by Don Vialoux, TechTalk

Economic News This Week

Canada’s Overnight Lending Rate to be announced on Tuesday at 9:00 AM EDT is expected to remain unchanged at 1.00%.

September New Home Sales to be released on Wednesday at 10:00 AM EDT are expected to increase to 385,000 from 373,000 in August.

Results of the FOMC meeting to be released on Wednesday at 12:30 PM EDT are expected to hold the Fed Fund rate at 0%-0.25%.

Weekly Initial Jobless Claims to be released on Thursday at 8:30 AM EDT are expected to decline to 375,000 from 388,000 last week.

September Durable Goods Orders to be release on Thursday at 8:30 AM EDT are expected to increase 7.4% versus a decline of 13.2% in August. Excluding transportation, Orders are expected to increase 1.0% versus a decline of 1.6% in August.

The first estimate of third quarter real annualized GDP growth to be released on Friday at 8:30 AM EDT is expected to improve to 1.9% from 1.3% in the second quarter.

The final October Michigan Sentiment Index to be released on Friday at 9:55 AM EDT is expected to remain unchanged at 83.1.

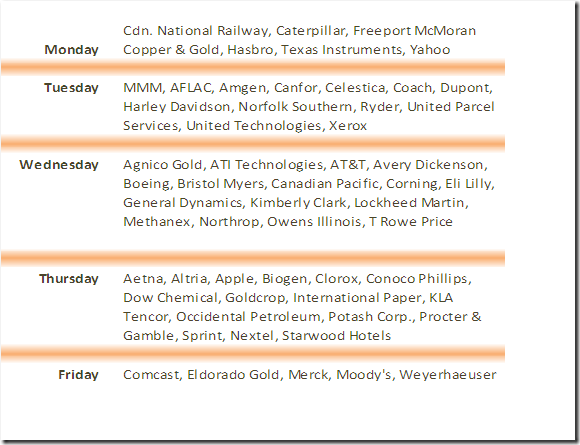

Earnings News This Week

Equity Trends

The S&P 500 Index added 4.60 points (0.32%) last week. Intermediate trend is down. The index fell below its 20 and 50 day moving averages on Friday. Short term support at 1,425.53 is being tested. Short term momentum indicators have recovered to neutral levels.

Percent of S&P 500 stocks trading above their 50 day moving average increased last week to 58.00% from 53.00% despite the decline in Friday. Percent remains intermediate overbought and trending down.

Percent of S&P 500 stocks trading above their 200 day moving average increased last week to 70.40% from 67.40%. Percent remains intermediate overbought and trending down.

The ratio of S&P stocks in an uptrend versus a downtrend (i.e. Up/Down ratio slipped last week to (305/108=) 2.82 from 3.05. Sixty nine S&P stocks broke resistance and 41 stocks broke support.

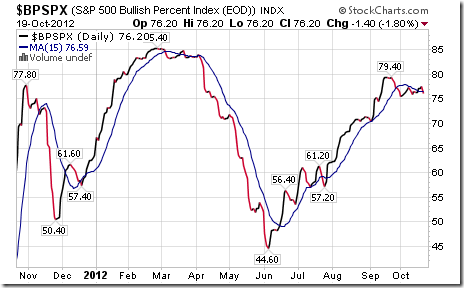

Bullish Percent Index for S&P 500 stocks slipped to 76.20% from 76.40% and remained below its 15 day moving average. The Index remains intermediate overbought and trending down.

The Up/Down ratio for TSX Composite stocks slipped last week to (144/69=)2.09 from 2.48. Nineteen stocks broke resistance and twenty stocks broke support.

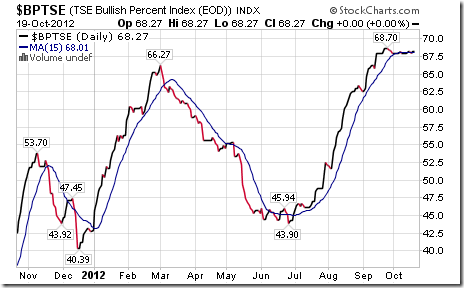

Bullish Percent Index for TSX Composite stocks slipped last week to 68.27% from 67.89% and remained below its 15 day moving average. The Index remains overbought and showing signs of rolling over.

The TSX Composite Index gained 213.94 points (1.75%) last week. Intermediate trend is neutral. Short term support is forming at 12,137.18 and resistance exists at 12,529.77. The Index bounced nicely from near its 50 day moving average and moved above its 20 day moving average. Short term momentum indicators are trending higher despite the decline on Friday. Strength relative to the S&P 500 Index has changed from neutral to positive.

Percent of TSX stocks trading above their 50 day moving average increased last week to 57.83% from 55.69% despite the drop on Friday. Percent remains intermediate overbought and trending down.

Percent of TSX stocks trading above their 200 day moving average increased last week to 59.04% from 57.32%. Percent remains intermediate overbought and trending down.

The Dow Jones Industrial Average added 15.46 points (0.12%) last week despite the fall last week. Intermediate trend is neutral. Resistance is at 13,661.87 and short term support at 13,296.43 is being tested. The Average fell below its 20 and 50 day moving averages on Friday. Short term momentum indicators have recovered to neutral levels. Strength relative to the S&P 500 Index remains neutral.

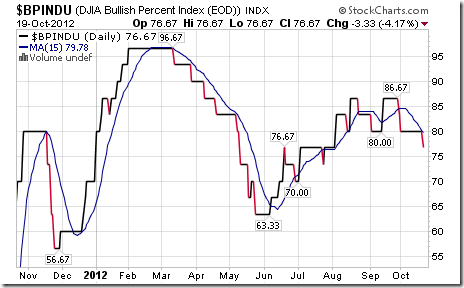

Bullish Percent Index for Dow Jones Industrial Average stocks fell last week to 76.67% from 80.00% and remained below its 15 day moving average. The Index remains intermediate overbought and has started to trend down.

Bullish Percent Index for NASDAQ Composite stocks fell last week to 56.88% from 57.69% and remained below its 15 day moving average. The Index is intermediate overbought and trending down.

The NASDAQ Composite Index fell 38.49 points (1.26%) lasts week following release of a series of disappointing third quarter reports by companies in the technology sector. Intermediate trend is down. The Index remains below its 20 and 50 day moving averages. Short term momentum indicators are oversold, but have yet to show signs of recovery. Strength relative to the S&P 500 Index remains negative.

The Russell 2000 Index slipped 2.09 points (1.26%) last week. Intermediate trend is down. Resistance is at 868.50. The Index fell below its 20 and 50 day moving averages on Friday. Short term momentum indicators are neutral. Strength relative to the S&P 500 Index remains negative.

The Dow Jones Transportation Average added 37.53 points (0.74%) last week. Intermediate trend is neutral. Support is at 4,870.74 and resistance is at 5,231.15. The Average remains above its 20 and 50 day moving averages. Short term momentum indicators are trending up. Strength relative to the S&P 500 Index remains positive. Seasonal influences are positive.

The Australia All Ordinaries Composite Index gained 70.78 points (1.57%) last week. Intermediate trend is up. The Index remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are overbought, but have yet to show signs of peaking. Strength relative to the S&P 500 Index remains positive.

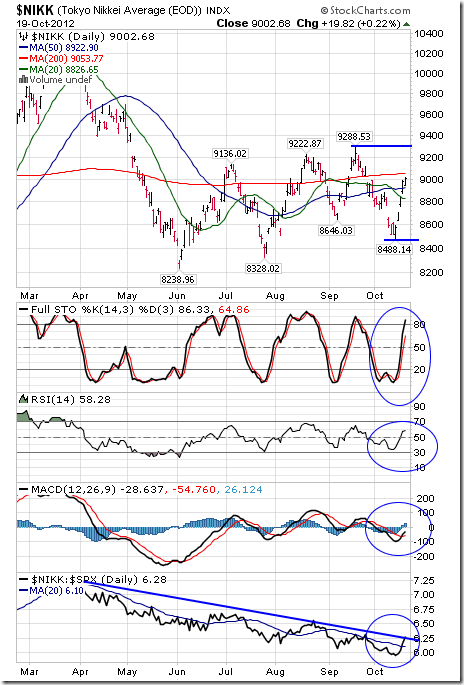

The Nikkei Average added 468.56 points (5.49%) last week. Intermediate trend is neutral. Support is at 8,488.14 and resistance is at 9,288.53. The Average moved above its 20 and 50 day moving averages. Short term momentum indicators are trending up. Strength relative to the S&P 500 Index has been negative, but is showing signs of change.

The Shanghai Composite Index added 23.37 points (1.11%) last week. Intermediate trend is down. Support is at 1,999.48 and resistance is at 2,145.00. The Index remains above its 20 and 50 day moving averages. Short term momentum indicators are trending up. Strength relative to the S&P 500 Index remains positive. Seasonal influences are about to turn positive.

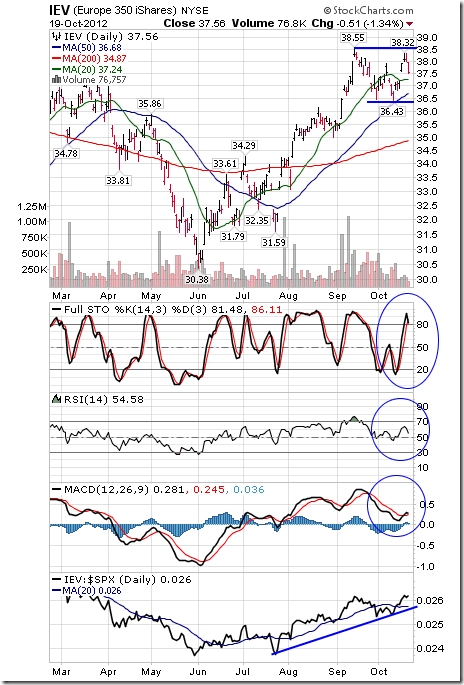

The Europe 350 ETF added 0.70 (1.90%) last week. Intermediate trend is up. Support is at 36.43 and resistance is at $38.55. Units remain above their 20, 50 and 200 day moving averages. Short term momentum indicators are trending up, but showing early signs of change. Strength relative to the S&P 500 Index remains positive.

The Athens Index gained another 45.78 points (5.54%) last week. Intermediate trend is up. The Index remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are overbought, but have yet to show significant signs of peaking. Strength relative to the S&P 500 Index remains positive.

Currencies

The U.S. Dollar slipped 0.03 (0.04%) last week despite the strong gain on Friday. Intermediate trend is neutral. Support is at 78.60. The Dollar remains below its 20, 50 and 200 day moving averages. Short term momentum indicators are mixed.

The Euro added 0.69 (0.53%) last week despite the sharp drop on Friday. Intermediate trend is neutral. Resistance is at 131.72. Short term momentum indicators are mixed. The Euro remains above its 20, 50 and 200 day moving averages.

The Canadian Dollar dropped 1.43 cents U.S. (1.40%) last week. Intermediate trend changed from up to down. The Canuck Buck fell below its 20 and 50 day moving averages. Short term momentum indicators are trending down.

The Japanese Yen fell 1.41 (1.11%) last week. Intermediate trend changed from up to down on a break below support at 126.72. Short term momentum indicators are trending down. The Yen remains below its 20 and 50 day moving averages and fell below its 200 day moving average.

Commodities

The CRB Index slipped $0.50 (0.16%) last week. Intermediate trend is up. Support is at $302.45 and resistance is at 321.36. The Index remains above its 200 day moving average and below its 20 and 50 day moving averages. Strength relative to the S&P 500 Index remains neutral/slightly negative.

Gasoline fell $0.22 (7.59%) last week. Intermediate downtrend was confirmed on a break below support at $2.703. Gasoline remains below its 50 and 200 day moving averages and fell below its 20 day moving average. Short term momentum indicators are trending down. Strength relative to the S&P 500 Index turned negative.

Crude Oil fell $0.92 (1.01%) last week. Intermediate trend is neutral. Support is indicated at $87.70. Crude remains below its 20, 50 and 200 day moving averages. Short term momentum indicators are mixed. Strength relative to the S&P 500 Index remains negative.

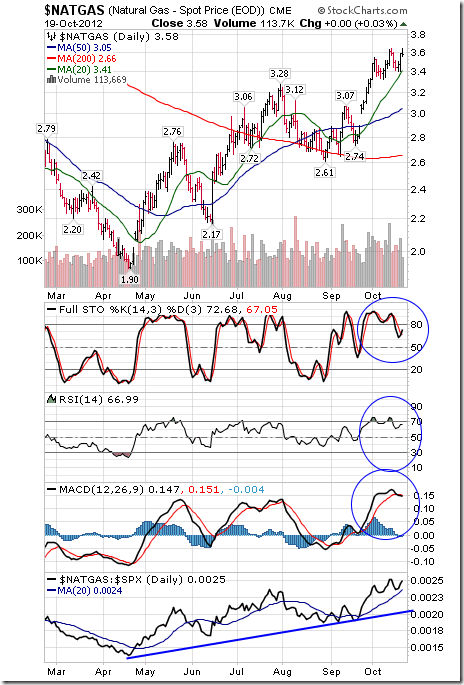

Natural Gas slipped $0.02 (0.56%) last week. Intermediate trend is up. Gas remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are overbought and showing signs of peaking. Strength relative to the S&P 500 Index remains positive.

The S&P Energy Index slipped 10.48 points (1.93%) last week. Intermediate trend changed from down to up on a break above 558.74. The Index remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are mixed. Strength relative to the S&P 500 Index changed from negative to neutral.

The Philadelphia Oil Services Index added 8.14 points (3.68%) last week. Intermediate trend is neutral. The Index moved above its 20, 50 and 200 day moving averages. Short term momentum indicators are trending up. Strength relative to the S&P 500 Index has turned neutral.

Gold lost another $33.00 per ounce (1.88%) last week. Intermediate trend is up. Gold remains below its 20 day moving average and above its 50 and 200 day moving averages. Short term momentum indicators are trending down. Strength relative to the S&P 500 Index has changed from positive to at least neutral. Seasonal influences are negative in the month of October.

The AMEX Gold Bug Index added 0.16 (0.03%) last week. Intermediate trend changed from up to down on a break below support at $489.51. The Index remains below its 20 day moving average and above its 50 and 200 day moving averages. Short term momentum indicators are trending down. Strength relative to gold remains slightly negative.

Silver fell $1.38 per ounce (4.12%) last week. Intermediate trend is up. Silver remains below its 20 day moving average and moved below its 50 day moving average. Short term momentum indicators are trending down. Strength relative to gold remains negative.

Platinum plunged $33.80 (2.04%) last week. Intermediate trend is up. Resistance is at $1,734.50. Platinum remains above its 50 and 200 day MAs and below its 20 day MA. Short term momentum indicators are trending down. Strength relative to gold remains positive.

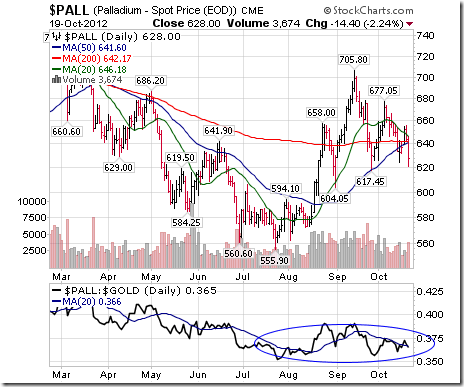

Palladium fell $5.95 (1.80%) last week. Palladium remains below its 20, 50 and 200 day moving averages. Strength relative to gold remains neutral.

Copper fell $0.06 per lb. (1.62%) last week. Intermediate trend changed from up to down on a break below support at $3.681. Short term momentum indicators are trending down. Strength relative to the S&P 500 Index has changed from positive to neutral.

The TSX Global Metals and Mining Index gained 28.75 points (3.17%) last week. Intermediate trend is up. The Index remains above its 50 day moving average and moved above its 20 day moving average. Short term momentum indicators are trending up. Strength relative to the S&P 500 Index has turned positive.

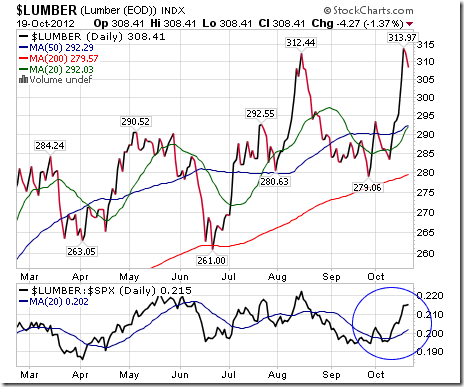

Lumber gained $14.55 (4.95%) last week. Intermediate uptrend was confirmed on a move above $312.44. Lumber remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are trending higher. Strength relative to the S&P 500 Index is positive.

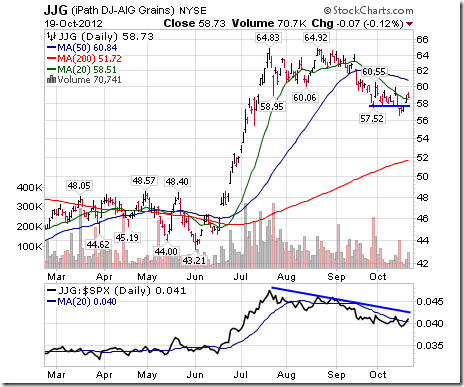

The Grain ETN added $0.68 (1.17%) last week. Intermediate downtrend was confirmed on a break below support at $57.52. Strength relative to the S&P 500 Index remains negative.

The Agriculture ETF was unchanged last week. Intermediate trend is up. Resistance is at $53.19. Units remain above their 50 and 200 day moving averages, but fell below its 20 day moving average on Friday. Short term momentum indicators are mixed. Strength relative to the S&P 500 Index remains neutral.

Interest Rates

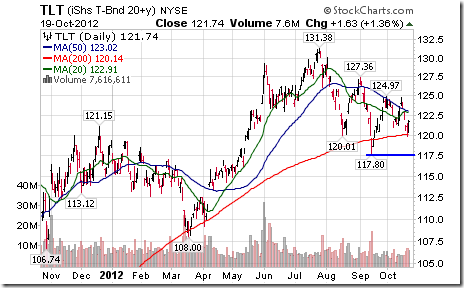

The yield on 10 year Treasuries increased 10.5 basis points (6.31%) last week. Intermediate trend is up. Support is at 1.599% and resistance is at 1.892%. Yield found resistance near its 200 day moving average. Short term momentum indicators are trending up.

Conversely, price of the long term Treasury ETF fell $2.23 (1.80%) last week.

Other Issues

The VIX Index added 0.92 (5.70%) last week. Intermediate trend changed from down to up on Friday on a break above resistance at 17.08.

Third quarter reports will dominate action in equity markets this week as they did last week. As of Friday, 116 S&P 500 companies had reported results. Earnings on a year-over-year basis were down 3.7%. Revenues were up 1.3%. Sixty companies reported higher than consensus earnings, 13% reported earnings in line with consensus and 26% reported less than consensus earnings. Responses to reports were significant in both directions. The focus this week moves from technology and financial service companies to consumer staples, industrial, materials and health care companies.

Intermediate technical indicators generally remain overbought. However, short term technical indicators (particularly Stochastics for broadly based equity indices and sectors recovered from oversold levels and recorded short term buy signals. Most broadly based equity indices and sectors with the exception of technology showed early signs of bottoming a week ago. Some had a rather severe test of their lows on Friday (e.g. Dow Jones Industrial Average). If the lows hold, the stage is set for a significant upside move between now and Inauguration Day in the third week in January. If the lows do not hold, downside risk is limited and will provide an opportunity to accumulate equities at slightly better prices.

Economic news this week generally is expected to be favourable. The focus is on the FOMC meeting. Bernanke will want to confirm that the Fed continues to provide monetary stimulus.

Macro events this week outside of North America will continue to impact equity markets. Weakness on Friday was attributed to failure of the European Union to reach a concrete agreement to resolve the sovereign debt crisis. More news on the topic is expected this week. Meanwhile, European economic data (e.g. Eurozone manufacturing PMI) is expected to show early signs of a bottom.

Cash positions held by corporations and individuals are huge and growing. Cash positions will start to be employed when the next President is determined and when the Fiscal Cliff is resolved (regardless of whom becomes President).

The Bottom Line

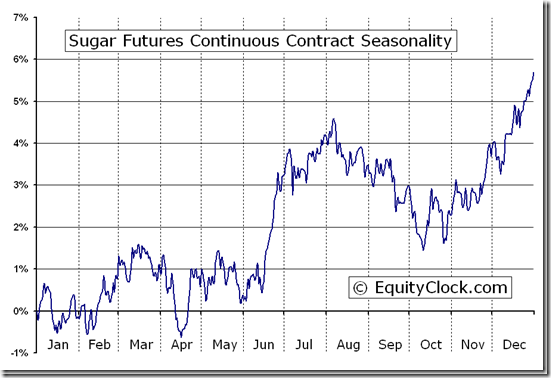

The entry point for the seasonal trade in North American equity markets (on Average during the past 61 years: October 28th) either was reached at the beginning of last week or will appear this week. Preferred strategy is to accumulate equities and Exchange Traded Funds with favourable seasonality at this time of year that already are showing technical signs of performing with or better than the market (i.e. S&P 500 for U.S. equity markets and TSX Composite for Canadian equity markets). Sectors include agriculture, forest products, transportation, industrials, steel consumer discretionary, China and Europe.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices.

To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Sugar Futures (SB) Seasonal Chart

The latest weekly update on ETFs in Canada to October 20th is available at

Tom Rogers’ Weekly Elliott Wave Blog

Following is a link:

http://www.tomrogers.net/signpost.htm

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

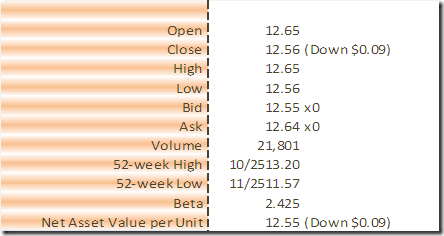

Horizons Seasonal Rotation ETF HAC October 19th 2012

Copyright © TechTalk