Upcoming US Events for Today:

- New Homes Sales for September will be released at 10:00am. The market expects 385K versus 373K previous.

- Weekly Crude Inventories will be released at 10:30am.

- The FOMC Rate Decision will be released at 2:15pm. The market expects no change at 0.25%.

Upcoming International Events for Today:

- German PMI for October will be released at 3:30am EST. PMI Manufacturing is expected to reveal 48.0 versus 47.3 previous. PMI Services is expected to show 50.2 versus 50.6 previous.

- Euro-Zone PMI for October will be released at 4:00am EST. PMI Manufacturing is expected to reveal 46.5 versus 46.0 previous. PMI Services is expected to show 46.4 versus 46.0 previous.

- German IFO Economic Sentiment for October will be released at 4:00am EST. The market expects 101.6 versus 101.4 previous.

The Market

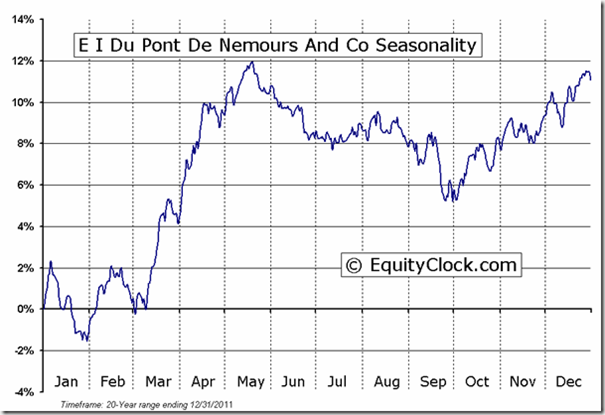

Equity markets logged another dismal session on Tuesday with the Dow Jones Industrial Average falling 243 points while the S&P 500 shed 20 points. Losses were led my the materials sector as Dow component DuPont missed on earnings, sending the stock lower by 9%, the most significant drop since the fourth quarter of 2008 when the stock dropped by an equivalent margin on four different occasions over a seven week period. Positive seasonal tendencies for the stock are primarily weighted toward the first half of the year as material sector benefits from improved manufacturing and production conditions.

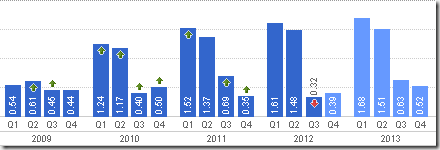

DuPont Earnings History & Projections:

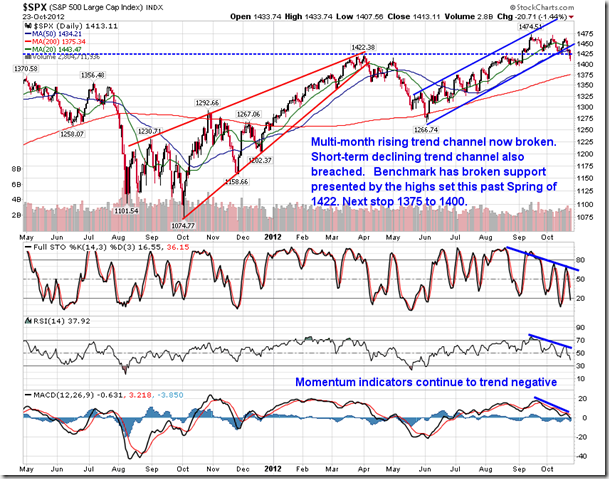

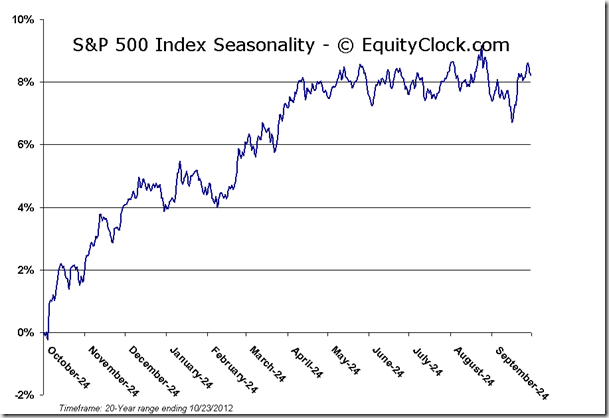

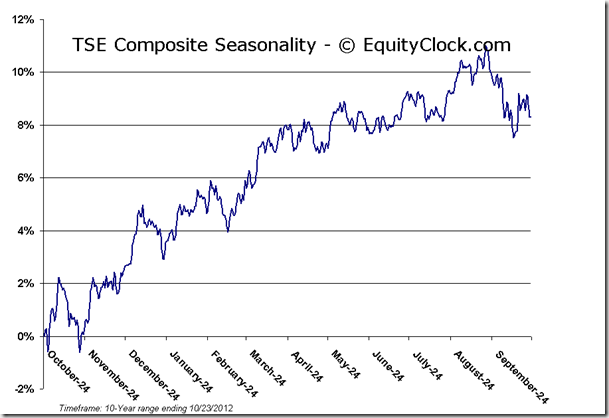

Tuesday’s declines caused significant technical damage to a market that was already teetering on an edge following Monday’s volatile session. Both the Dow Jones Industrial Average and the S&P 500 broke firmly below 50-day moving averages, putting the current decline on an intermediate time-scale. And in addition to the positive intermediate 4-month old trend channel that was broken on Friday, the negative short-term trend channel that had been in place for the past month has also been breached, escalating the severity of the declines. Both the Russell 2000 and the Nasdaq Composite have been trading below 50-day averages for a few days, now testing 200-day moving averages, a break of which could be significantly detrimental to the approaching 6-month positive seasonal trend. Losses are more typical for the six month seasonal trend between November and April when major benchmarks trade below 200-day averages during the period. It will be critical for the seasonal trend ahead that the market finds support soon, otherwise gains ahead may be in doubt. The S&P 500 will likely test support somewhere above its 200-day average. However, given the overwhelming evidence of a market that is rolling over, it is no longer a matter of what levels the market will find as support, but rather how long will the new declining trend last. Earnings focus is taking the steam out of this market, a scenario that may continue until the bulk of earnings have been reported by the end of next week. Stocks will have likely reacted to this backward looking data and begin to refocus on the future outlook, which, if recent economic data provides an indication, is showing signs of improving in the US with recent upside surprises in consumer confidence, housing, and manufacturing. Clarity pertaining to the election and the fiscal cliff could help alleviate excessive cash balances on corporate balance sheets that currently sit at historic highs. Cash balances have swelled 14 percent and are on track toward $1.5 trillion for the Standard & Poor’s 500, according to JPMorgan. Cash balances could be used for shareholder distributions, share buybacks, takeovers, or even hiring, each of which could be positive for equity values into 2013.

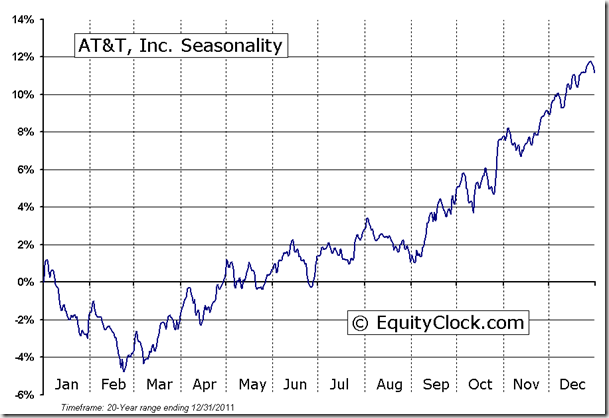

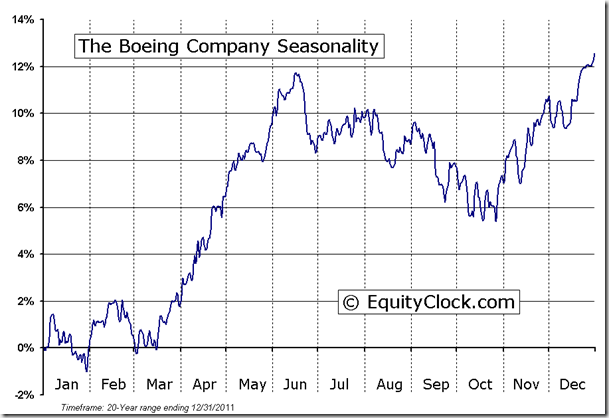

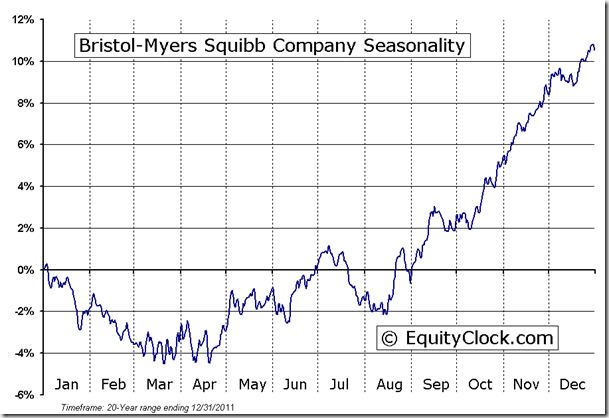

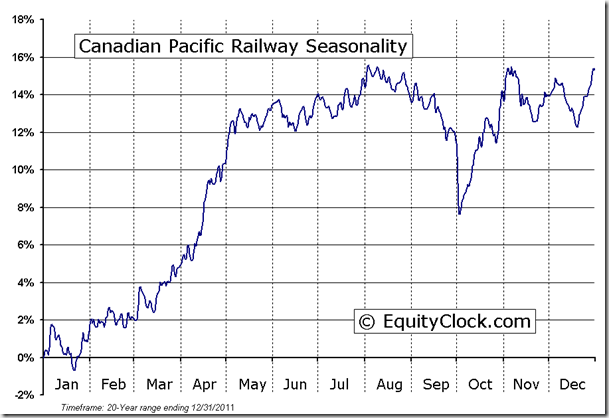

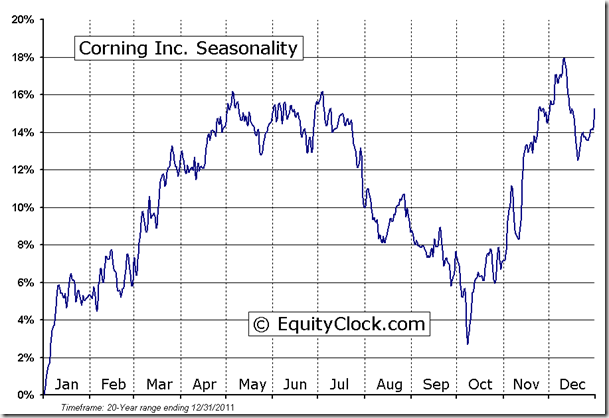

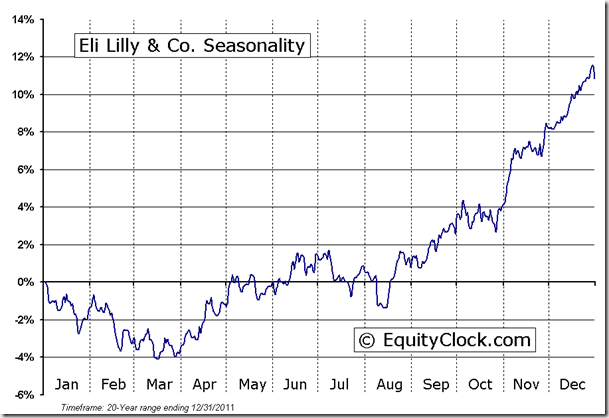

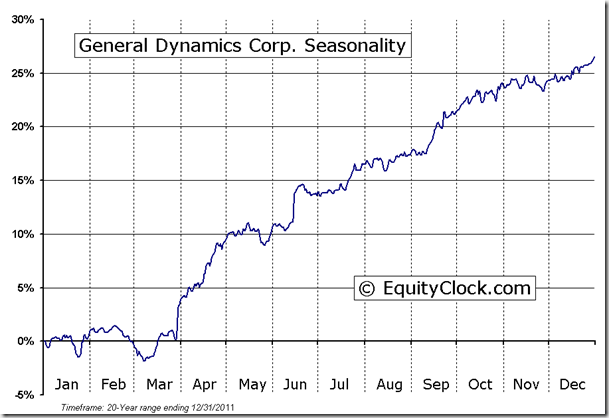

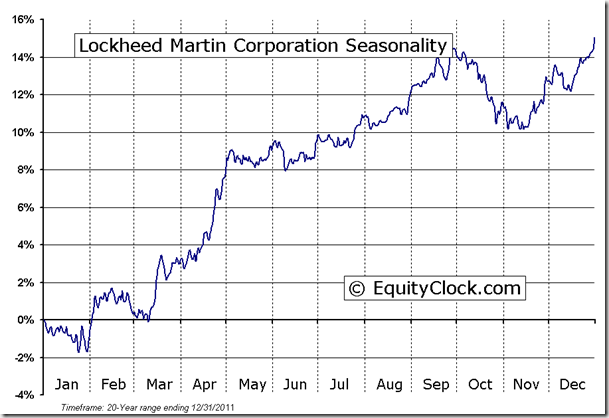

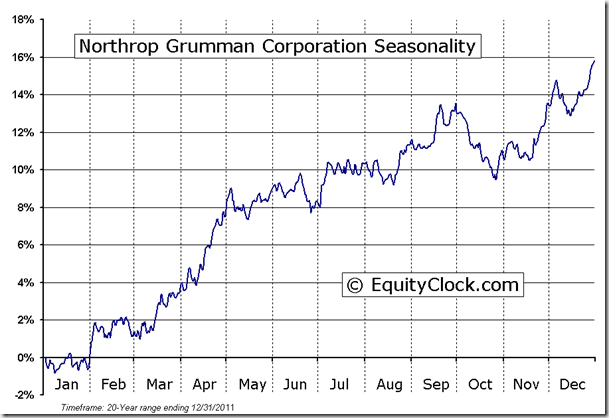

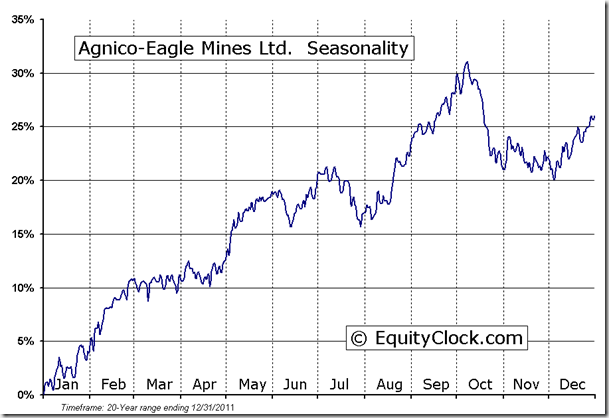

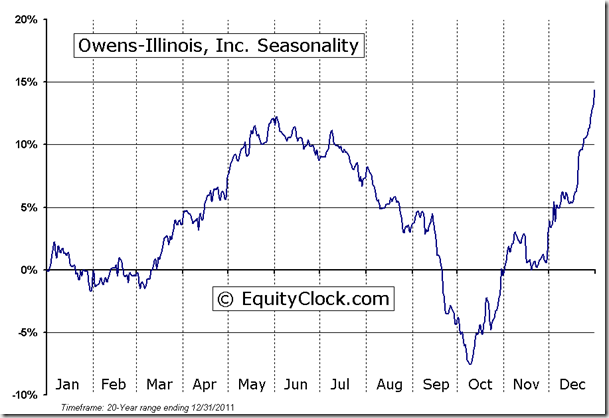

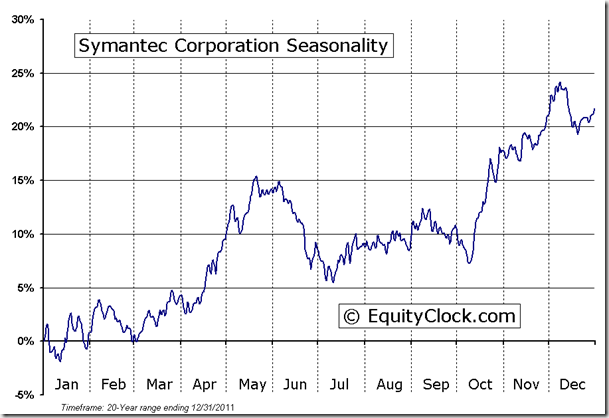

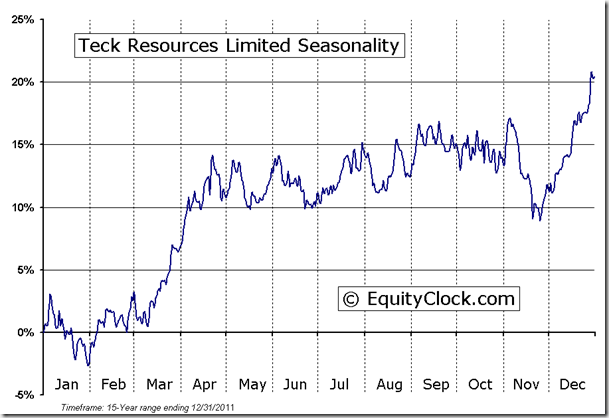

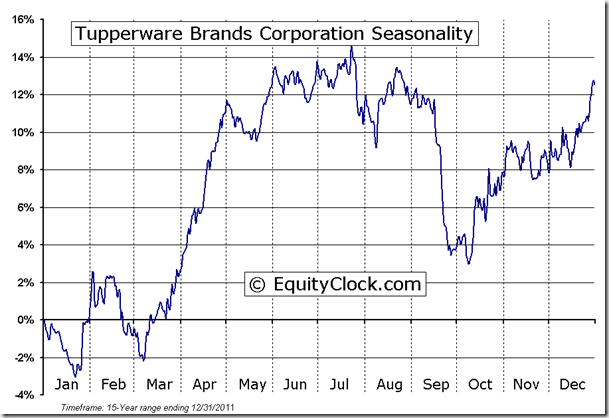

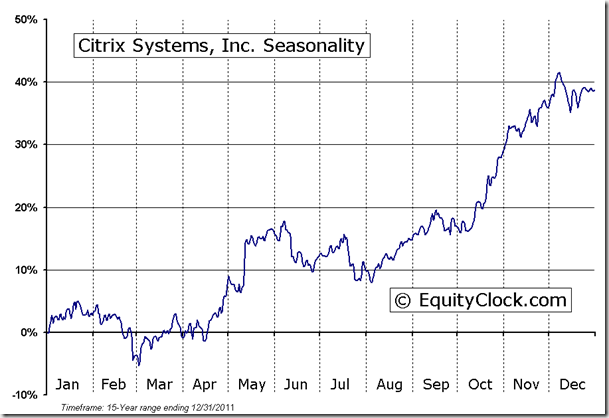

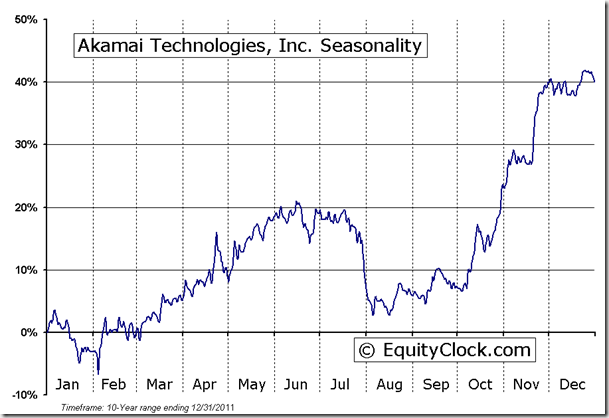

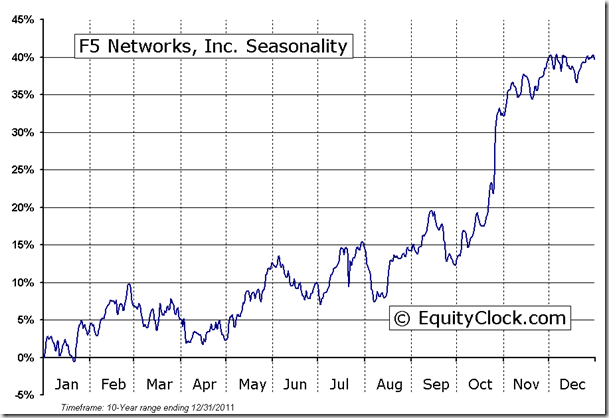

Companies reporting earrings today include AT&T, Boeing, Bristol-Myers, Canadian Pacific Railway, Corning, Delta Airlines, Dr. Pepper Snapple Group, Eli Lilly, EMC Corp, General Dynamics, Lockheed Martin, Northrop Grumman, Teck Cominco, Tupperware Corp, US Airways, Agnico-Eagle Mines, Akamai, Citrix, F5 Networks, Owens-Illinois, and Symantec. Today will be one of the busiest days for earnings yet this cycle with 186 companies reporting. The number of companies reporting tomorrow balloon to 309. Stay tuned tomorrow for the seasonal charts of some of the major companies as many stocks enter periods of seasonal strength at the end of this month.

Sentiment on Tuesday, as gauged by the put-call ratio, ended bearish at 1.06. A bearish trend in sentiment remains intact.

Chart Courtesy of StockCharts.com

TSE Composite

Chart Courtesy of StockCharts.com

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $12.51 (down 0.24%)

- Closing NAV/Unit: $12.48 (down 0.62%)

Performance*

| 2012 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 2.50% | 24.8% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.