by Ryan Lewenza, CFA, VP, U.S. Equity Strategist, TD Wealth, and Donato Scolamiero, CFA, V.P., U.S. Equities

Highlights from the report:

• Q3/12 earning season was mixed with reported revenues disappointing while earnings results came in better-than-expected.

• The percentage of companies within the S&P 500 Index (S&P 500) that beat consensus revenue estimates declined from 66% in Q1/12 to 40% in Q3/12, which is the lowest ‘beat rate’ for reported revenues during this recovery. S&P 500 Y/Y revenue growth is projected to be flat in Q3/12 with energy (-14.7%) and materials (-6.4%) posting the weakest growth rates.

• While companies had a difficult time beating revenue estimates, they fared a lot better on the bottom-line with 71% of companies that reported beating earnings estimates. Q3/12 earnings are projected to be up modestly at 1-1.5% Y/Y, which is tracking about 3% higher than earlier estimates.

• All told we would give the Q3/12 earnings season a C+ rating, with the weaker topline results overshadowing the better-than-expected earnings results.

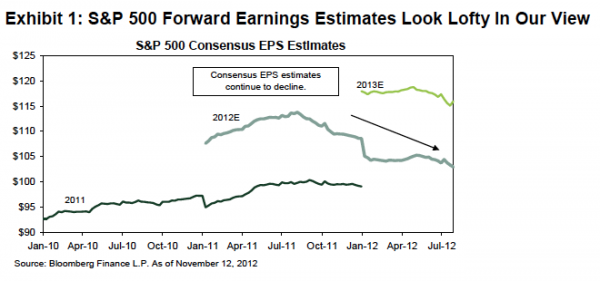

• Forward earnings expectations still remain too high in our view and are likely to be revised lower in the coming months. With our expectations of slowing earnings growth, we believe companies that can continue to grow earnings at higher and more dependable growth rates than the market will likely be rewarded with premium valuations. To this end we screened for companies in the S&P 500 that have expanded sales at least 5% and EPS 10% on a Y/Y basis in each of the last four quarters. Of the stocks that made the list, we would highlight Apple Inc. (AAPL-Q), Visa Inc. (V-N), Family Dollar Inc. (FDO-N), Schlumberger Ltd. (SLB-N), CVS Caremark Corp. (CVS-N) and Stericycle Inc. (SRCL-Q).

The complete report is available for viewing or downloading in the following slidedeck:

U.S. Equity Strategy (Q312 Earnings Recap) - November 16, 2012

Copyright © TD Waterhouse (TD PAIRRL)