by Don Vialoux, TechTalk

Upcoming US Events for Today:

- No Economic Events Scheduled

Upcoming International Events for Today:

- No Economic Events Scheduled

The Markets

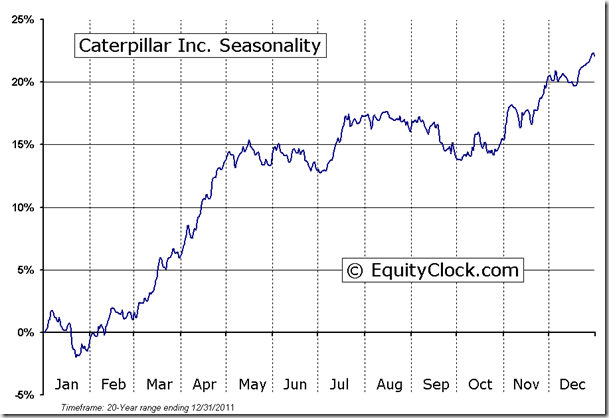

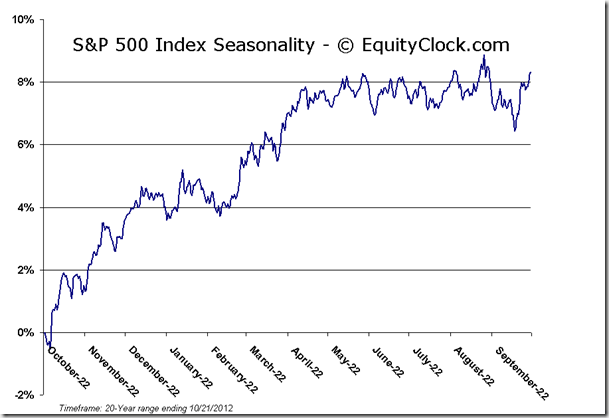

Markets sold off on Friday, producing the largest one day loss since the end of June as investors reacted to the reality of the earnings situation in the US. General Electric and McDonanlds were the latest companies to report earnings that missed expectations, pushing the stock values of these two bellwethers lower by 3.42% and 4.46%, respectively. As well, continued weakness in the Technology sector remains as a substantial burden on US benchmarks heavily weighted in the sector. Microsoft and Google continued on their recent path of declines following earnings, while Apple, which hasn’t even reported yet, continues to be on a slide that began shortly after their latest iPhone launch in September. Other companies have also traded sharply lower prior to reporting, such as Caterpillar, which reports today. With 98 S&P 500 companies having reported earnings thus far, only 42% have reported sales above estimates, causing concern for investors. The beat rate on earnings per share, however, has been a respectable 70%. Prior to Friday of last week, broad markets had been trading higher with weakness isolated to particular names that disappointed investors expectations following reports. Now investors are finally reflecting the expected weakness of the of the remainder of the earnings period on stock values, an event that is more typical than not at this point during third quarter earnings season. October is typically a volatile month as a result of the earning reports that are released and seasonal averages show gains through to mid-month followed by losses into October 28th, which has been identified as the average optimal date to enter broad market indices for the seasonally favorable six months of the year. Weakness in the short-term still presents a certain appeal to take advantage of long opportunities in the equity market for the period of seasonal strength ahead.

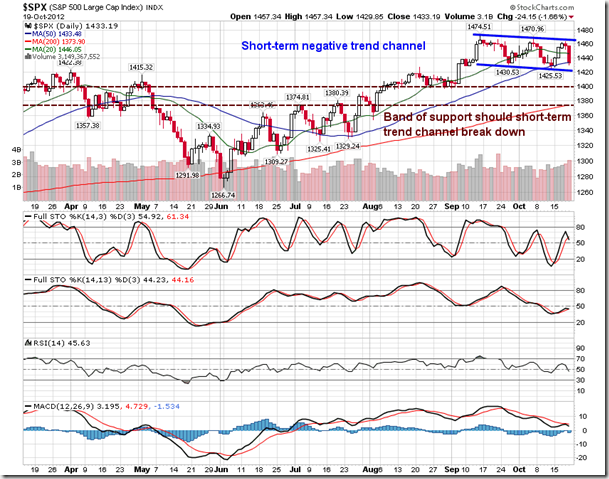

Despite the strong drop on Friday, equity benchmarks, such as the S&P 500 and the Dow Jones Industrial Average, still managed to finish marginally positive for the week. The price action of both the Dow and the S&P 500 finished precisely at 50-day moving averages, the level which these benchmarks started the week at. The S&P 500 continues to remain in this short-term negative trend channel that began mid-September. The lower limit of this channel sits around 1420, while the upper limit is now around 1460. Downside risks should the market break below this range fall to 1375 to 1400, which is approximately a 25-point band above the current level of the 200-day moving average, now at 1374. A catalyst would likely be required in order to break below the 200-day moving average, potentially putting the market into correction territory.

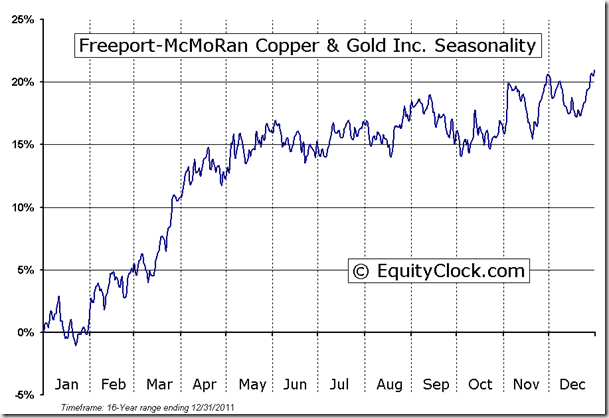

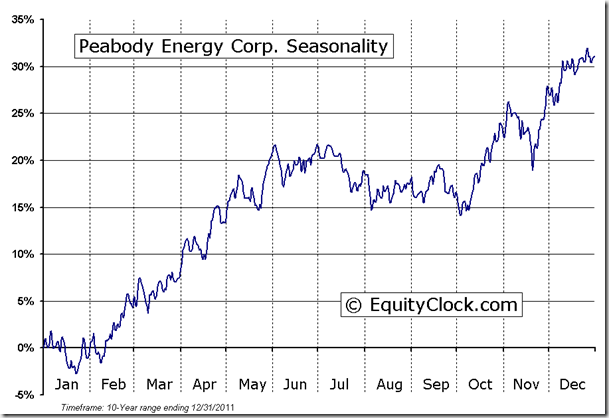

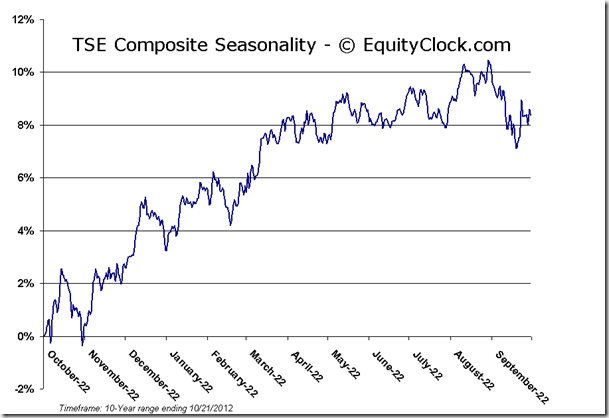

Overall, although Friday was a risk-off session, it did not suggest panic in equity markets. Treasury yields were only little changed, holding around the 200-day moving average line in the case of the 10-year. The US Dollar Index resisted at its 20-day moving average line, continuing to suggest short-term weakness. And equity benchmarks less weighted in Technology, such as the TSX, held up relatively well amidst the substantial weakness in the US, suggesting that present weakness is primarily related to the recent technology earnings events and not something more broad based. The bias for stocks between now until the end of the year is to the upside based on positive seasonal tendencies, improving economic data, and accommodative central bank policy. Should any of these factors come into doubt or a catalyst is realized that severely threatens the future outlook, our bias is likely to change, but for now respecting the risks is more important than speculating an outcome. A definitive breakout in treasury yields above 200-day moving averages and a breakdown in the US Dollar Index below support at 78.60 would likely trigger the next leg higher in risk assets, mainly in stocks and commodities.

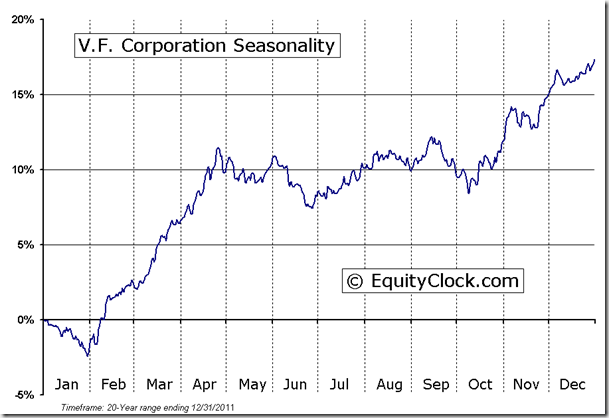

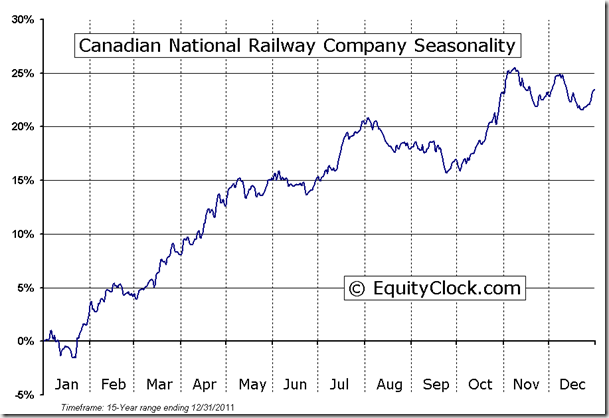

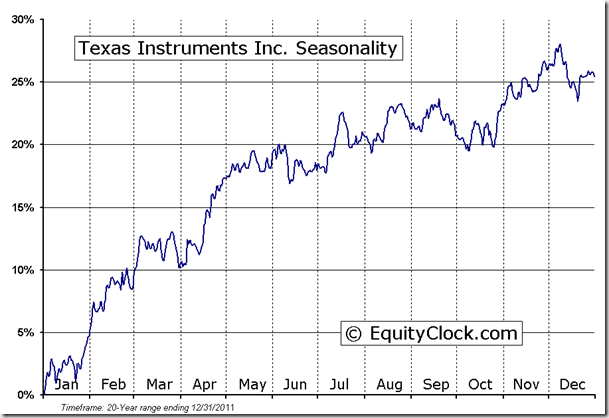

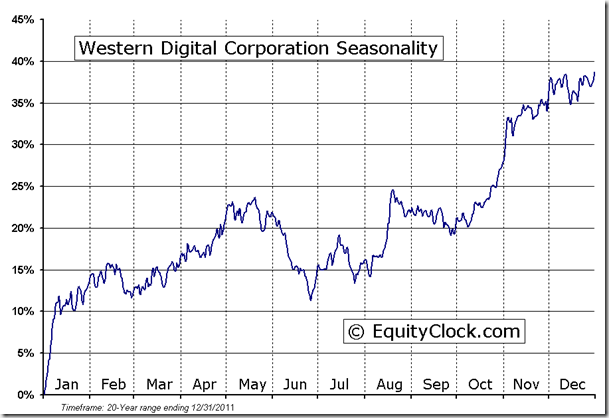

Companies reporting earnings today include Caterpillar, Freeport-McMoRan, Hasbro, Peabody Energy, SunTrust Banks, VF Corp, Canadian National Railway, Texas Instruments, Western Digital, and Yahoo.

Sentiment on Friday, as gauged by the put-call ratio, ended bearish at 1.12. After trading outside of the recent rising channel mid last week, the put-call ratio swung back into range on Friday, continuing with the apparent bearish trend for equities that begun in the middle of September.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $12.56 (down 0.71%)

- Closing NAV/Unit: $12.55 (down 0.64%)

Performance*

| 2012 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 3.07% | 25.5% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.

Copyright © TechTalk