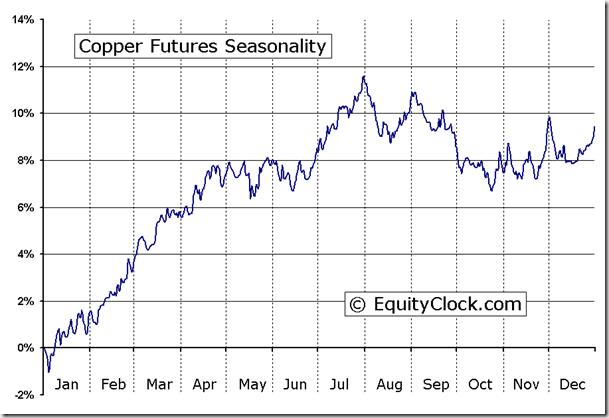

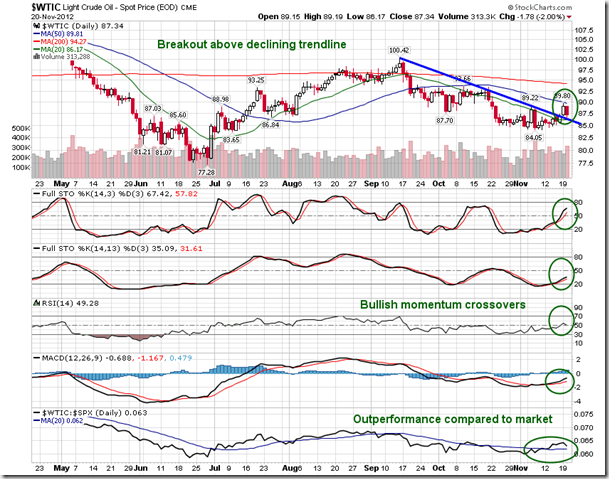

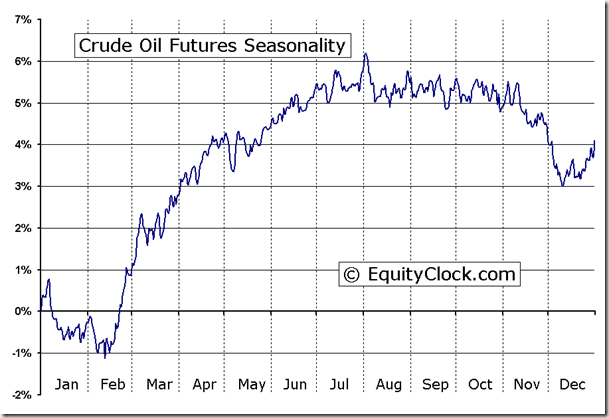

Commodities have been stellar performers this month, bucking the negative equity trend and seeming to benefit from the recent presidential election. Gold, Silver, Copper, Platinum, and even Crude Oil have traded flat to positive for the month, significantly outperforming equity markets that have been sold off due to fiscal cliff fears. Seasonal tendencies for each of the commodities are very much mixed for this second to last month of the year, however, positive seasonal trends are very near, suggesting that positive influences may continue to benefit commodity prices for months to come. Obviously the easy money policy from the US Fed has been a benefit and if the US Dollar starts to show any weakness, commodity prices could soar. The US dollar index has gained 1.3% since the month began, yet commodity prices have been unphased.

Sentiment on Tuesday, as gauged by the put-call ratio, ended bearish at 1.10.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $12.24 (up 0.33%)

- Closing NAV/Unit: $12.28 (up 0.23%)

Performance*

| 2012 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 0.82% | 22.8% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.

Copyright © TechTalk